Smaller wallets have resumed accumulation, yet larger holders keep distributing, creating a tense standoff around the $105K level. At press time, BTC traded at $111,398, down more than 3% over the past 24 hours. A strong defense of this zone could help rebuild market confidence, but a breakdown might unleash a new wave of selling pressure.

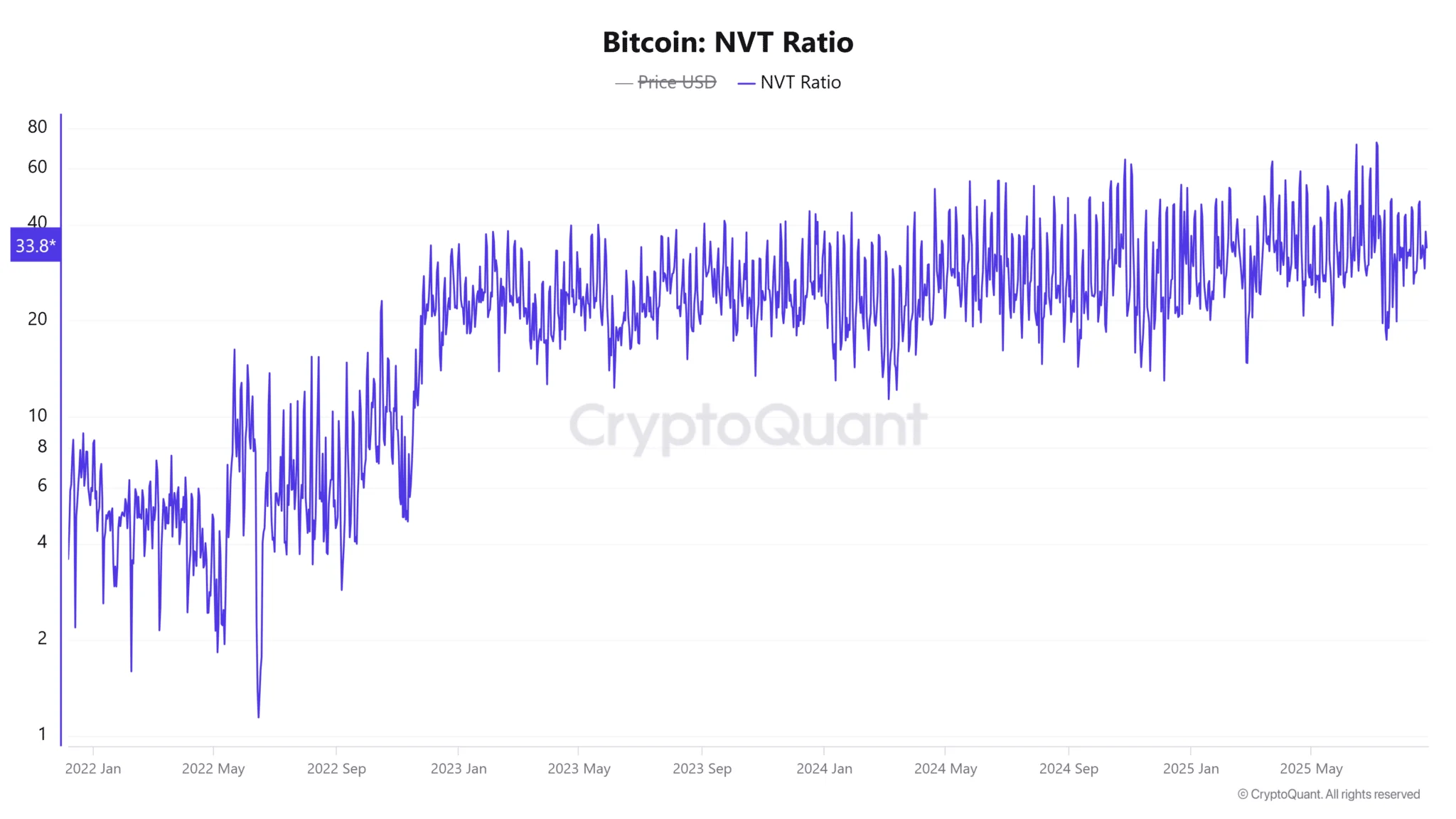

NVT Signals Warning Signs

The NVT ratio has dropped nearly 11% to 33.8, reflecting weaker transaction activity relative to market valuation. This widening gap between market cap and on-chain activity points to fading organic demand, raising concerns over Bitcoin’s underlying strength. Should the NVT continue trending downward, holding key support levels could become increasingly difficult, even if some investors remain committed to accumulation.

On-chain activity paints another cautious picture. Bitcoin’s daily transaction count has fallen to 97K, while network growth dropped to 72K. These steep declines indicate fewer active users, weaker adoption momentum, and slowing capital inflows. If this trend persists, Bitcoin will struggle to maintain higher valuations as the pool of active participants keeps shrinking.

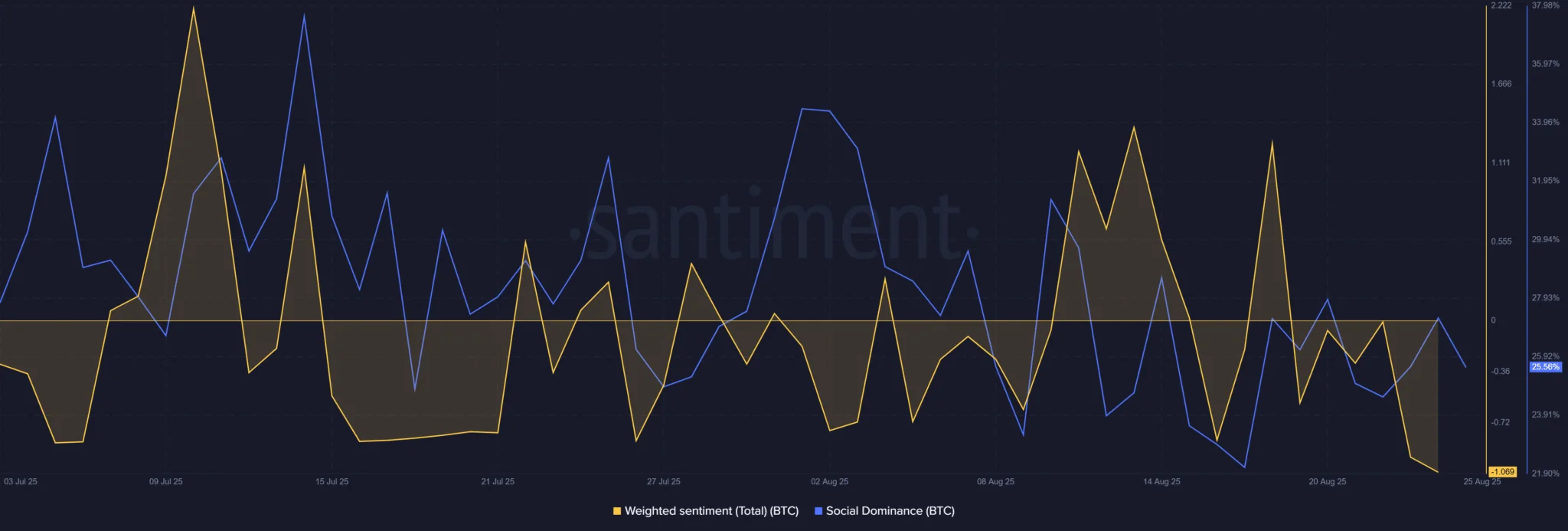

Two Factors Amplifying Fear

Market sentiment has turned notably bearish. Weighted Sentiment dropped to –1.06, while Social Dominance slipped to 25.56%. This reflects fading confidence and Bitcoin’s declining role in broader market discussions. As capital exits BTC, it may rotate into altcoins or leave the crypto space entirely, amplifying volatility.

Despite some accumulation from smaller wallets, Bitcoin’s broader outlook leans bearish. The weakening NVT ratio, slowing network growth, and negative sentiment outweigh the resilience of a subset of investors. While short-term rebounds remain possible, the dominant trend points toward deeper corrections before any sustainable recovery can take shape.