According to Glassnode data, Bitcoin’s 14-day average transaction fees have dropped to just 3.5 BTC per day — the lowest level since late 2011, when the network was still in its infancy. This sharp decline highlights a notable drop in demand for block space, signaling weaker on-chain activity in recent weeks.

Signs of Portfolio Diversification

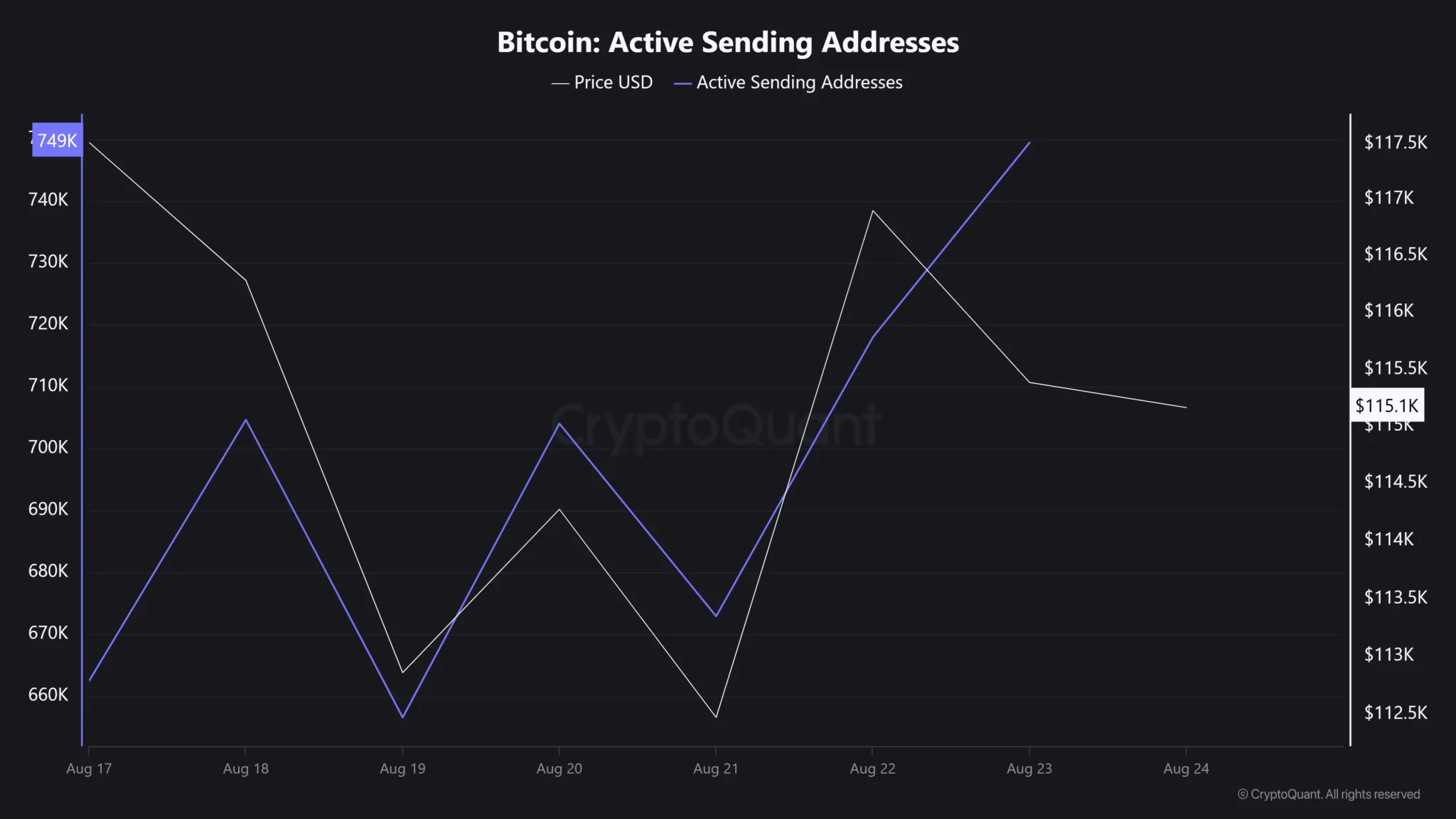

In contrast to falling fees, data from CryptoQuant showed a sharp rise in the number of active sending addresses over the past 48 hours. This usually indicates investors moving coins out of their wallets — either to rebalance portfolios or to take positions elsewhere.

The timing is striking, as most major altcoins have recorded strong gains during the same period, reinforcing the view that investors are rotating capital out of Bitcoin in search of more attractive short-term returns.

At the same time, Bitcoin has also seen a significant spike in exchange outflows over the past week. Typically, this is interpreted as a bullish signal, reflecting long-term confidence as investors move BTC into self-custody.

However, when combined with the surge in sending activity, the picture becomes less clear. Some of those outflows may be flowing into altcoins rather than cold storage, suggesting a broader repositioning across the crypto market.

What Lies Ahead for Bitcoin?

Taken together, the data suggests that the market is in transition. Bitcoin appears to be losing some trading momentum to altcoins, which have outperformed in the short term.

Still, the continued exchange outflows indicate that long-term conviction in Bitcoin has not disappeared. The current market reflects a tug-of-war between profit-taking rotations into altcoins and persistent faith in Bitcoin’s core value.