Bitcoin has surged above USD 95,000, hitting its highest level in nearly two months after escaping a prolonged sideways consolidation and triggering hundreds of millions of dollars in short liquidations.

On the 12-hour TradingView chart, Bitcoin briefly climbed to USD 96,250 before a slight pullback and is currently trading around USD 95,360. Notably, this rally decisively pierced the USD 93,000–94,000 resistance zone that had capped price action for about 57 consecutive days. This makes the breakout structurally meaningful rather than just another short-term price spike.

Extended consolidation phases often act like “pressure chambers,” where liquidity and leverage build up on both the long and short sides. Once price breaks out of that range, the unwinding of trapped positions typically produces strong, sudden market movements — and that is exactly what has happened with Bitcoin.

Short liquidations triggered the breakout

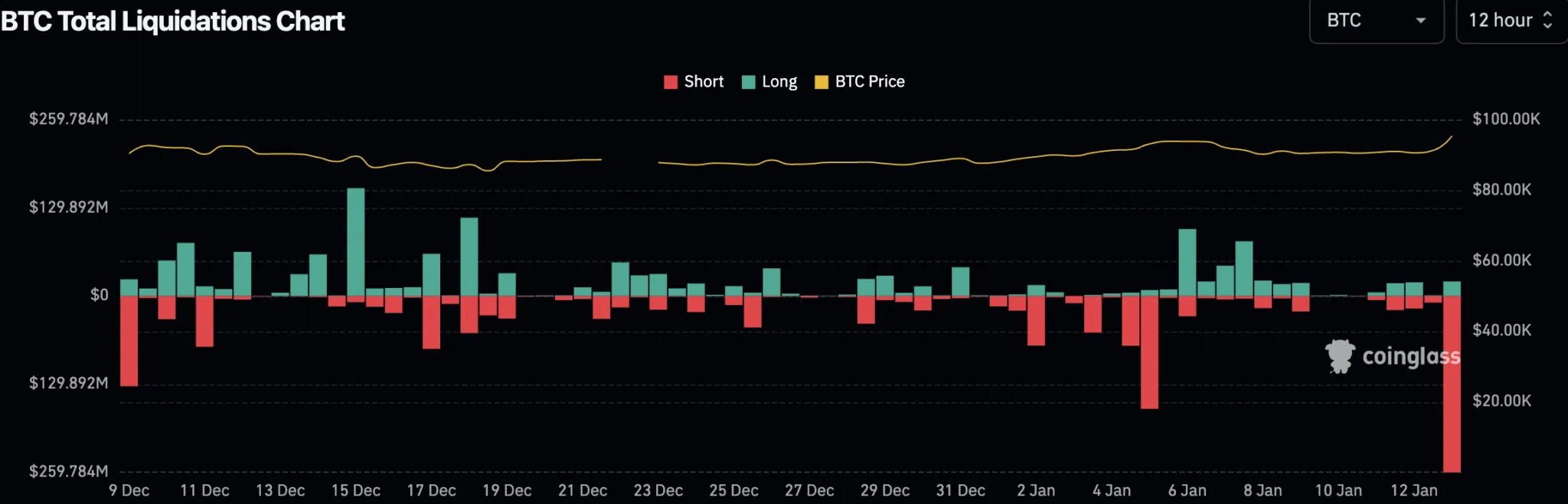

Data from Coinglass shows that as Bitcoin moved above USD 93,000, a wave of forced short liquidations totaling nearly USD 250 million occurred within just 12 hours, while long liquidations remained relatively small.

This indicates that bearish traders had heavily bet on the USD 93,000–94,000 zone continuing to serve as strong resistance. When BTC broke through this “price ceiling,” a cascade of stop-losses and margin calls was triggered, forcing short sellers to buy back Bitcoin at market prices. This classic short squeeze rapidly accelerated the rally toward USD 95,000 and beyond.

From a price-structure perspective, Bitcoin formed a bottom near USD 84,000 in late November and then continued to establish higher lows throughout December and early January — a signal that buying pressure had gradually overtaken the sell side ahead of the breakout.

Why the USD 95,000 level matters

Reclaiming the USD 95,000 mark is not only psychologically important; it also shifts the technical landscape. The former consolidation ceiling around USD 93,000 has now turned into the nearest support, while the next major resistance sits between USD 96,000 and USD 98,000 — an area that previously acted as a distribution zone before November’s sell-off.

If Bitcoin holds above its breakout level, market participants may view this move as a trend transition rather than a temporary short squeeze. With most short positions already flushed out and market liquidity reset, continued buying momentum could push BTC back toward six-figure territory in the upcoming sessions.