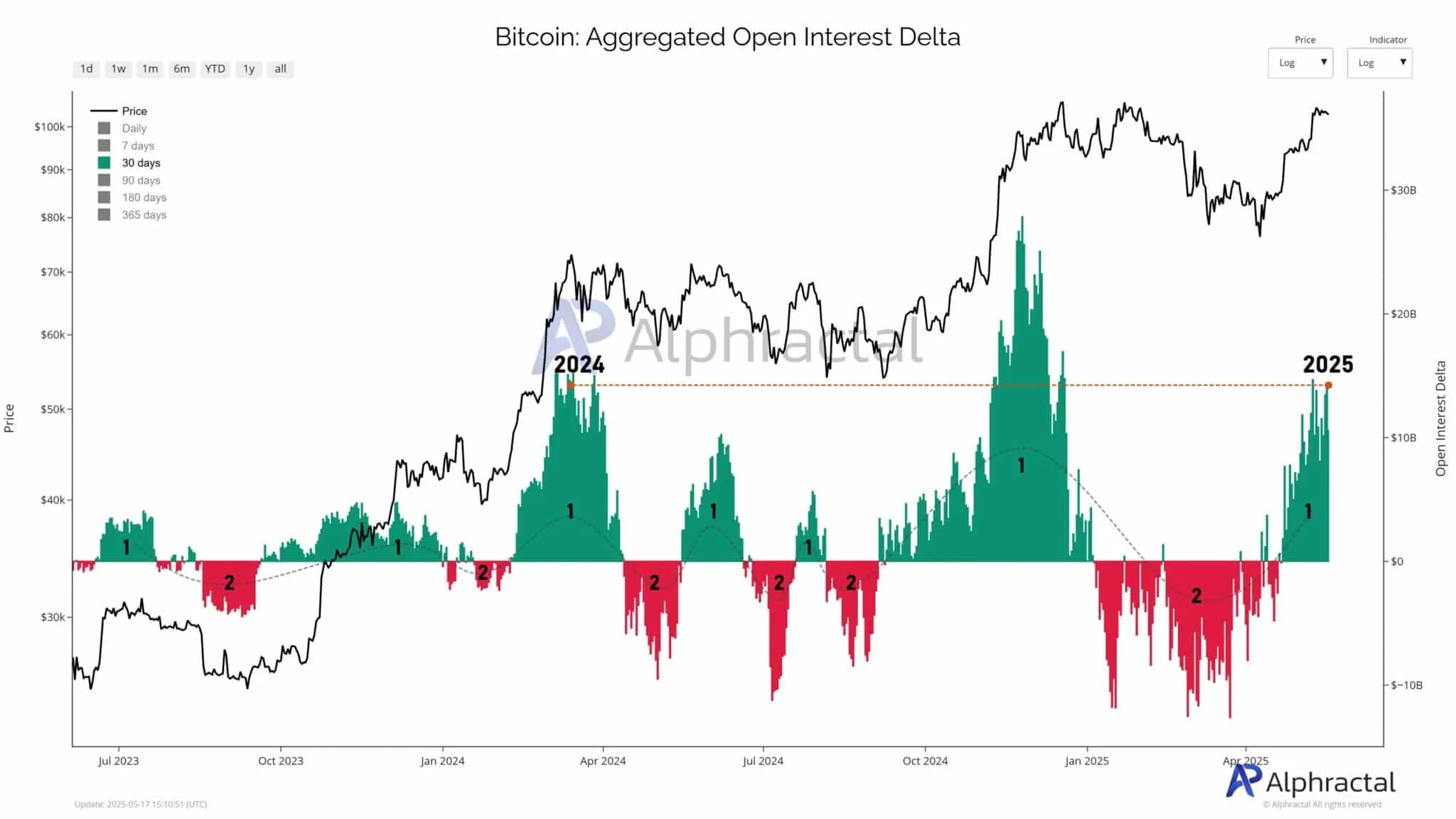

Over the past 24 hours, Bitcoin has risen by more than 2%, officially surpassing the $105,000 mark. Beyond the price rally, a key development catching analysts’ attention is the Delta indicator of Open Interest (OI), which is now flashing familiar signals for seasoned traders.

In the last 30 days, the aggregated Delta index has reached its highest level since early 2024 — a period when Bitcoin broke past $73,000 and set a new all-time high. Now, similar patterns are re-emerging across various derivatives indicators, sparking speculation that the market may be entering a new bullish cycle.

Two Key Phases in the Delta Cycle

According to market analysts, the Open Interest cycle is typically divided into two distinct phases:

Phase 1 is when positions build up rapidly, reflecting bullish sentiment. During this phase, the Delta index usually trends positive.

Phase 2 marks the unwinding of positions — particularly those with high leverage — causing the Delta to turn negative and signaling a shift in market sentiment.

The rotation between these two phases mirrors the rhythm of leveraged capital flows and broader market psychology.

Currently, data from the Alphractal platform suggests that Bitcoin may be entering a new Phase 1 — reminiscent of the periods preceding previous strong rallies. Many experts believe this could be the early stage of a renewed upward trend.

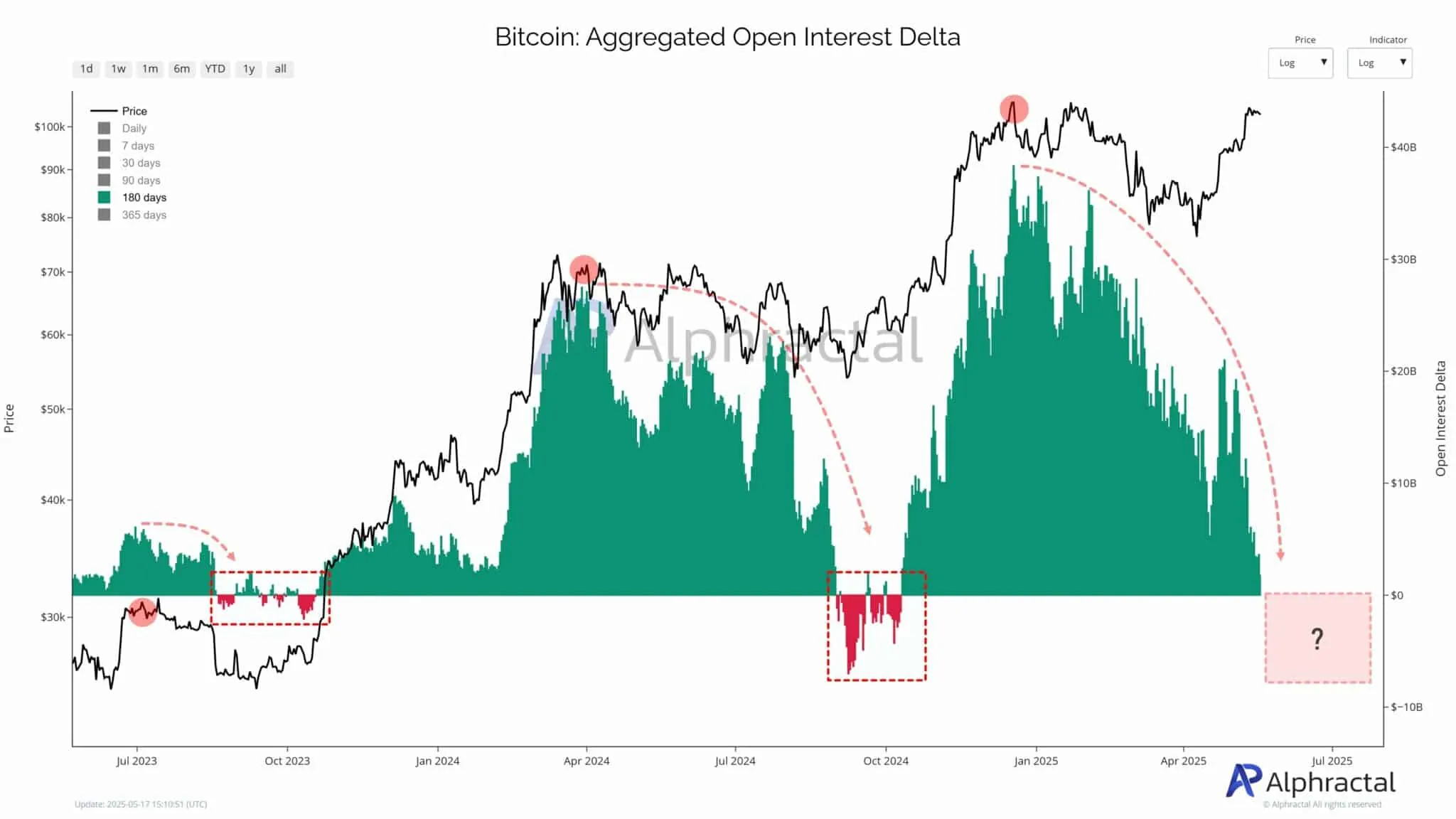

Long-Term View: What the 180-Day Delta Tells Us

Looking at a broader time frame, the 180-day Open Interest Delta offers deeper insights into market behavior.

Historically, significant drops in this long-term Delta index have preceded large-scale liquidations — especially among leveraged long positions. Interestingly, these steep declines often coincided with short-term market bottoms.

At present, the 180-day Delta is hovering just above zero — a critical threshold. If it dips into negative territory, it could signal the beginning of a new accumulation phase, during which institutional investors quietly re-enter the market.