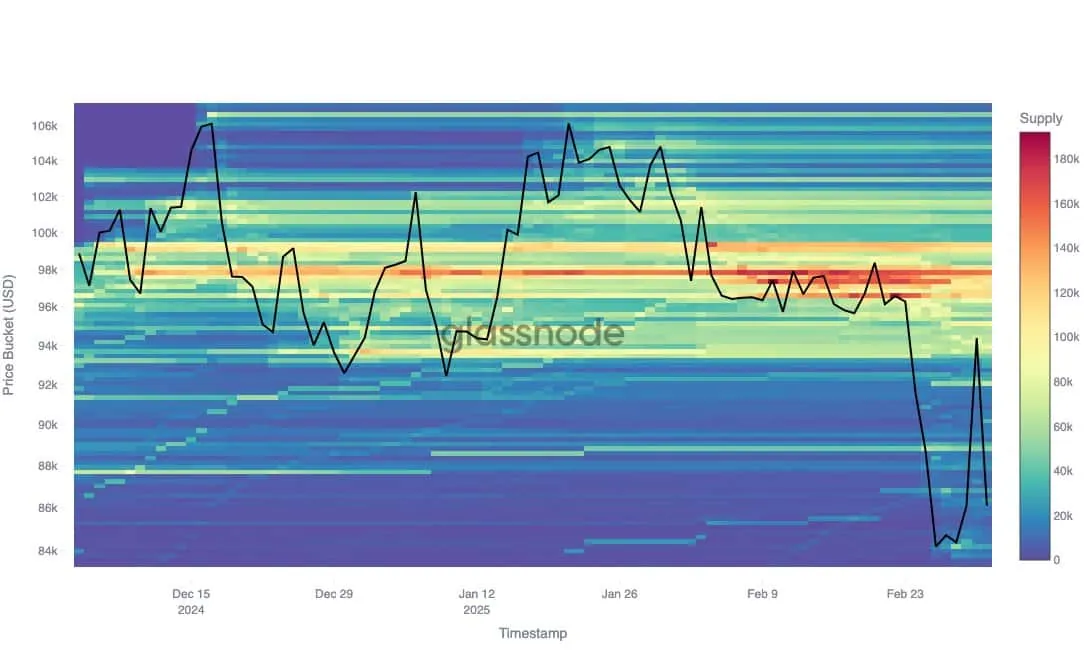

In recent weeks, the cryptocurrency has experienced extreme volatility. According to Glassnode, this heightened market turbulence allowed sellers to dominate, ultimately leading to a phase of capitulation.

Approximately one-third of the BTC accumulated between $96,000 and $97,500 in February 2025 was sold off as prices plummeted, primarily due to weaker hands cutting their losses. However, some addresses within this price range seized the opportunity to accumulate Bitcoin near the local bottom of $83,000, forming a staircase-like pattern.

Despite these accumulation efforts, strong profit-taking has continued to dominate, signaling capitulation. Historically, such events often precede local bottoms, followed by price recoveries as investors buy the dip.

Buying activity has emerged from various investor groups, yet supply within the $93,000–$83,000 range remains relatively thin. Most purchases were concentrated around $84,200 (23,000 BTC) and $86,900 (25,800 BTC), primarily by long-term investors.

Typically, when investors shift to buying amid declining prices, this demand fuels a rebound. This trend reversal was evident over the past 24 hours, with Bitcoin reclaiming the $87,000 level.

While weak hands opted to sell during the downturn, others took advantage of the dip to accumulate. This behavior is particularly evident as retail traders re-enter the market despite ongoing uncertainty.

Notably, new BTC issuance remains above 13,000 BTC, with crab wallets (holding 1–10 BTC) surging to 15,000 BTC and fish wallets (10–100 BTC) maintaining a supply of 5,500 BTC. This suggests that retail investors are actively buying Bitcoin at current market prices, demonstrating confidence and driving strong demand.

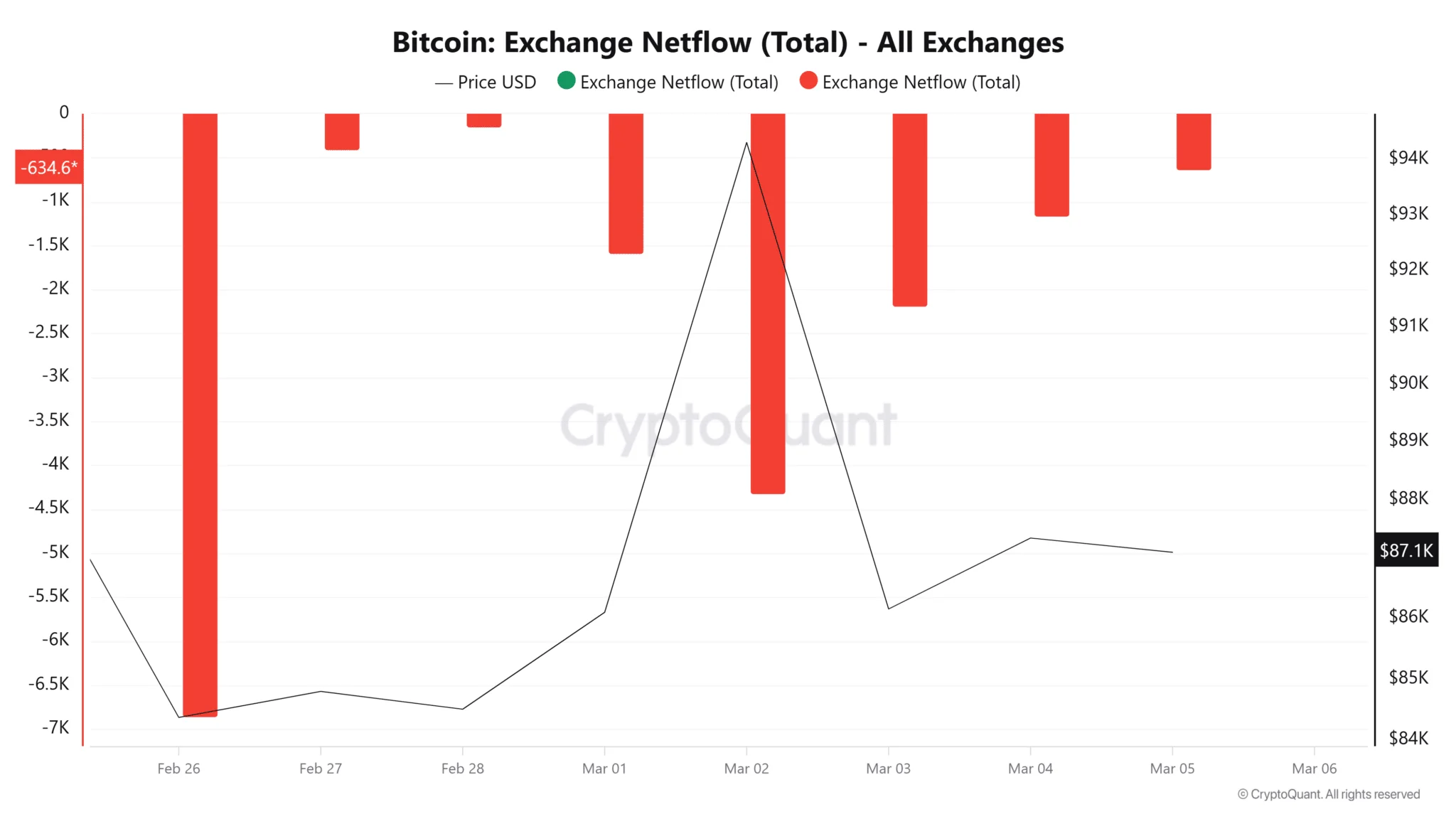

Bitcoin’s net flow remained negative throughout a volatile week, indicating continued investor accumulation. The rising outflows reflect growing confidence in the market, as participants view price dips as buying opportunities before the next rally.

As smaller holders increase their purchases while larger institutions remain hesitant, Bitcoin is becoming scarcer. This scarcity plays a crucial role in BTC’s recovery prospects—when supply is low and demand remains steady, prices are likely to rise.

Retail investors have shown resilience amid the market downturn, yet speculative sellers continue to react to news and external factors, adding pressure to Bitcoin’s price action. For a sustainable rally, accumulation from sharks and whales will be essential.