The sudden increase in Bitcoin’s value, completely opposite to its previous downward trend, has caught many traders by surprise, especially those who had bet on the market to continue declining.

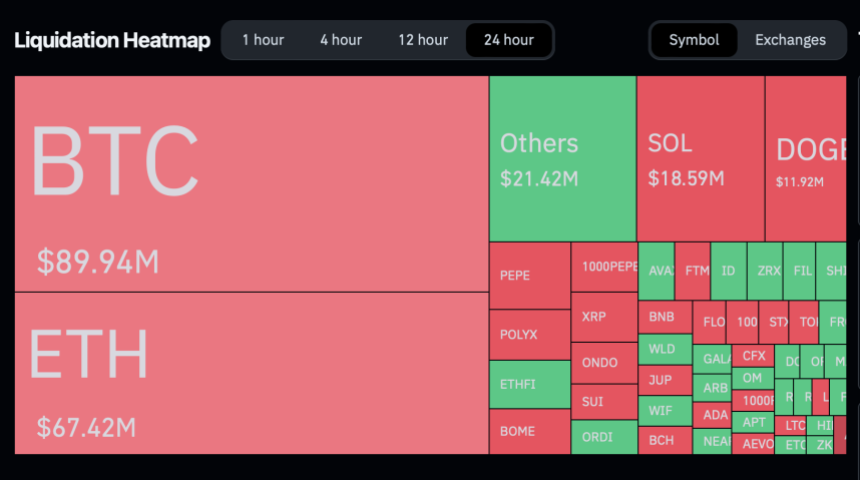

Over 80,000 traders have had to face liquidation. Data from Coinglass shows that approximately 86,047 traders incurred losses exceeding $250 million USD within just 24 hours.

Major exchanges such as Binance, OKX, Bybit, and Huobi have suffered the most significant financial losses, notably Binance with liquidation amounts reaching $128.7 million USD. Other platforms like OKX, Bybit, and Huobi also recorded significant liquidation amounts of $99.87 million USD, $33.18 million USD, and $17.70 million USD, respectively.

The majority of the affected positions were short positions, reflecting widespread predictions of a market downturn that did not materialize. Short positions accounted for about 57.55% of the liquidated amount, equivalent to $164.10 million USD, from traders betting against the market.

Conversely, holders of long positions also faced their share of losses, contributing to nearly 40% of the total liquidation amount, reaching $121.07 million USD.

The recovery of Bitcoin and prospects for the future

The strong recovery of Bitcoin, when in a moment it regained its high level above $67,000 USD, has sparked interest in market behavior and its potential future trends.

Although the market capitalization decreased by 6.6% over the past week, the value of Bitcoin still increased significantly by 6% in the last 24 hours, pushing the market capitalization above $140 billion USD. The revival in trading activity, with daily trading volume rising from below $60 billion USD to higher levels, indicates improved investor confidence and increased trading interest.

At the rate the #Bitcoin Macro Index is pumping, I wouldn't be surprised if we get a top by mid-2024, which would hint at a double pump cycle like 2013… a second top in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Furthermore, cryptocurrency analyst Willy Woo has presented an optimistic outlook for Bitcoin, indicating the possibility of a “double pump” cycle reminiscent of market models observed in 2013.

Related: Bitcoin Spot ETFs Witness Third Consecutive Day of Outflows

According to Woo, this model could forecast two significant price increases for Bitcoin in the coming years, with the first peak predicted in mid-2024 and a more substantial increase thereafter in 2025.

While such double pump scenarios are rare, Woo’s analysis, based on current market conditions and Bitcoin’s growth potential, provides an overview of the future of the world’s leading cryptocurrency.

Good trading

Yas

Very interest projects