Bitcoin surged to nearly $52,000, marking its highest price since December 2021. Major financial institutions continue to bolster their reserves with Bitcoin, even as its value increased by 21% in the past week.

In the last seven days, Bitcoin experienced a 21% surge, reaching $52,000 for the first time since December 2021. The primary driver behind this price increase is the growing influx of capital into Bitcoin ETF funds, reaching a peak of $631.3 million in February.

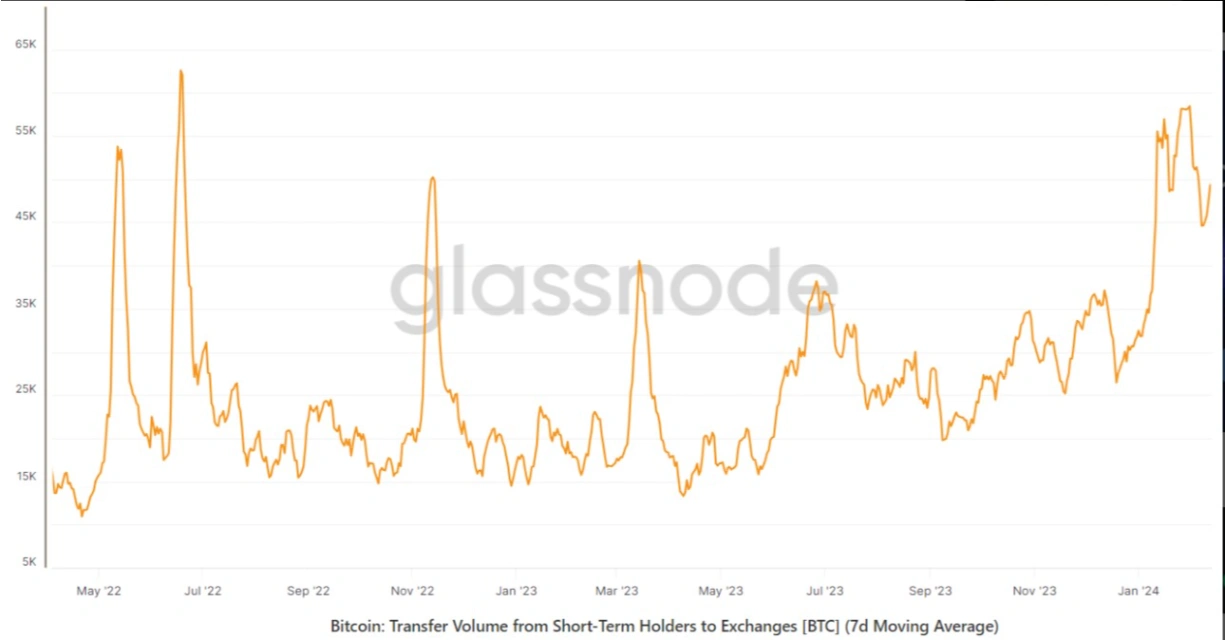

According to Glassnode, the short-term holder supply is decreasing. If these conditions persist, Bitcoin’s price could surpass $55,000. Short-term holders, those who purchased Bitcoin less than six months ago, significantly increased the volume of their Bitcoin on exchanges, averaging 49,504 Bitcoin per day in the past week. In comparison, long-term holders only sent 2,023 BTC per day during the same period, indicating that short-term holders are the primary sellers. Although 79% of the supply is held by long-term holders, the potential for rapid sell-offs remains.

Notably, all holders have been sellers in the past 7 days, except for very large whales holding over 100 BTC, likely representing institutional entities. These investors have added a total of 20,168 BTC, valued at over 1 billion USD, possibly driven by institutions issuing Bitcoin ETF Spot such as BlackRock, Fidelity, BitWise, Ark 21Shares, and others. Data indicates an increasing demand for ETF products as Bitcoin prices rise, providing strong support for the upward momentum.

This data demonstrates that the increase beyond $55,000 is no longer solely reliant on retail flows. Consequently, indicators reflecting previous outcomes, such as Google search trends or the “Fear and Greed Index,” may not accurately capture the risk tolerance of institutional investors and the subsequent demand for Bitcoin.

Short-term Bitcoin holders quickly deposited funds into exchanges, but the price surged from $42,900 to $52,000 within 7 days, representing a 21% increase. Unless long-term holders decide to partially cash in their holdings, all signs point to a weakening supply, creating conditions for further upward movement towards $55,000.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.