In a recent X (formerly Twitter) post, Santiment observed compelling reasons supporting a potential upward trajectory for Bitcoin’s [BTC] prices. The successful breach of the $43k resistance on December 20th served as a positive indicator of bullish momentum. A recent report underscored the robustness of miner revenue, with escalating transaction fees contributing to its elevation.

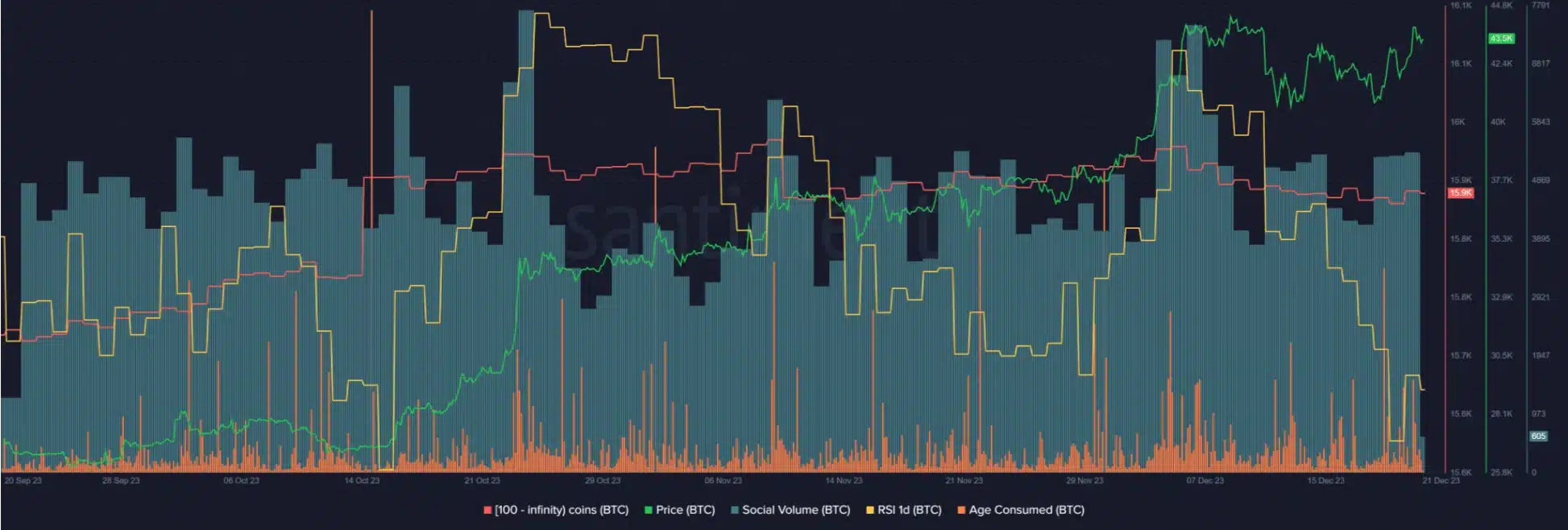

Taking a closer look at the metrics, Santiment reported a decline in social volume over the weekend, a consistent trend observed over the past few months. This was an anticipated development.

The count of addresses holding 100+ BTC increased from 15,941 on December 19th to 15,956 on December 20th. The age-consumed metric exhibited a notable spike on December 18th, suggesting a potential surge in selling pressure, although subsequent data showed no significant increases.

As emphasized in the Santiment post, the RSI dropped to 42.09 on December 19th before rebounding to 50.38 on December 20th.

However, it’s crucial to acknowledge that Santiment’s data calculations differ slightly from the widely-used technical analysis platform, TradingView. On TradingView, the RSI for the spot BTC market on Binance was at 57 on December 19th, a considerable contrast to Santiment’s 42.09. Discrepancies may arise due to minor variations in rounding or the utilization of different daily closes, influenced by distinct time zones.

Furthermore, Santiment’s data aggregation methods may differ, contrasting with the exclusive reliance on Binance data in the chart above.

Examining the TradingView chart, the RSI registered at 45 on October 12th but has not revisited that level since. A dip below 50 would signal an early indication of a shift in momentum favoring sellers.

Does this suggest that Bitcoin may not be on the verge of a rebound? Both charts concurred on one crucial point – Bitcoin maintained a bullish bias. The RSI remaining above the neutral 50 indicated that buyers retained control at the current moment, and the technical structure on the one-day chart continued to favor the bulls.

Related: Argentina Accepts Contract Payments in Bitcoin and Other Cryptocurrencies

While BTC had surpassed the $43k resistance, it encountered challenges breaching the local resistance at $44.25k. Open Interest had been on an upward trend since December 19th, signaling a bullish sentiment resurgence.

Anticipations revolved around the possibility that surpassing the local resistance at $44.2k would attract a fresh influx of capital into the futures markets, bolstering further gains.