Bitcoin reclaimed $35,000 after the FOMC meeting

On Wednesday, the Federal Reserve decided to maintain its policy and promised to continue focusing on controlling inflation. This had been anticipated by analysts beforehand.

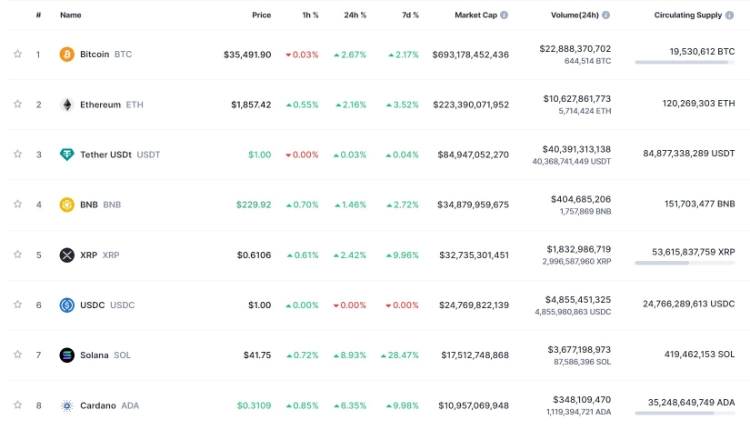

In tandem with Bitcoin’s rise, Solana surged by 16%, and altcoins saw significant gains throughout the Wednesday session. Meanwhile, Bitcoin’s late surge pushed its price to a 17-month high above $35,500.

Solana (SOL) continued its notable upward trajectory, rising 16% in the past 24 hours to reach its highest level in 14 months. Other Layer 1 blockchain tokens such as Avalanche (AVAX), Polkadot (DOT), and Near Protocol (NEAR) also recorded gains between 6% and 10%.

Decentralized Finance (DeFi) tokens, which had lagged behind in October, also made a comeback with Uniswap (UNI) and Aave (AAVE) rising by 15% and 10%, respectively.

Ether (ETH), the second-largest cryptocurrency by market capitalization, rose nearly 2%, outperforming Bitcoin in some fundamental aspects.

FOMC Meeting:

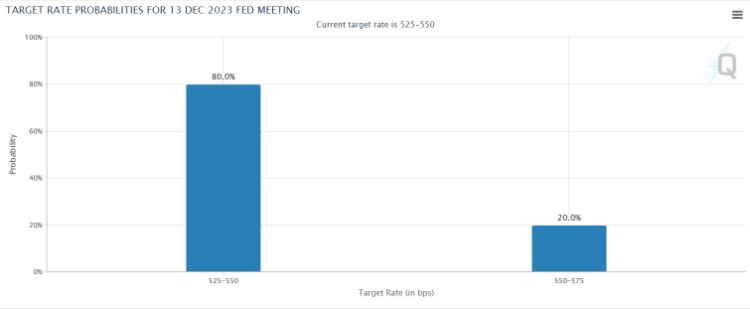

The Federal Open Market Committee (FOMC) of the United States Federal Reserve kept the federal funds rate range at 5.25% – 5.50% on Wednesday, as many had predicted.

Fed Chair Jerome Powell noted during a press conference after the FOMC meeting that the increase in the yields of U.S. Treasury bonds had contributed to tightening financial conditions, but he left open the possibility of further rate hikes if necessary.

Edward Moya, a market analyst at OANDA, observed in a note: “The Fed may have acted after keeping rates at the highest level in 22 years for an extended period.” “The Fed does not rule out the possibility of raising rates in the coming months, but futures contracts suggest that traders remain unconvinced.”

According to the CME FedWatch Tool, market participants now see a 74% likelihood that the Fed will maintain the current interest rates in January, up from 59%, and may start cutting rates around mid-2024.

Stocks closed the day with strong gains, with the S&P 500 index rising by 1.1% and the technology-focused Nasdaq 100 index gaining 1.5%. The yield on the 10-year U.S. Treasury bond dropped to 4.73%, down from nearly 5% earlier in the week, reducing the likelihood of a higher interest rate hike.

Justin d’Anethan, Head of Business Development at cryptocurrency market maker Keyrock, stated in an email: “BTC serves as a hedge against loose monetary policies, so lower interest rates will reinforce that value proposition and the willingness of investors to buy and hold cryptocurrencies.” “If hints of changes in rate policies become clearer, the cryptocurrency market is expected to grow.”

MicroStrategy’s Bitcoin profit surges by an additional $900 million.

Michael Saylor, the founder of MicroStrategy, has been steadily acquiring Bitcoin since the beginning of the third quarter. MicroStrategy has reported a profit of $900 million from its total of 158,400 Bitcoins, driven by optimism regarding the approval of exchange-traded Bitcoin futures funds.

Michael Saylor’s company added 6,067 more Bitcoins during the third quarter, including an additional 155 Bitcoins in October, according to MicroStrategy’s November 1st report.

In October, @MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC. Please join us at 5pm ET as we discuss our Q3 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/w7eRUcGobi

— Michael Saylor⚡️ (@saylor) November 1, 2023

The CEO of MicroStrategy stated that the company has no immediate plans to change its Bitcoin strategy.

“Our commitment to buying and holding Bitcoin remains strong, especially in the context of the growing potential for institutional adoption.”

>>> Bitcoin Sentiment Soars and Mining Difficulty Reaches New ATH

While the company’s revenue increased by 3% to $129.5 million in the quarter, it wasn’t sufficient to offset the losses, resulting in a net loss of $143.4 million. The company noted that the losses were due to the depreciation of digital assets and income taxes, totaling $33.6 million out of the net loss of $143.4 million.

The company also expressed confidence in the position of its integrated artificial intelligence-driven business intelligence products, with software licenses and subscription services increasing by 16% and 28% compared to the same period last year.

According to Google Finance, MicroStrategy’s stock price (MSTR) increased by 2.7% in after-hours trading, reaching $438 USD.