Bitcoin has rebounded, surging past the $98,000 mark following an announcement by U.S. Treasury Secretary Scott Bessent that trade negotiations with China will officially begin on May 10.

On May 7, 2025, Bitcoin’s realized market capitalization — a metric that measures the total value of all BTC based on the last price at which each coin moved — hit a new record high of $890 billion. This marks the third consecutive week the metric has posted unprecedented growth.

This surge reflects the growing capital inflow into Bitcoin, with both long-term holders (LTHs) and short-term holders (STHs) expanding their positions. It signals growing investor confidence in the market trend and raises expectations for a potential new bull run for the world’s leading cryptocurrency.

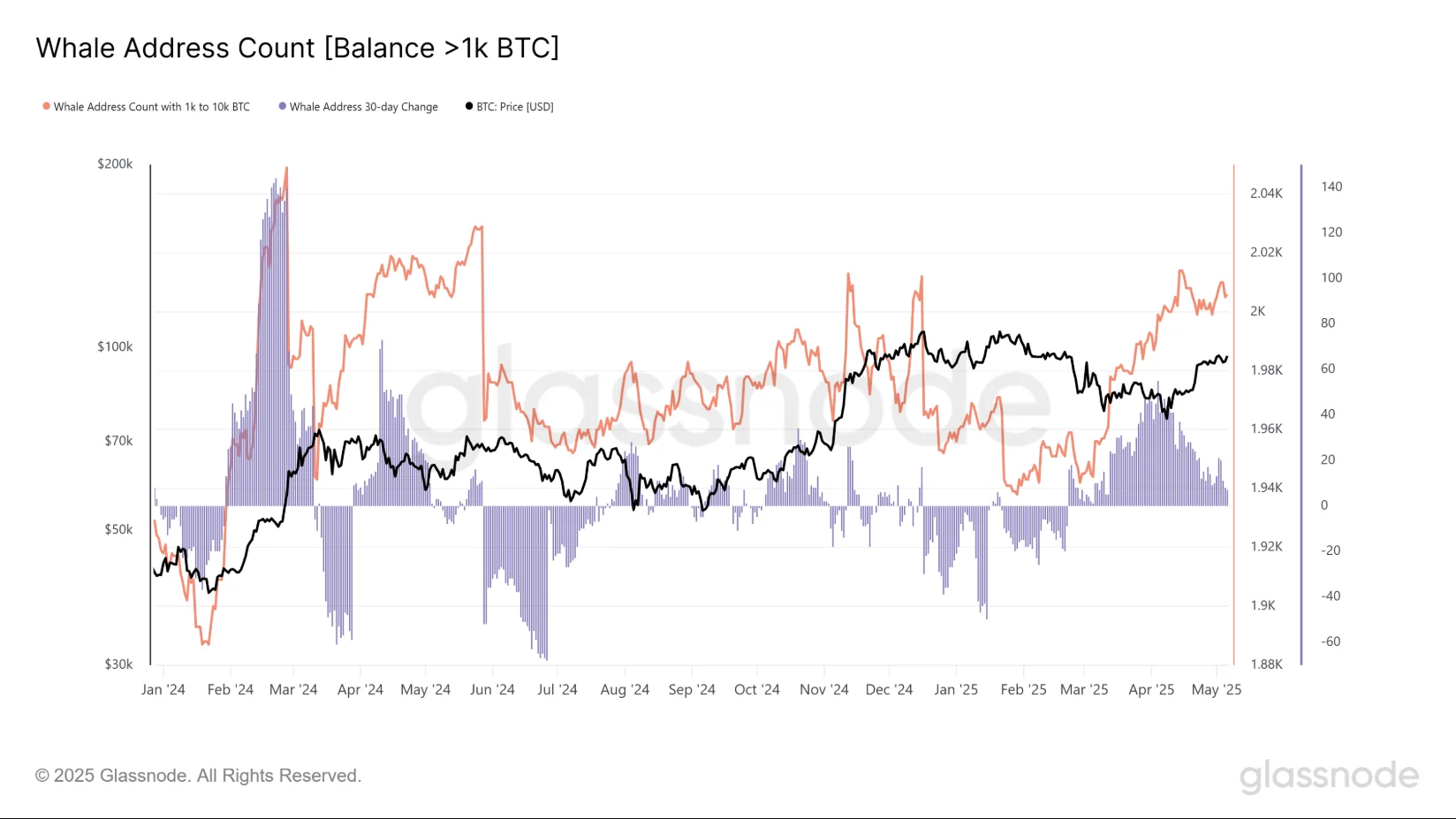

This bullish sentiment has been reinforced by aggressive accumulation from “whales” — large-scale investors — since the end of March 2025. In just six weeks, wallets holding between 10 and 10,000 BTC collectively added 81,338 BTC, indicating strong confidence in continued price appreciation and the possibility of Bitcoin returning to the $100,000 level soon.

Glassnode data also shows that the number of whale wallets holding over 1,000 BTC rose from 1,945 on March 1 to 2,006 by May 7 — the largest 30-day increase of this cohort in 2025 and the highest level since Q1 2024, when Bitcoin hit an all-time high following a similar accumulation phase.

Can Bitcoin Break Through the $100,000 Barrier?

The support zone between $93,000 and $95,000 proved resilient on May 6, with buying pressure sustaining prices above this range, backed by long-term positions. However, risks remain if the price slips into the low-liquidity zone between $91,600 and $89,000 — especially as markets await the release of the FOMC meeting minutes and statements from the Federal Reserve this week.

Conversely, if Bitcoin can break through the key resistance area between $97,000 and $99,000 — a level that formed a critical price cluster in Q1 and triggered a correction — the long-term outlook could tilt decisively bullish. A breakout would likely trigger a short squeeze and attract fresh liquidity into the market.

The $100,000 level is now seen more as a psychological milestone than a technical resistance. If BTC can turn the $97,000–$99,000 zone into solid support, a path toward $110,000 may open up — although much will still depend on broader market dynamics and actual trading momentum.