Bitcoin is showing clear bullish signals this week as spot market buyers regain dominance, officially ending a nearly two-month consolidation phase. The January recovery continues to strengthen as renewed spot demand pushes Bitcoin above the $95,000 level for the first time since mid-November.

At the time of writing, Bitcoin is trading around $97,200, according to TradingView data. This move marks a decisive breakout above a multi-week consolidation zone that had capped BTC’s price action since late 2025.

Bitcoin Breaks Out of a Prolonged Consolidation Phase

Throughout most of December and early January, Bitcoin traded sideways within a narrow range between $88,000 and $94,000, following a sharp correction from its November highs. The recent upside breakout signals a notable technical shift.

Specifically, Bitcoin has formed a higher high on the 12-hour chart—often a key indication of a developing uptrend. Importantly, trading volume expanded alongside the breakout, suggesting the move was driven by genuine market participation rather than thin liquidity. This reduces the likelihood of a short-lived price spike and points to renewed investor engagement at higher price levels.

Spot Market Data Signals Renewed Buy-Side Pressure

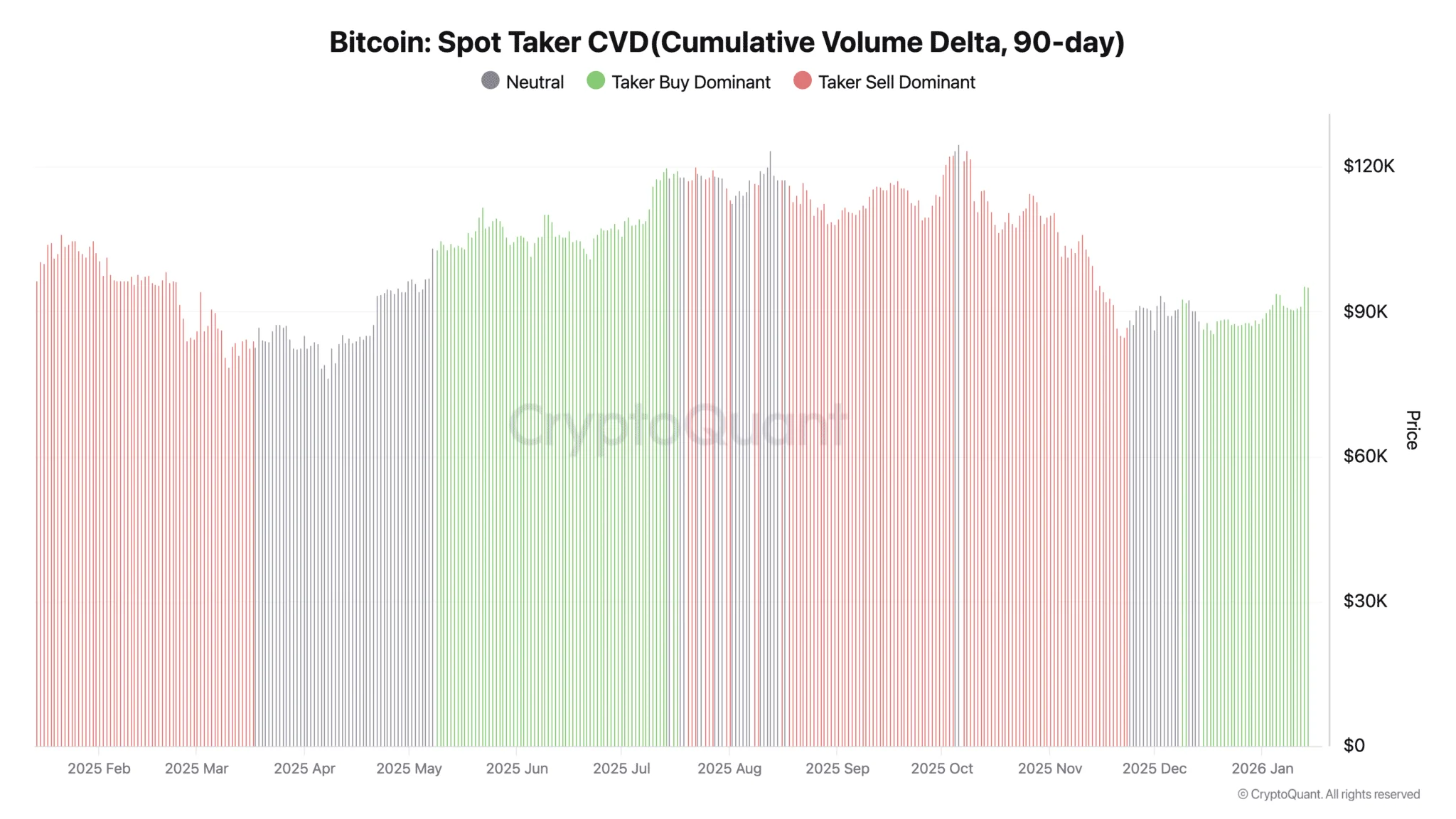

According to CryptoQuant, Bitcoin’s 90-day Spot Taker Cumulative Volume Delta (CVD) has turned positive again in January, indicating a return of taker buy dominance.

Taker CVD measures whether aggressive market participants are buying or selling at market price. A sustained positive reading shows that buyers are willing to pay higher prices to gain exposure—behavior typically associated with momentum-driven rallies rather than passive accumulation.

This marks a clear shift from the September–November period, when taker sell dominance aligned with Bitcoin’s corrective phase.

Accumulation Metrics Reinforce the Bullish Outlook

Further confirmation comes from the Accumulation/Distribution (A/D) indicator, which has continued trending higher throughout the breakout. The metric recently reached a local high of 5.05 million, suggesting that capital inflows have persisted even as Bitcoin moved above key resistance levels.

Historically, rising accumulation alongside a breakout increases the probability that price strength is supported by broad market participation, rather than short-term speculative positioning alone.

Key Levels to Watch

With the $95,000 level reclaimed, the $94,000–$95,000 zone is now likely to act as near-term support. On the upside, Bitcoin is approaching the psychological $100,000 milestone. Price action around this level will be crucial in determining whether the current momentum can extend further.