On April 22, Bitcoin recorded its strongest gain in 45 days, surpassing the $93,000 threshold — coinciding with gold also reaching a new all-time high. This breakout reflects investors’ growing concern over a potential global economic downturn as trade tensions escalate.

In stable markets, Bitcoin futures typically carry a premium of 5% to 10% to compensate for the risks associated with contract expiration. Currently, the premium stands at just 6% — a rather modest figure, considering that Bitcoin surged by $6,840 in just two days, from April 20 to 22. Some analysts believe this signals Bitcoin is gradually decoupling from broader stock market trends.

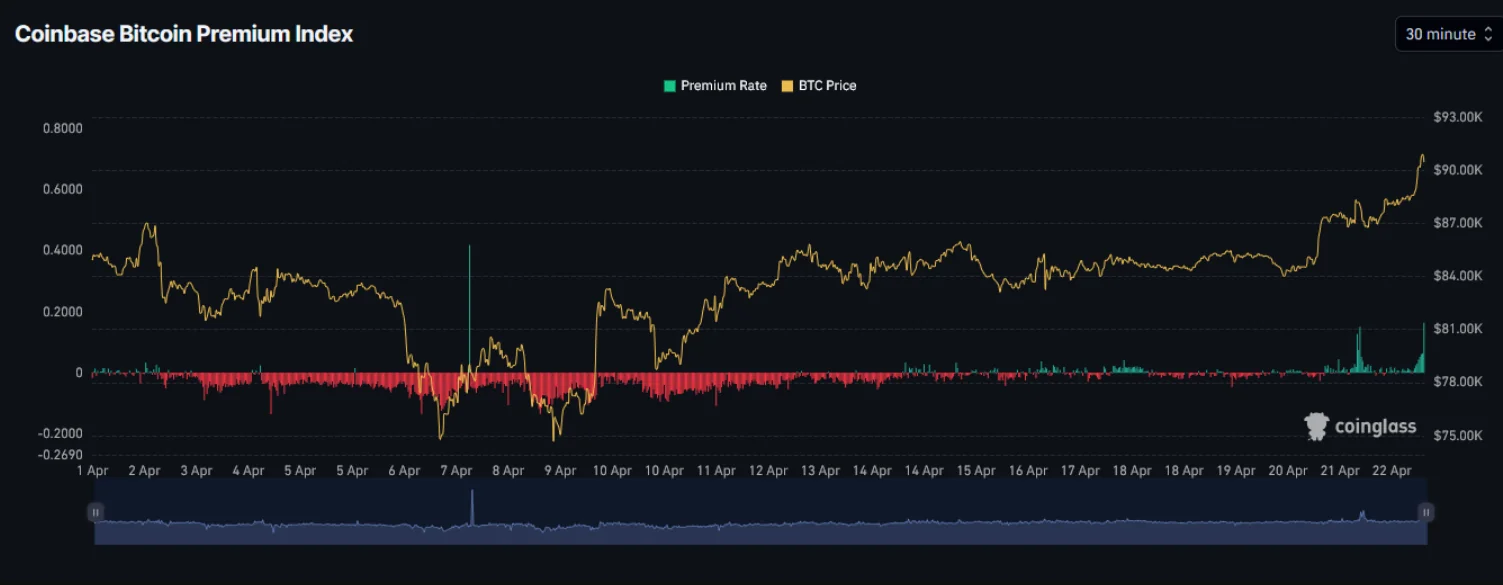

To better understand the driving forces behind this surge, the Coinbase Bitcoin Premium Index is a key metric to watch. This index tracks the price difference between Bitcoin on Coinbase Pro — a platform favored by institutional investors in the U.S. — and Binance, which is more popular among global retail traders. When the index rises, it indicates increasing buying pressure from institutional players.

In early April, retail investors dominated the market. However, from April 21 to 22, institutional demand picked up, as seen in the 0.16% uptick in the Coinbase premium — according to data from CoinGlass.

Since tariff-related concerns began weighing on market sentiment, institutional investors had largely stayed on the sidelines. But the recent Easter holiday seems to have marked a shift in momentum.

Analyst Rekt Capital noted that Bitcoin has decisively broken out of its long-term downtrend:

“The months-long bearish phase is over. Once a technical downtrend is broken, an upward trend emerges.”

Another macroeconomic factor influencing the market is the increasingly strained relationship between President Trump and Federal Reserve Chair Jerome Powell. Their disagreement on how to tackle inflation — triggered by tariffs — and the Fed’s reluctance to cut interest rates have raised concerns over the Federal Reserve’s independence.

The U.S. Dollar Index — which measures the dollar’s strength against major global currencies — has been sliding since February, hitting its lowest level since 2022. Speculation that Trump may attempt to interfere with the Fed’s policies is adding further uncertainty.

Against this backdrop, Bitcoin is emerging as a promising alternative asset. As a decentralized, censorship-resistant digital currency not controlled by any single entity, Bitcoin is becoming an increasingly attractive safe haven as confidence in traditional monetary systems continues to erode.