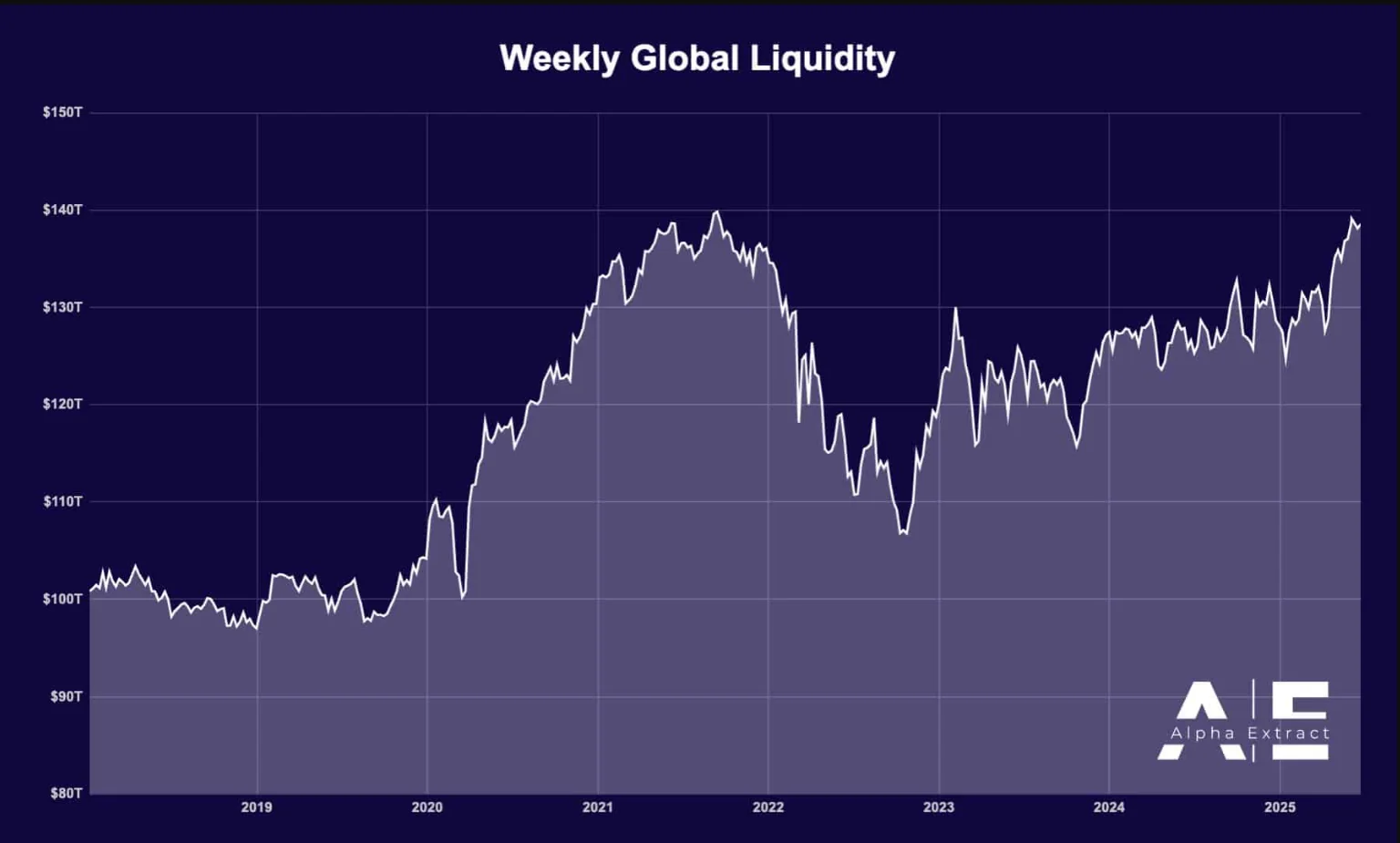

Bitcoin continues its strong upward momentum as global liquidity approaches the $140 trillion mark — a level nearly matching its historical peak. This trend is fueled by a weakening U.S. dollar and a sharp drop in the bond market volatility index (MOVE), paving the way for capital to flow into risk assets.

According to data from Alpha Extract, global liquidity increased by $460 billion last week, representing a 0.33% rise. This fresh inflow of capital provides a critical macroeconomic foundation that supports Bitcoin’s bullish trajectory.

RoC Remains Elevated, Signaling Bull Market Conditions

The 3-month Rate of Change (RoC) indicator remains high, reinforcing the idea that Bitcoin’s breakout above $78,000 is no random spike. Historically, a rising 3-month RoC has been linked to strong bull markets and heightened risk appetite. Despite ongoing geopolitical tensions, especially in the Middle East, the stable upward path of RoC continues to bolster Bitcoin’s price action.

As tensions between the U.S. and Iran ease, market fear has also subsided. While direct conflicts can sometimes increase liquidity through emergency spending, the current preference is for stability and sustainable growth — an ideal backdrop for Bitcoin and other risk assets to climb.

Institutional Flows and Whale Activity Signal Confidence

Institutional capital continues to flow into Bitcoin with no sign of slowing down. Notable whale activity further confirms this trend. In one high-profile transaction, a whale withdrew 163 BTC (worth approximately $17.16 million) from Binance. Yet this was only the tip of the iceberg: the same entity made a series of transfers totaling 2,263 BTC (around $235 million), with 2,100 BTC moved into cold storage — a clear sign of long-term conviction and a safer asset management strategy.

Meanwhile, ETF inflows are reinforcing the optimistic outlook. According to Trader to The Fund, Bitcoin ETFs recorded $350.48 million in net inflows during the latest session, marking 10 consecutive days of positive flows — a strong signal of growing institutional interest.