While Bitcoin (BTC) continues to post impressive gains, on-chain metrics paint a much quieter picture. At the time of reporting, BTC was trading around $109,919, up 2.04% in the past 24 hours. However, the number of active addresses remains flat at around 850,000 — a level last seen when Bitcoin was valued at just $16,000 in 2022.

This divergence reflects a shifting market dynamic: institutional capital is increasingly flowing in through off-chain channels like ETFs and corporate bonds. These investment vehicles make it difficult for traditional on-chain metrics to fully capture the real demand for Bitcoin.

Are Institutions Redefining the Market Cycle?

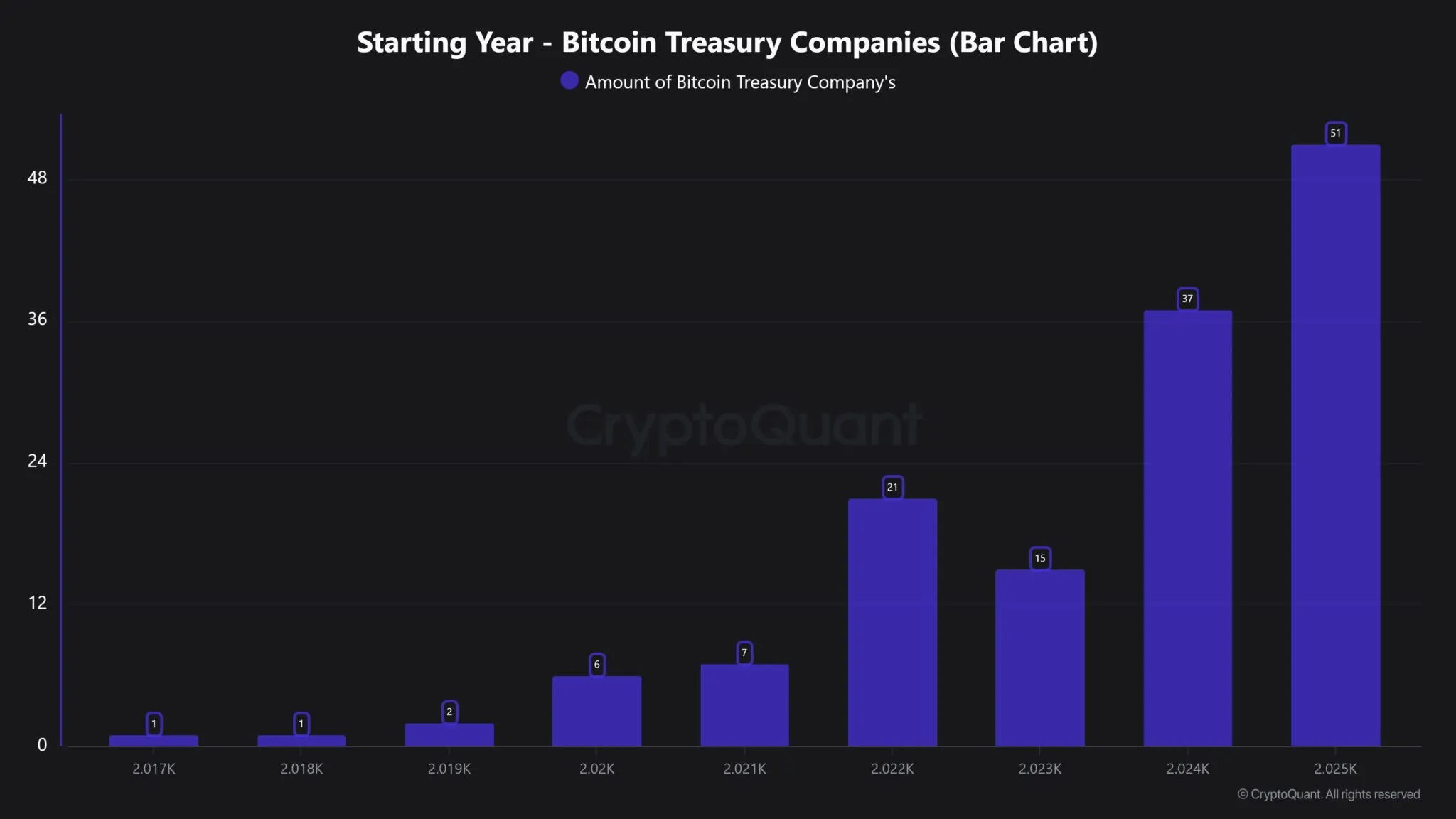

One of the most significant trends is the growing number of companies adding Bitcoin to their balance sheets — a sign of long-term confidence from institutional players. According to data from CryptoQuant, by 2025, 51 companies now hold BTC in treasury — nearly double the figure from two years ago. Unlike retail investors who tend to follow short-term price swings, institutions are accumulating Bitcoin with a long-term view, gradually repositioning it as a macro hedge — the so-called “digital gold” in the eyes of global investors.

Miners Remain Firm in Their Bullish Outlook

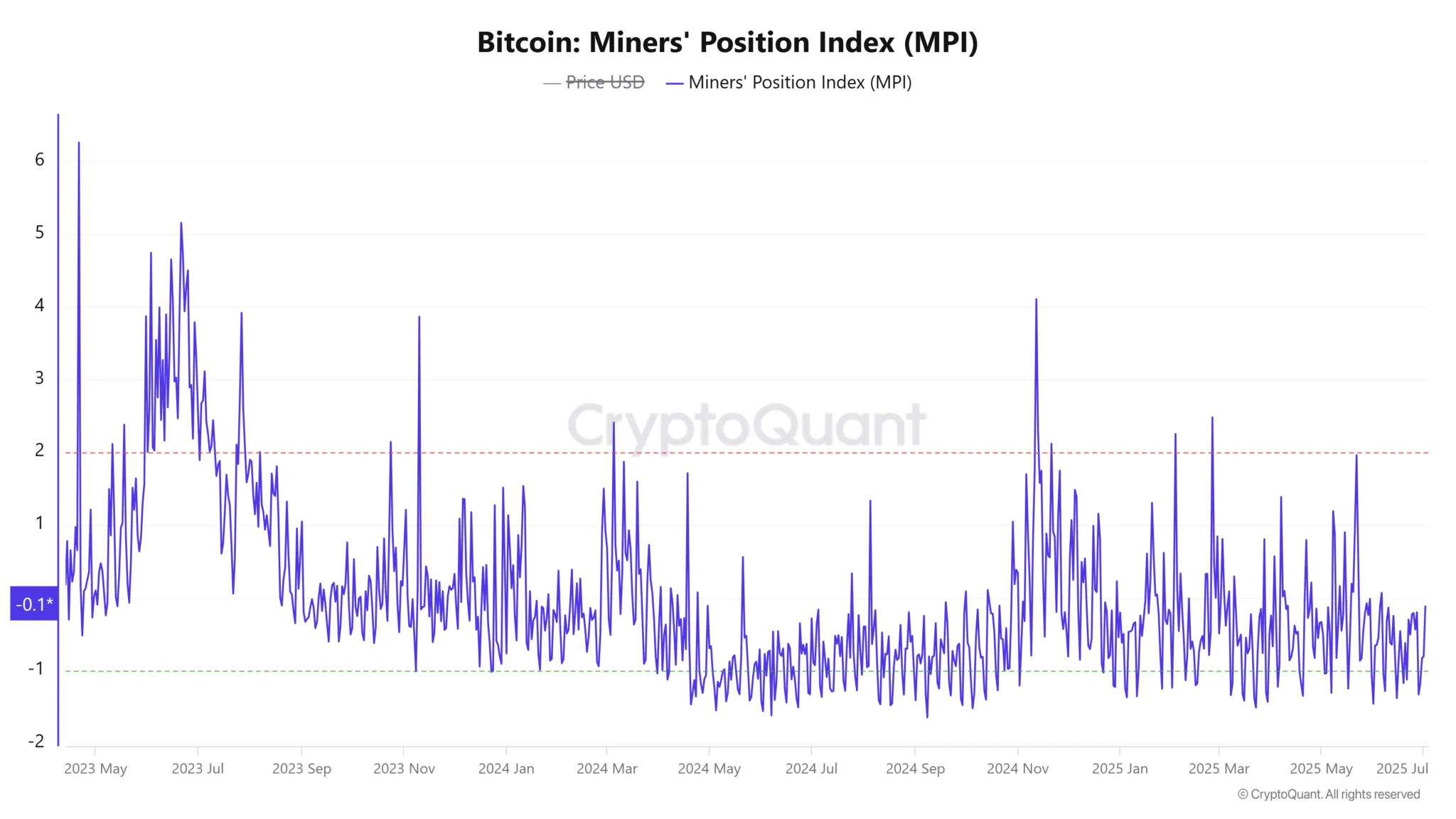

Data from the Miner Position Index (MPI) shows the metric has jumped 68.51% daily but remains in negative territory. This means miners are currently selling less BTC than their annual average. Historically, negative MPI values suggest miner optimism about future price increases. Conversely, if miners anticipate a downturn, they typically offload more coins to exchanges.

The current holding behavior — despite rising mining costs — provides a quiet yet solid layer of support for Bitcoin’s price rally. This conviction helps ease short-term supply pressure and reinforces long-term market confidence.

These developments suggest Bitcoin may be entering a new growth phase — one that’s less noisy in terms of on-chain activity but powered by strong institutional backing and long-term conviction from key market participants. A quieter yet deeper bull cycle may be unfolding for the world’s leading cryptocurrency.