Long-Term Holders Control 80% of Supply — A Supply Shock in the Making?

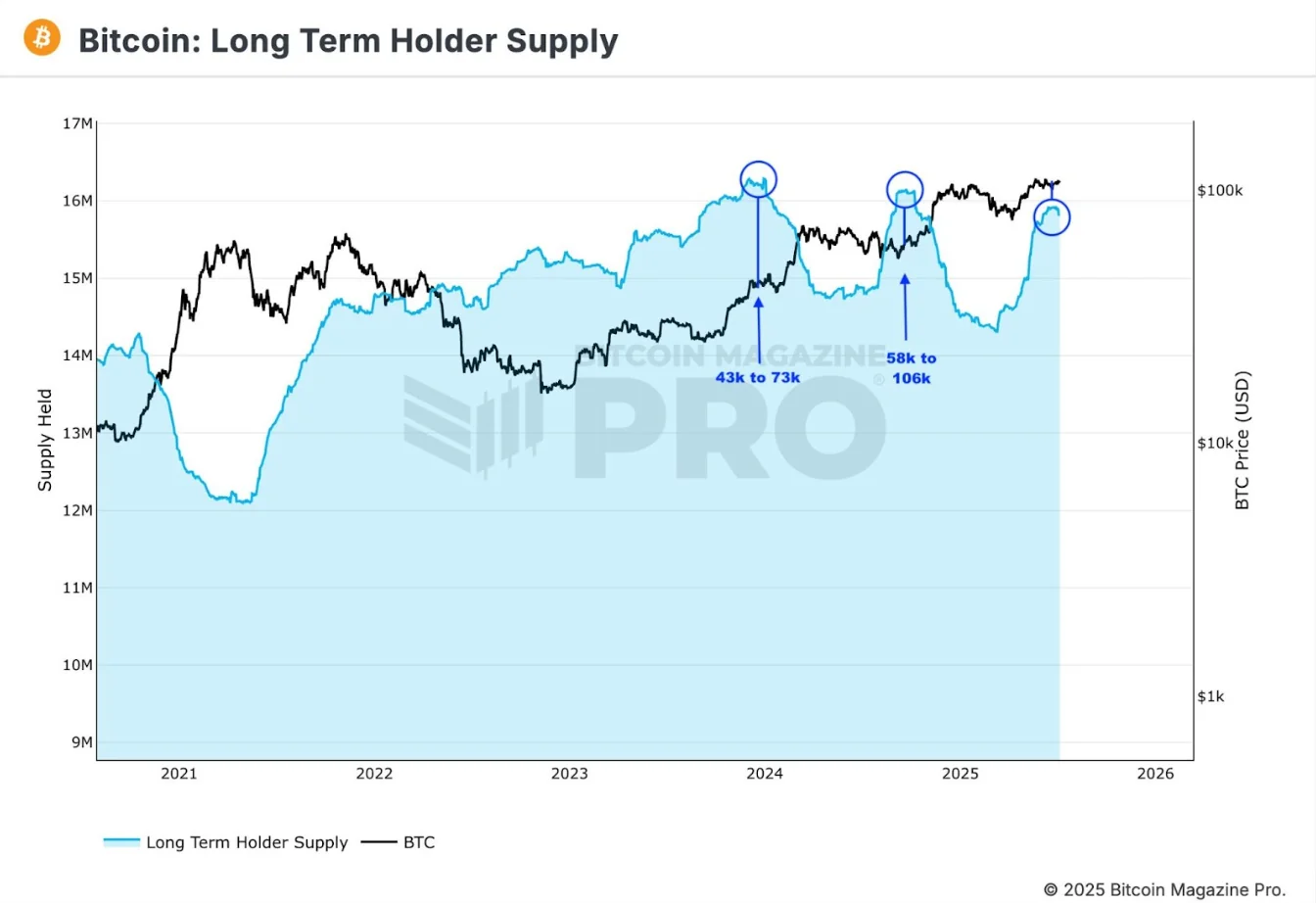

According to the latest data, long-term holders (LTHs) — those who have held BTC for at least 155 days — now control 80% of the total circulating Bitcoin supply. This is considered a strong indicator of investor confidence in the long-term value of the asset.

Crypto market analyst CrediBULL Crypto noted: “Over 80% of all the Bitcoin that will ever exist is currently being HODL’d.”

He emphasized that in Bitcoin’s 15-year history, the LTH supply has only surpassed 80% twice — in February and October 2024 — and both times were followed by BTC price rallies of 72% and 84%, respectively.

This phenomenon is driven by the fact that when most BTC is held by so-called “diamond hands,” even a small wave of new demand can trigger sharp upward price movements due to a supply crunch.

CrediBULL Crypto added: “Now that the ‘excess’ supply has returned to long-term holders — and with Bitcoin treasury companies leading the way — the next upward impulse is imminent. And this time, it could surpass the previous two, potentially breaking through $50,000.”

As of June 5, the total supply held by long-term holders reached an all-time high of 14.7 million BTC, worth approximately $1.6 trillion. Combined with consistent institutional accumulation, the market is approaching a state of “illiquid supply,” a key ingredient for explosive price action if demand increases.

Traders Eye $130,000 BTC in Q3

On derivatives platform Deribit, traders are increasingly buying September call options with a strike price of $130,000 — signaling bullish expectations for the months ahead.

Singapore-based QCP Capital wrote in a Telegram note: “Volatility remains pinned near historical lows, but a decisive breakout above the $110,000 resistance could spark renewed volatility. Some larger players appear to be positioning for exactly that.”

QCP also observed that traders are maintaining September call spreads targeting $115,000 to $140,000, suggesting a structurally bullish outlook for Q3.

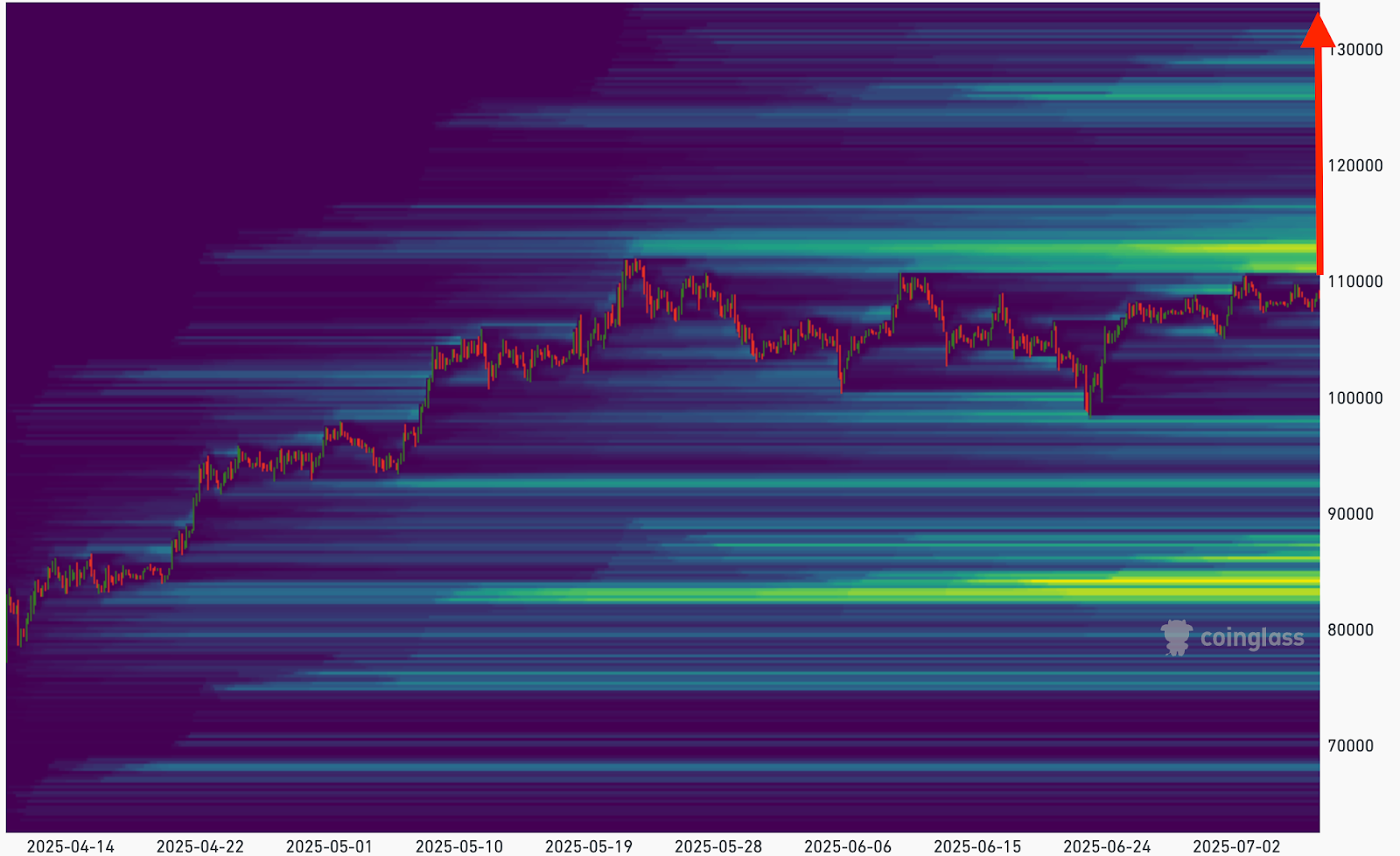

According to CoinGlass, the BTC/USDT three-month liquidation heatmap shows large liquidity clusters just above $110,000, with heavy sell orders placed between $122,000 and $130,000.