Bitcoin saw a sharp surge in the past 24 hours, breaking above $107,000 — its highest level this week — as strong institutional inflows boosted market sentiment. However, signs of profit-taking suggest a possible short-term correction ahead.

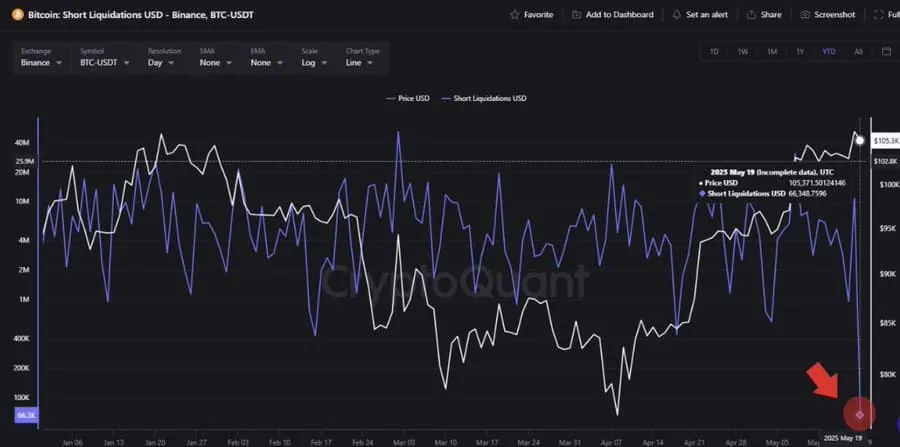

Over the last day, Binance recorded an all-time high in short liquidation volume. Short liquidations occur when traders betting on a price drop are forced to close positions due to a sudden price increase, triggering stop-loss orders. Specifically, Bitcoin’s price jumped from $103,195 to $105,535 — a 3.48% gain — wiping out short positions and causing losses totaling $66.3 million for traders on the wrong side of the bet.

Interestingly, these liquidations often signal potential for further price increases, as they indicate new capital entering the market. Data shows that much of this capital is likely coming from traditional financial institutions. Recently, 10 Bitcoin ETFs reported a net inflow of 2,103 BTC, worth over $210 million. Notably, BlackRock’s iShares contributed 1,250 BTC, raising its total holdings to more than 633,000 BTC — valued at approximately $66.28 billion.

The return of institutional investors is a positive signal, suggesting renewed confidence in Bitcoin. If this trend continues, it could help expand crypto market infrastructure and attract both retail investors and large “whale” players back into the game.

However, despite the bullish momentum, the market still faces notable risks, especially on the psychological front. A key indicator — Binary Coin Days Destroyed (CDD) — currently suggests that long-term holders may be preparing to sell. With the index sitting at 1, it implies that seasoned investors are moving their assets, likely to lock in profits.

In addition, technical analysis shows Bitcoin is currently in an overbought state. When the Relative Strength Index (RSI) crosses above 70, it often signals that the asset is overvalued and could soon face a correction. This reinforces the likelihood that some investors are taking profits while waiting for a more favorable re-entry point.

In summary, while Bitcoin is experiencing strong growth fueled by institutional interest, the risk of a short-term pullback remains. Investors should stay cautious and monitor market developments closely before making further decisions.