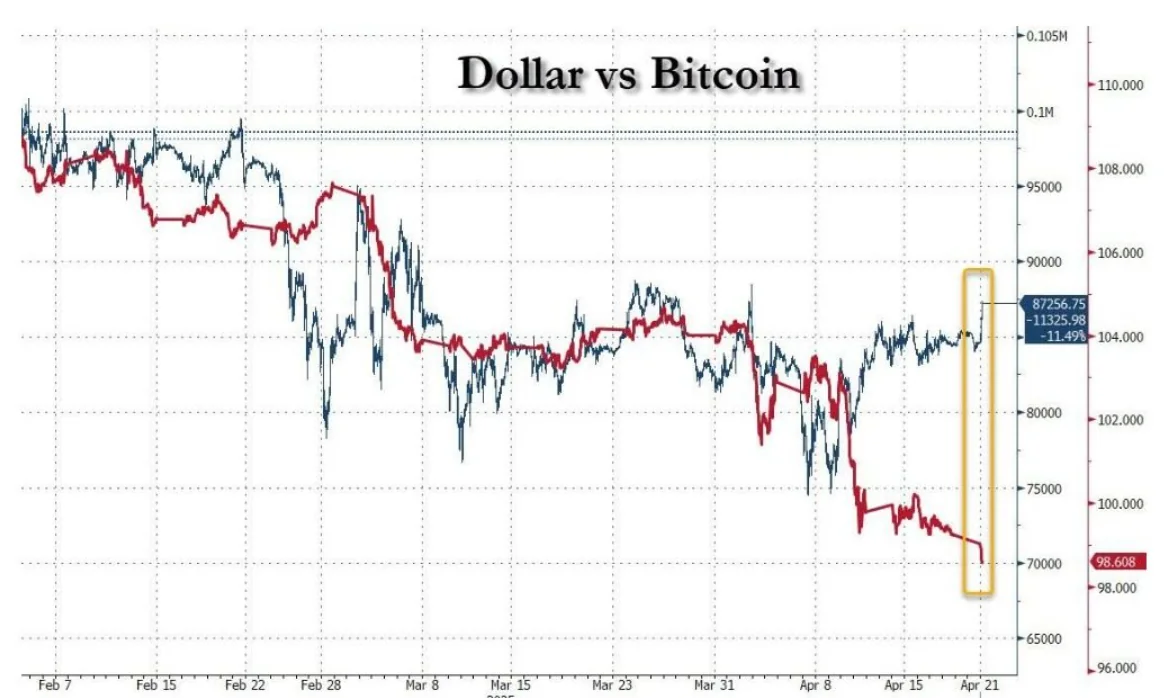

Amid growing concerns over a potential global trade war and a weakening US dollar, Bitcoin is increasingly showing signs of decoupling from the stock market, instead mirroring the bullish momentum of gold.

During the April 21 trading session on Wall Street, Bitcoin continued its strong rally, further distancing itself from the downward trend in equities as trade tensions between the US and several countries intensified.

According to data from TradingView, the BTC/USD pair surged past $88,000, marking its highest level this month. After ending last week with impressive gains, the leading cryptocurrency extended its upward trend, tracking the performance of gold, which also set a new all-time high at $3,430 per ounce.

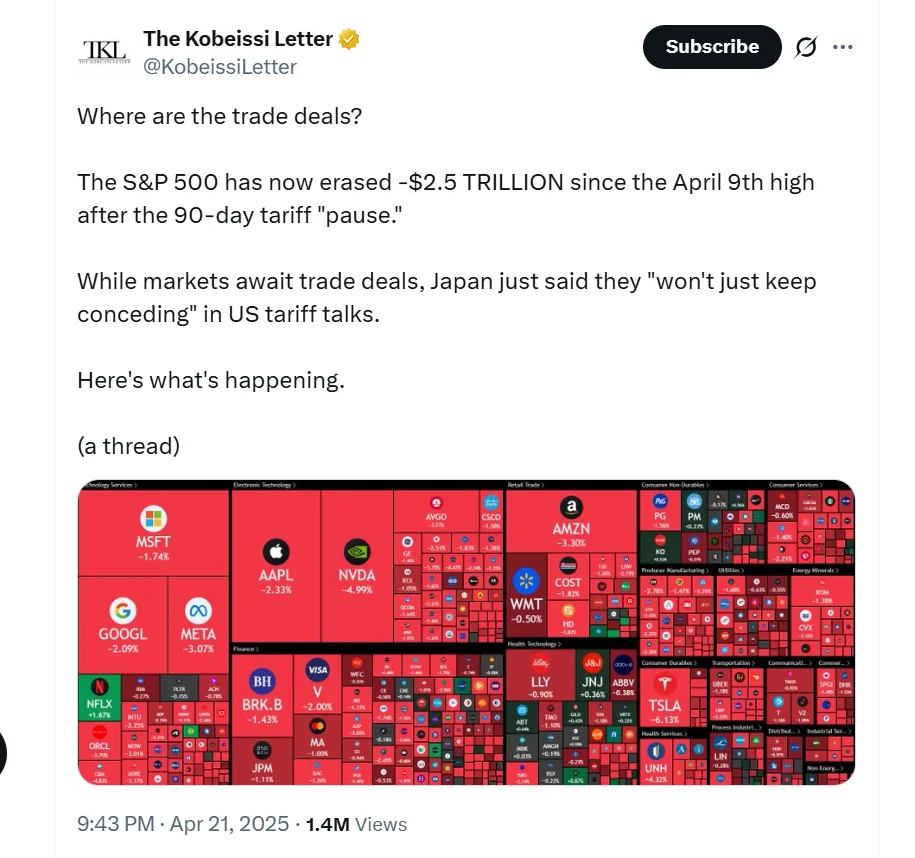

In stark contrast, the stock market saw a sharp decline. As of now, the S&P 500 and Nasdaq Composite indices have each dropped by more than 2%, driven by heavy sell-offs.

Bitcoin’s momentum underscores its growing independence from traditional equities, especially amid mounting global uncertainty shaking investor confidence.

Escalating trade tensions between the US, China, and Japan—alongside former President Donald Trump’s increasing criticism of Federal Reserve Chairman Jerome Powell’s interest rate policies—have only deepened market volatility.

On the X platform, financial news outlet The Kobeissi Letter commented: “Tech stocks continued to be heavily sold off last week. Nvidia (NVDA) is down more than 15% since the start of the week, while many ‘Mag 7’ stocks have also lost over 10%.”

The post added: “Without the support of big tech, the market is struggling to find its footing.”

Meanwhile, the US Dollar Index (DXY) is also under pressure, now trading at its lowest level since March 2022. DXY has fallen below 99 points—its weakest reading in the past 52 weeks.

As the report concluded: “While the DXY hits a 52-week low, both Bitcoin and gold are soaring. It’s clear the market is in dire need of a trade agreement—sooner rather than later.”