Bitcoin has just experienced a sharp pullback after officially falling below the psychological $90,000 level, triggering a massive wave of liquidations across the derivatives market. Forced selling pressure from highly leveraged positions is pushing the crypto market into a more sensitive phase.

On January 21, Bitcoin briefly dropped to around $89,162 before stabilizing near $89,368, down roughly 1.9% on the session. The move not only broke an important psychological level but also dragged the Relative Strength Index (RSI) down to around 33.7, signaling weakening momentum after sustained selling pressure.

A Leverage Flush Dominated by Long Liquidations

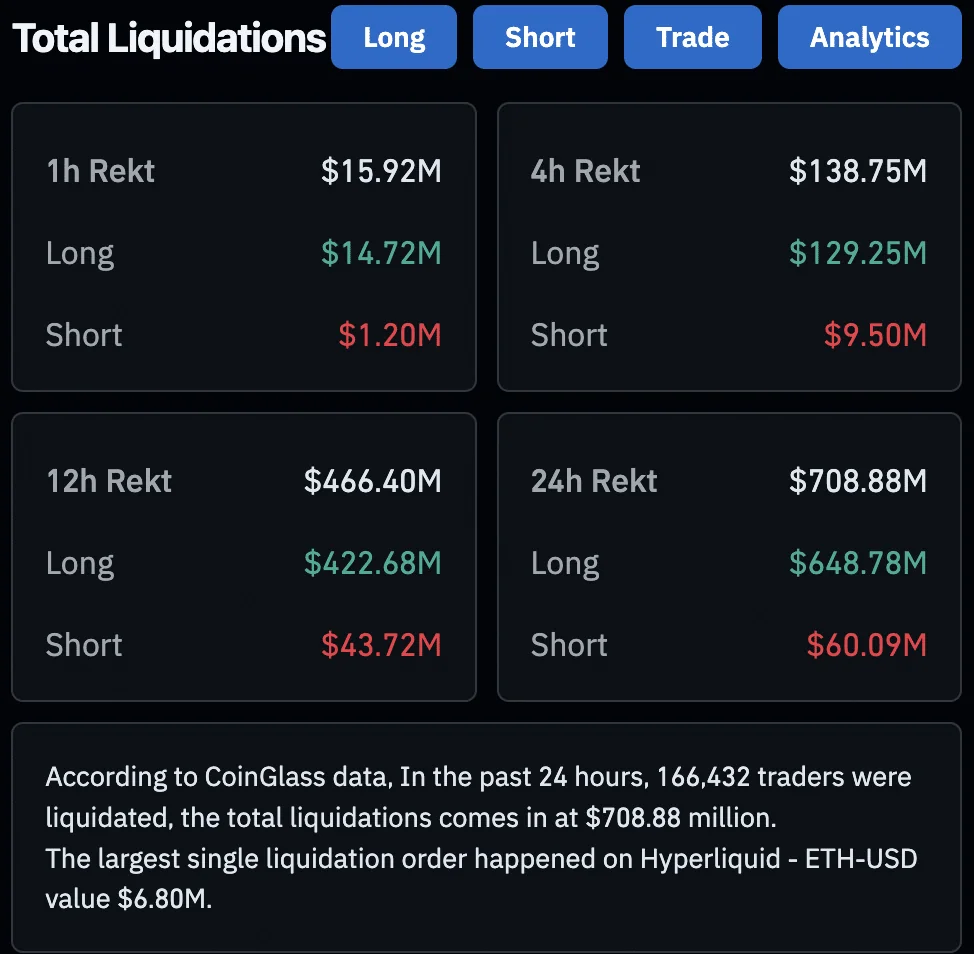

Data from CoinGlass shows that the sell-off was largely driven by long-side leverage being wiped out.

Over the past 24 hours, total crypto liquidations reached $708.88 million, including:

-

$648.78 million from long positions

-

Just $60.09 million from short positions

In the last 12 hours alone, liquidations totaled $466.40 million, again heavily skewed toward longs with $422.68 million, compared with $43.72 million from shorts.

CoinGlass also reported that 166,432 traders were liquidated during the 24-hour period.

This kind of imbalance usually suggests the market was positioned for continuation or a bounce. However, as spot prices pushed lower, cascading stop-outs were triggered, amplifying the sell pressure.

Bitcoin Leads the Pullback as Traders Watch the $90,000 Level

With Bitcoin losing the $90K handle, attention now turns to whether price can quickly reclaim that psychological zone or whether sellers will continue to defend it on any rebound attempt.

From a market structure perspective, the combination of a sub-$90K print and an RSI near the low-30s suggests Bitcoin has entered a more fragile phase. Bounces can occur, but they are often volatile and highly sensitive to headline-driven risk sentiment and funding conditions in derivatives markets.

Still, the clearest signal from the data is positioning. The liquidation skew shows the market is deleveraging aggressively. Once forced liquidations slow, near-term sell pressure can sometimes ease, allowing the market to stabilize.