Key Bitcoin Fundamentals Surging in October

What’s catching the attention of the crypto community is the soaring open interest (OI) in Bitcoin options, which has now reached an all-time high.

This increase in OI has not been limited to the Chicago Mercantile Exchange (CME), as data from The Block and Velo Data shows that it has surpassed the previous peak of $14.9 billion set in October 2021, reaching an impressive $16.96 billion when accounting for both crypto and traditional finance exchanges.

#Bitcoin options just surpassed peak open interest from 2021 👀

enforcing our thesis that watching options flows and positioning is increasingly important pic.twitter.com/JIB9YQITeY

— Kelly Greer (@kellyjgreer) October 26, 2023

This surge in open interest indicates a substantial influx of capital into the options market, coupled with a noticeable uptick in CME’s open interest. The CME’s options OI, as well as its futures OI, has been on an upward trajectory in recent weeks. In fact, CME is on the verge of surpassing Binance as the leading Bitcoin futures exchange.

The prevailing theory at the moment is that institutional investors are strategically positioning themselves for the anticipated approval of a spot Bitcoin ETF. However, some argue that retail traders are also playing a significant role in this trend. The combination of these factors has created a positive sentiment around Bitcoin, with many speculating that it could drive the asset’s price even higher.

One notable technical analyst, known as “Crypto Kid,” has pointed out a high number of call options compared to puts. Currently, Coinglass data shows that calls make up 67.99% of the options, while puts account for 32.01%.

This disparity in favor of call options has led Crypto Kid to suggest that the current open interest could push Bitcoin’s price up to $40,000. Call options allow holders to buy an asset at a predetermined strike price, while put options enable holders to sell at the strike price.

The total #Bitcoin open interest has recently reached an all-time high and could potentially drive $BTC to $40,000…👇

It’s possible that we will see a BTC bull run soon because institutional investors are anticipating higher prices, either after ETF approvals or the halving.… pic.twitter.com/Jtf55kBLnQ

— Crypto Kid (@CryptoKidcom) October 29, 2023

Market sentiment, often measured by the put-call ratio (PCR), is currently in bullish territory with a ratio of around 0.47 (below 0.7 is generally seen as bullish). This further supports the idea that investors are optimistic about Bitcoin’s future.

In terms of technical analysis, “Duo Nine” predicts that Bitcoin’s next move could take it to $36,000, although a retest of the $31,000 to $32,000 price range is not ruled out. Resistance lies between $34,800 and $35,000, with support in the range of $33,400 to $33,600. Another analyst, “Mac,” shares a similar outlook, aiming for a $37,000 target.

Looks to me #Bitcoin likes to play.

This consolidation here can mean only two things:

🔹 Next leg up, test 36k

🔸 Next leg down, re-test 31-32kThe pump from 30k to 35k was in one day. The price likes to revisit such candles so I lean a bit bearish here.

Your bias? #BTC pic.twitter.com/ggJC4sjS9x

— Duo Nine ⚡ YCC (@DU09BTC) October 30, 2023

As of the latest data from CoinMarketCap, Bitcoin is currently trading at $34,100, indicating a 0.79% decline in the past 24 hours. Over the past week, the asset has fluctuated between the $33,400 and $34,800 price points.

In summary, the significant rise in open interest reflects growing investor interest in Bitcoin derivatives, which could have substantial implications for its price in the near future.

Bitcoin Mining Difficulty Achieves Record High

Bitcoin mining difficulty has once again reached a new all-time high (ATH), marking the fourth consecutive positive adjustment. The mining difficulty, a fundamental feature of the Bitcoin blockchain, determines how challenging it is for miners to solve blocks. This metric is measured in terms of the number of hashes miners must generate to complete a block.

The purpose of this feature is to maintain a consistent block production rate on the network. When miners increase their computing power, known as “hashrate,” they solve blocks more quickly.

>>> Price Forecasts: Ethereum’s Positive Outlook and Bullish XRP Expectations

To maintain the standard block production rate, the blockchain automatically increases the difficulty in the next scheduled adjustment. This process is entirely automated, following the code established by Satoshi Nakamoto, and it serves as a control mechanism for cryptocurrency inflation. Miners cannot simply increase their hashrate to create more tokens.

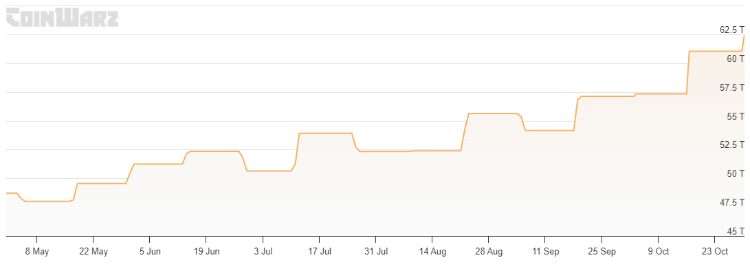

The recent trend in Bitcoin mining difficulty over the last three months shows that the network has experienced a 2% increase in the last 24 hours, resulting in a new ATH of 62.46 trillion.

This marks the fourth consecutive positive difficulty adjustment, a noteworthy occurrence. The reason for this ongoing increase in difficulty is the substantial growth in the Bitcoin mining hashrate. The 7-day average Bitcoin mining hashrate, as shown in the chart, has been consistently climbing and reaching its own ATHs. The fact that the network has had to raise the difficulty level four times in a row underscores the relentless expansion of mining facilities.

Despite the price of Bitcoin experiencing some challenges, much of the recent hashrate growth has occurred during this period. The revenue of miners largely depends on the asset’s price, as block rewards are distributed at a relatively constant rate. With Bitcoin’s recent rally to higher levels, it’s possible that miner expansion will continue, leading to significantly higher revenues for miners.