After two weeks of sluggish performance, Bitcoin (BTC) has staged an impressive comeback with three consecutive days of gains. From a local low of $98,000, the leading cryptocurrency surged to around $106,000, signaling a strong recovery trend.

Although BTC has regained most of its previous losses—delivering profits to both short-term and long-term investors—the long-term holders (LTHs) show no signs of cashing out. Instead, they remain committed to their holding strategy, anticipating higher price levels ahead.

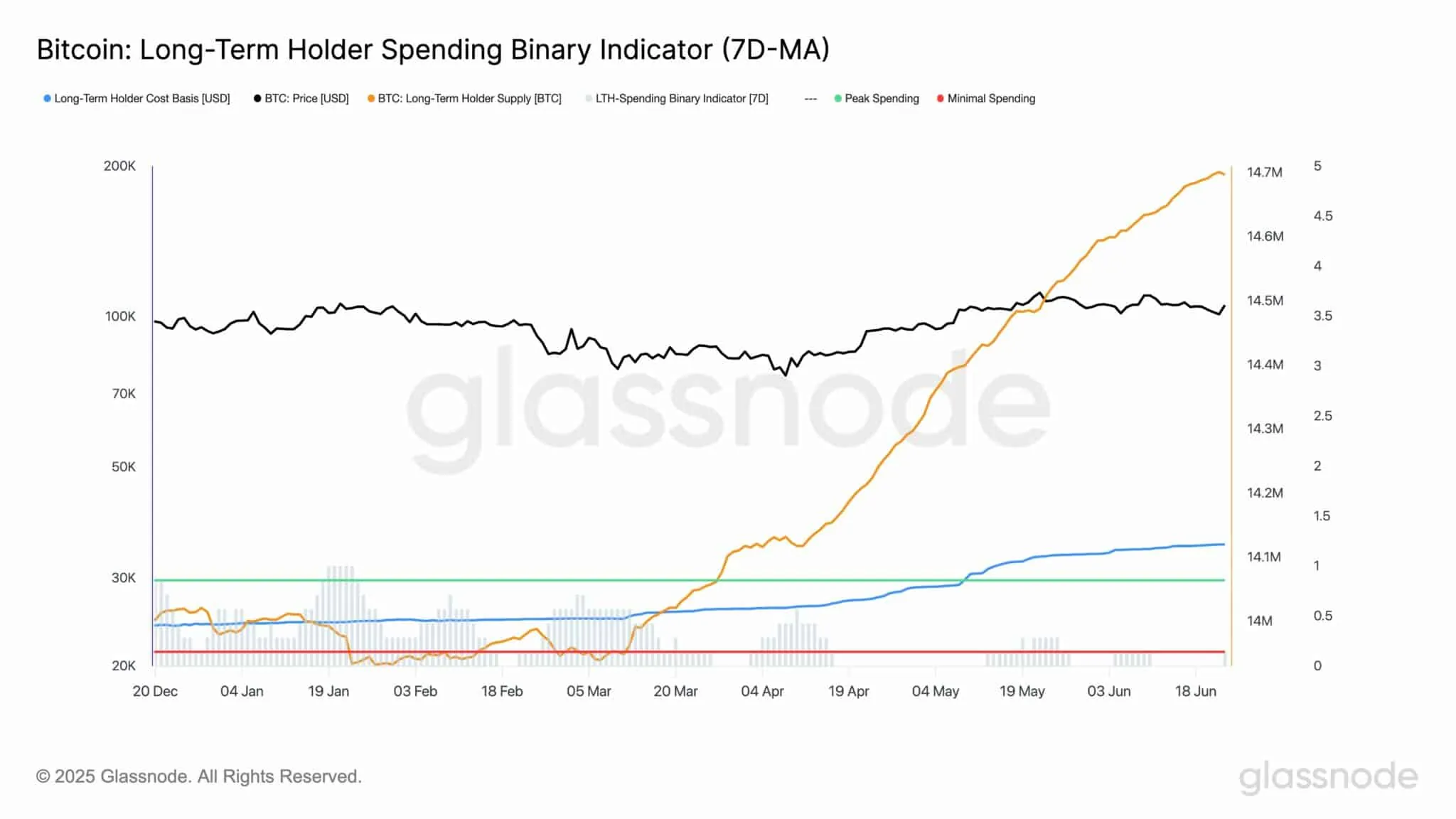

According to data from Glassnode, long-term spending activity is currently at its lowest in two weeks, a clear indication that LTHs are not looking to sell. This group now holds nearly 14.7 million BTC, close to the all-time high.

The Net Position Change indicator for HODLers has also turned positive this past week, reaching 10,330 BTC—highlighting a period of strong accumulation. Historically, such large-scale accumulation by LTHs often signals solid support zones and potential price rallies.

Notably, the RHODL ratio—which compares long-term confidence to short-term interest—is now at 2,700, reflecting strong conviction from long-term investors. This not only reduces selling pressure but also helps attract fresh capital back into the market.

Fueled by this long-term optimism, Bitcoin recently touched a local high of $106,800. The decision by veteran holders to continue accumulating rather than selling suggests a broadly positive market sentiment.

If this momentum continues, BTC may soon retest the $107,000 mark and aim for the next resistance zone at $109,457. However, if LTHs shift sentiment and begin distributing their holdings, the market could face a pullback toward the $104,348 level.