Bitcoin experienced significant volatility, surging to $88,500 overnight before plummeting to $82,500 after U.S. President Donald Trump signed an executive order imposing reciprocal tariffs on trade partners and setting a base import tax of 10% on all goods from every country.

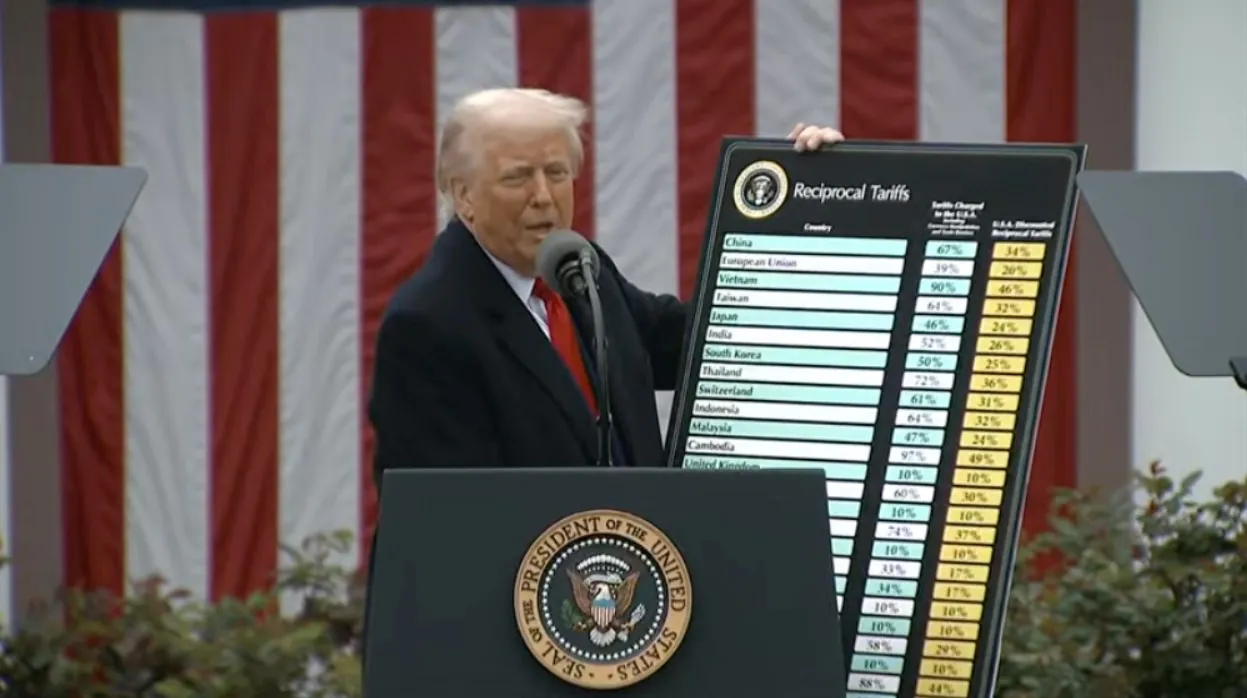

Under the new policy, reciprocal tariffs will be approximately half the rate that other nations impose on U.S. imports. For example, China currently levies a 67% tax on U.S. goods, so the corresponding U.S. tariff on Chinese goods will be 34%. Additionally, Trump announced a standard 25% tariff on all imported cars.

Speaking to the media, Trump emphasized that this tariff policy would restore the U.S. economy to its former golden age:

“From 1789 to 1913, the United States thrived under a protective tariff policy. During that time, America was the wealthiest it had ever been. In the 1880s, the government even formed a commission to determine how to use the vast revenue from import tariffs.”

“However, in 1913, for some inexplicable reason, they introduced income tax, forcing American citizens to bear the tax burden instead of foreign nations,” Trump said.

He stressed that this new tariff policy is a move toward economic protectionism, aiming to revert to a 19th-century economic model where tariffs replace income tax.

Meanwhile, Whale Alert detected a large Bitcoin transaction in which 1,050 BTC was transferred from the cryptocurrency exchange Binance to an unidentified wallet.

Blockchain tracking data recorded this transaction on Wednesday, linking it to the wallet address “bc1qcpflj68.” Although little information about this wallet has been disclosed, data shows it has conducted hundreds of large-scale fund transfers with other unknown addresses, totaling 223 transactions.

Previously, a similar mysterious Bitcoin transaction was identified between a wallet with similar characteristics and the major U.S. cryptocurrency exchange Kraken.