After a week of sharp swings, Bitcoin briefly climbed above $112,000 before retreating slightly, stirring mixed sentiment across the market. Yet, analysts argue that the broader bull trend remains intact and may even be gearing up for a stronger breakout.

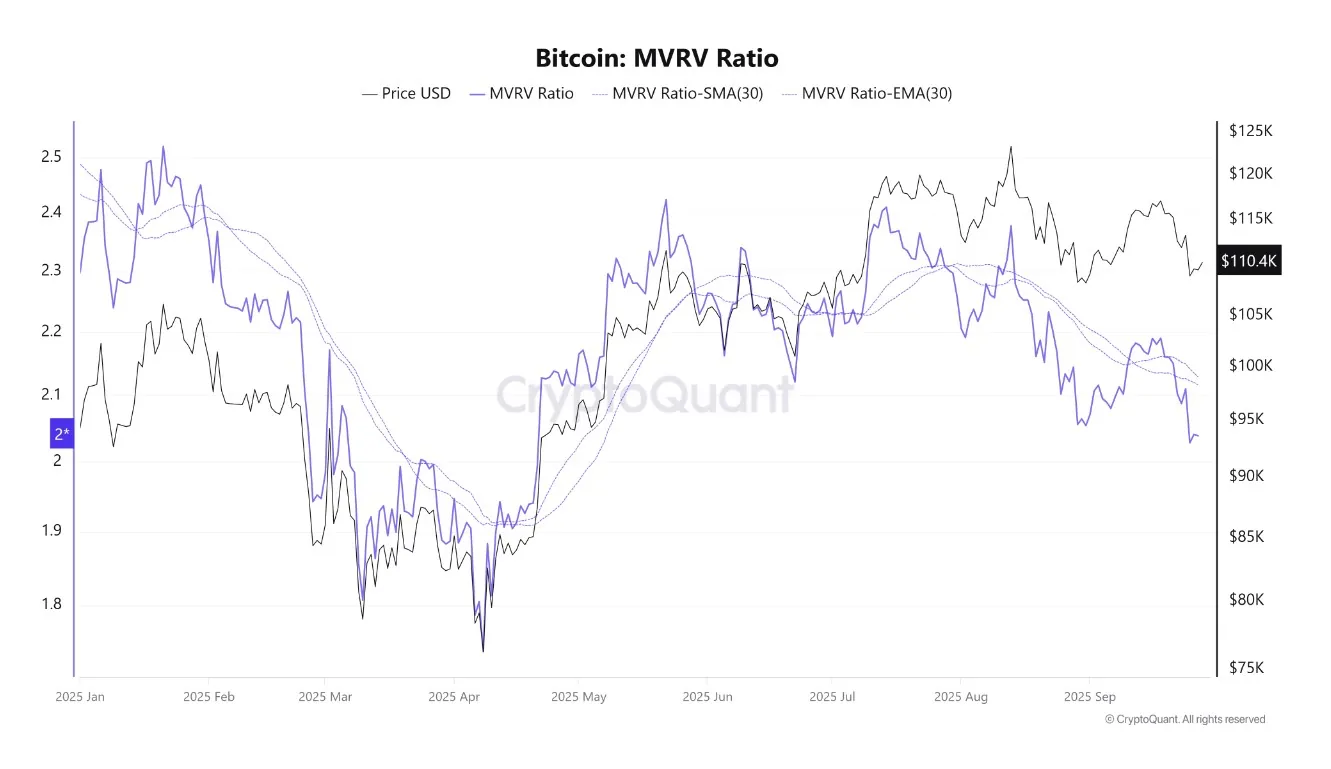

According to data from CryptoQuant, several on-chain indicators continue to signal upside potential. Among the most notable is the MVRV ratio, which measures the gap between Bitcoin’s market value and the average cost basis of its holders. The metric has cooled to the 2.0 level—a range historically seen as a “mid-cycle reset” rather than a danger zone. Investors remain in profit, but without the overheated conditions that often trigger steep corrections.

In previous cycles, similar consolidations in the MVRV ratio marked the start of renewed, more powerful rallies. Supporting this outlook, the behavior of long-term holders has been particularly telling. On-chain data shows that profit-taking among these investors has dropped significantly, with many continuing to hold their coins. This conviction reduces selling pressure and tightens supply, creating a favorable backdrop for future price growth if fresh demand enters the market.

Together, these factors echo the “mid-cycle” phases observed in both 2017 and 2020, when Bitcoin paused before launching into explosive rallies. Recent volatility, therefore, looks less like the end of the bull market and more like a healthy digestion phase, clearing excesses before momentum resumes.

Market commentator Mr. Wall Street reinforced this perspective, noting that Bitcoin is still trading firmly above key support zones. At around $107,500—just 12% below its all-time high of $125,000—he sees no evidence that the current cycle has peaked. In his view, none of the major macro indicators have flashed bearish signals, and the current weakness is driven more by short-term macroeconomic uncertainty than by structural distribution.

Looking ahead, he expects a highly bullish fourth quarter, with Bitcoin potentially reaching new all-time highs between $140,000 and $170,000 before this cycle tops out. He also forecasts as many as six interest rate cuts by the U.S. Federal Reserve over the next six months, a policy shift that could further support risk assets. From a technical standpoint, the 4-hour EMA200 is seen as the next short-term target, while the current price zone offers an attractive entry point for new long positions.

While upcoming U.S. economic data releases—such as job openings, ISM figures, and unemployment rates—could inject short-term volatility, the broader picture remains bullish. Analysts suggest that if history rhymes, the market may be setting the stage for the next major rally toward uncharted price levels.