Over the past 24 hours, Bitcoin (BTC) has experienced significant intraday swings, trading from a low of $89,420 to nearly $93,000, marking a 4.3% trough-to-peak move. Similar volatility also appeared in U.S. equities, particularly the Nasdaq, reinforcing the growing correlation between Bitcoin and other risk-on assets.

Price action: Two bullish structures continue to support BTC

Bitcoin is currently trading within two overlapping bullish formations:

-

A minor ascending triangle forming short-term price compression.

-

A major ascending trendline that has supported every rebound since November.

BTC has tapped the lower boundary of the smaller triangle with precision, while the RSI has formed a bullish divergence, signaling weakening selling momentum even as the price printed marginal new lows. This pattern often precedes sharp rebounds if support holds.

However, a breakdown from this minor structure would expose the major trendline. Losing that support could send BTC toward the deeper liquidity bands at $86,000 – $80,500, which historically flush out over-leveraged long positions.

VALR CEO Farzam Ehsani noted:

“Resistance at $92,000 and a narrowing range are setting the stage for a decisive breakout that could determine the trend for months.”

Fed rate cut reaction: Macro caution clashes with technical signals

The Fed’s 25 bps rate cut briefly pushed BTC to $94,500 before sellers stepped in, repeating patterns seen in previous rate-cut cycles.

Chair Jerome Powell hinted that elevated Treasury purchases may continue—a subtle suggestion of QE-style support—while also warning about rising employment risks and tariff-driven inflation. Despite 9 of 12 FOMC members supporting the cut, markets perceived the tone as cautious, not strongly dovish, triggering a pullback in BTC.

Ehsani added:

“Scrutiny of U.S. government decisions is increasing, especially with large Bitcoin-holding companies under financial pressure. A new wave of corporate failures is considered unacceptable.”

Selling pressure eases sharply, signaling a potential bottom

CryptoQuant data shows a significant decline in sell-side activity:

-

Exchange deposits dropped from 88,000 BTC in late November to 21,000 BTC today.

-

Whale deposits fell from 47% to 21%.

-

Average deposits shrank from 1.1 BTC to 0.7 BTC.

NoOnes CEO Ray Youssef commented:

“A dovish-leaning Fed could trigger a Santa rally, pushing BTC back above $100,000, ETH above $3,500, XRP to $2.3, and Solana toward $150.”

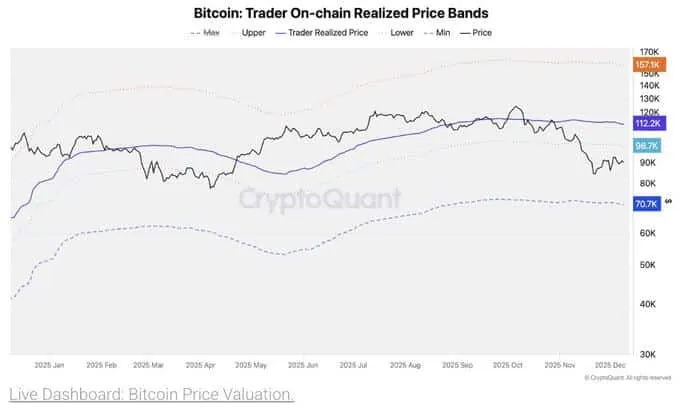

Path toward $96K: Is an upside move still possible?

If BTC maintains its bullish structure:

-

$99,000 is the first major resistance.

-

Above that, $102,000 and $112,000 come into play.

-

In the near term, a push toward $96,000 remains possible if BTC avoids a deeper liquidity sweep.

Youssef emphasized:

“Market structure is slowly stabilizing after heavy selling and forced unwinds. However, the depth of the recovery remains shallow.”

“ETF inflows only recently turned positive, and spot buying pressure is still underwhelming.”