The crypto market is entering a sensitive phase as a wave of macroeconomic factors converge at the end of January. On January 27 alone, five key U.S. economic indicators are scheduled for release, setting the stage for a volatile start to February.

What makes the situation more critical is that these data releases coincide with U.S. President Donald Trump’s speech at 4:00 PM ET. Investors will be closely watching for any remarks on a potential government shutdown, interest rate cuts, or new policy signals.

Against this backdrop, the big question is whether the crypto market—especially Bitcoin (BTC)—can withstand the pressure, as more than 60% of total capital inflows across the market remain BTC-led.

Institutional Pressure and Rising Fear

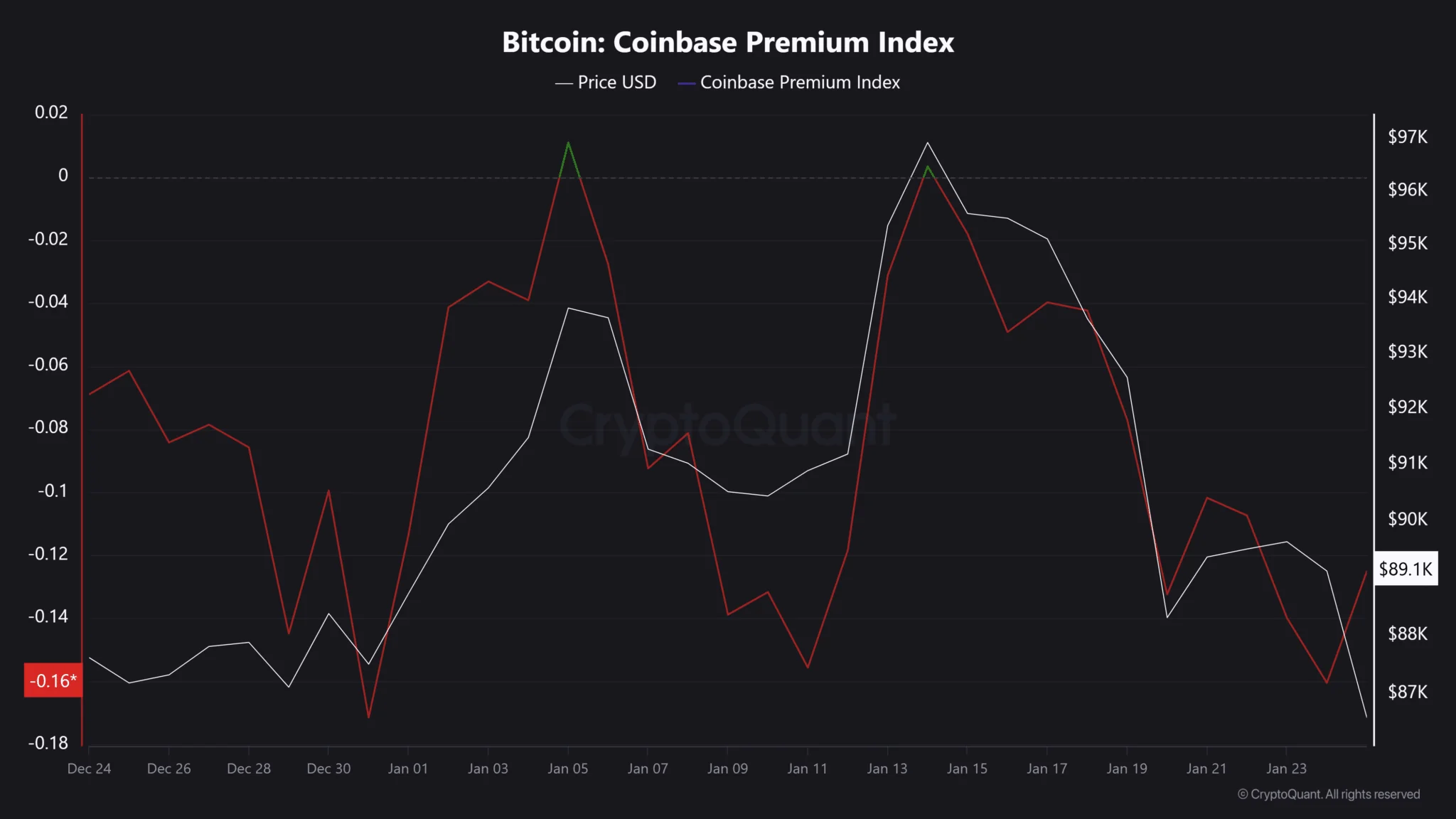

From an institutional standpoint, timing could hardly be worse for Bitcoin. Outflows from Bitcoin ETFs continue, while the Coinbase Premium Index has turned negative, signaling that U.S. investors are stepping away from risk assets and rotating capital into safer alternatives.

At the same time, the Fear & Greed Index has dropped 12 points over the past week and is now approaching the “Extreme Fear” zone. This area is often associated with early signs of capitulation, as holders begin realizing losses.

This raises concerns that upcoming macro releases, Trump’s speech, and the FOMC meeting could be enough to drag Bitcoin’s January return into negative territory for the first time since the 2022 bear market.

A Market Caught Between Caution and Optimism

Still, the current picture is not entirely bearish. Defensive positioning can also be interpreted as a phase of accumulation before the next cycle. However, market data shows a clear divergence.

Spot flows remain weak and institutional demand has yet to recover. Meanwhile, on Binance, the BTC/USDT pair shows a 70% long bias, indicating that traders remain optimistic about a potential rally.

Open Interest is moving back toward the $60 billion level, and the Estimated Leverage Ratio continues to rise, signaling that leverage is returning to the market. When speculative capital grows while real liquidity stays thin, Bitcoin becomes highly vulnerable to sudden price swings.

Breakout or Breakdown Risk Intensifies

On the chart, Bitcoin has been consolidating within a tight $85,000–$90,000 range. Historically, such price compression often ends with a sharp directional move, triggering cascading liquidations as leveraged positions are flushed out.

With weak spot demand, rising speculative exposure, and a macro-heavy calendar—especially the FOMC meeting on January 28—the pressure is steadily building. As a result, the probability of Bitcoin closing January in the red is increasing.

The market now stands at a crossroads: either a strong breakout if supportive news emerges, or a sharp sell-off if fear takes control.