Bitcoin saw a remarkable recovery last night, once again surpassing the $106,000 mark. Interestingly, however, Google search trends for Bitcoin have slightly declined, suggesting that public interest hasn’t risen in step with the price. This could indicate that traders are still actively participating in the BTC market, while also hinting at a possible shift in momentum — a common precursor to the beginning of an altcoin season, especially if Bitcoin’s dominance shows signs of weakening.

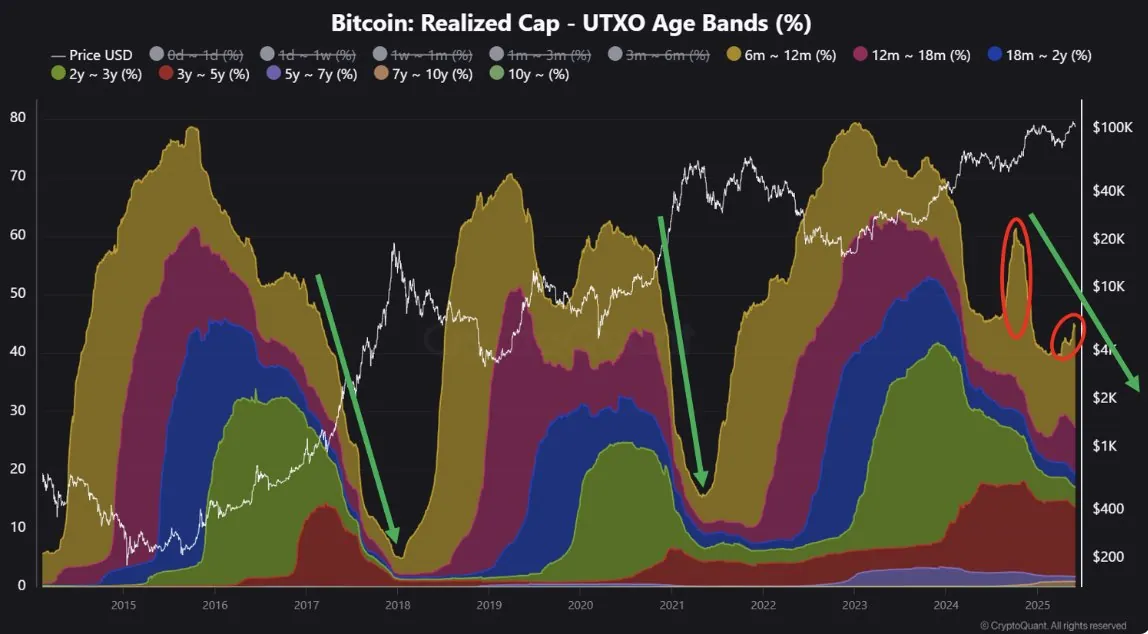

In reality, altcoins are starting to show signs of strength amid a declining BTC supply held by long-term holders (LTHs). Data from UTXO age bands reveal that the number of BTC held in mid-to-long-term wallets is decreasing — a historical signal that has often coincided with strong price rallies and the rise of altcoins.

As more investors buy Bitcoin while others take profits, BTC’s market share typically peaks, which is often when capital starts rotating into altcoins. However, the current trend appears somewhat different: despite Bitcoin’s rising price, older UTXO bands have not declined significantly, suggesting that long-term holders are still being cautious. This could explain why BTC only undergoes mild corrections, whereas many altcoins are seeing sharper declines.

Overall, a broader downward trend is gradually taking shape. Historically, altcoins tend to outperform in the second half of each growth cycle. While today’s market appears sluggish and indecisive, this could actually signal a distribution phase — a period where capital is quietly reallocating ahead of the next acceleration phase.

If Bitcoin can break through key resistance levels, we may see capital flow more decisively into altcoins, driving their prices higher. On the other hand, if long-term holders continue to hold tightly and new capital remains weak, altcoins may continue to lag behind.

In this context, patience remains a wise strategy. Altcoins still hold strong potential — especially if the market returns to its typical growth trajectory. Furthermore, the fact that large wallet addresses are gradually reducing their BTC holdings may be another signal that an altcoin season could soon emerge.

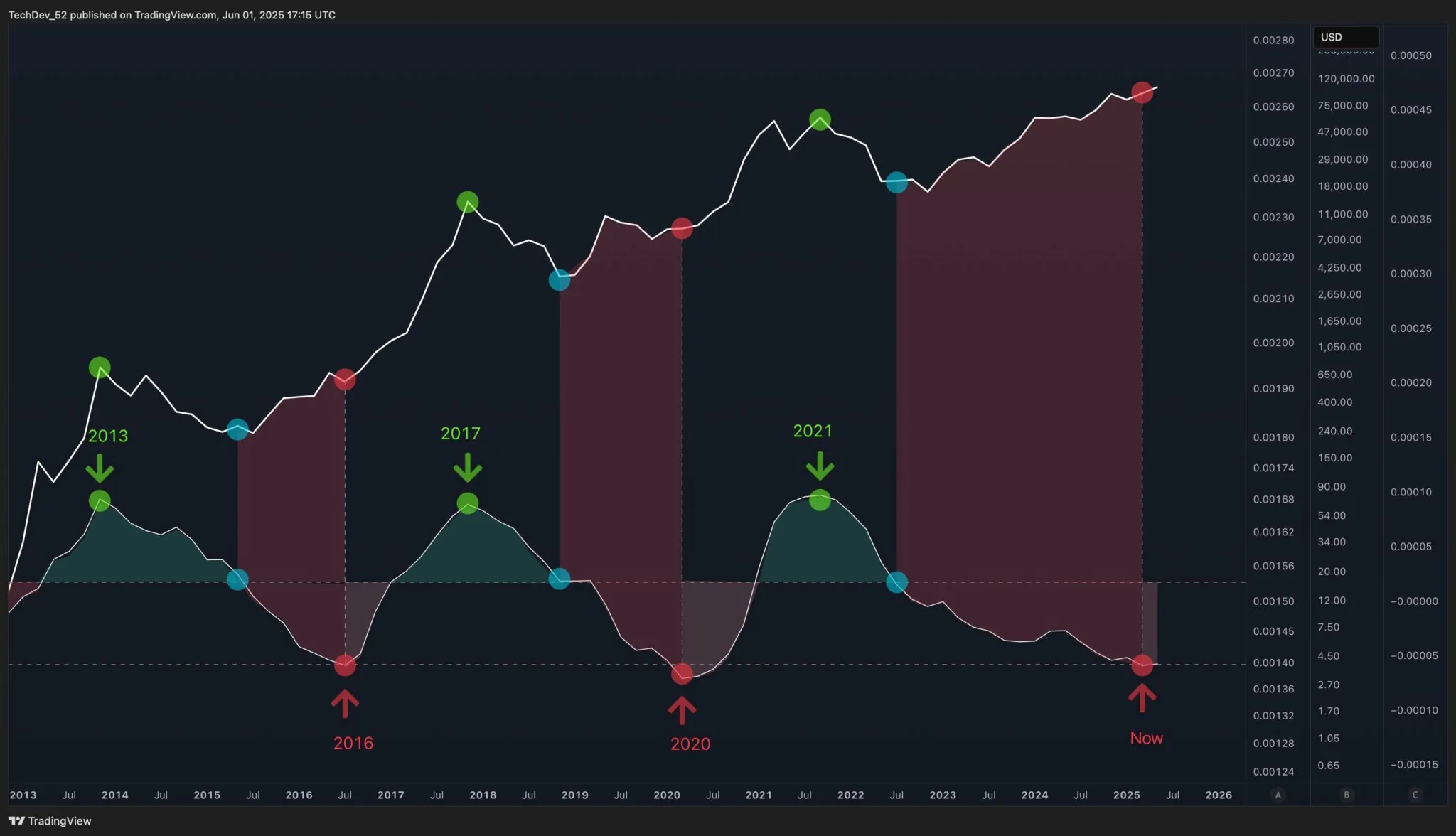

Nonetheless, the current market picture extends beyond short-term fluctuations. At the time of writing, macro trends suggest that the altcoin bear market could be nearing its end, although a full-fledged bull run has yet to begin.

Historical patterns in 2016 and 2020 marked major market bottoms just before significant price surges. Today, market signals are reflecting a similar setup, indicating that conditions may be ripening for a new growth cycle.

Over the next one to three years, the market could enter a fundamentally different phase — one where altcoins have a strong chance to rebound and outperform following a prolonged accumulation period.

Another important indicator is CoinMarketCap’s “Altcoin Season Index,” currently sitting at 22 — a figure that suggests the altcoin season has yet to truly kick off. While many altcoins have gained a share of the market, their growth in dominance has remained modest in recent months.