Bitcoin is demonstrating notable signs of recovery despite the gloomy outlook across both the stock market and the broader cryptocurrency space. The rebound appears to be fueled by a wave of global sell-offs triggered by U.S. President Donald Trump’s announcement last week of steep tariffs on imported goods, according to a recent report by Binance Research.

As of mid-session on April 7, Bitcoin had risen nearly 1%, reaching the $79,000 mark. In contrast, the S&P 500 – which tracks major U.S. stocks – remained mostly flat, while gold futures for the previous month fell by about 1.5%, according to Google Finance data.

In its April 7 report, Binance – the world’s largest cryptocurrency exchange – noted: “Even following the new tariff announcement, BTC has shown signs of resilience, maintaining or slightly increasing in value on days when traditional risk assets declined.”

Another encouraging indicator is the growing amount of Bitcoin held by long-term investors, signaling their continued confidence and suggesting that recent market turbulence has not triggered widespread panic selling.

On April 2, President Trump announced a minimum 10% tariff on most imported goods into the U.S., along with a “reciprocal” tax targeting products from 57 countries.

Following the announcement, major U.S. stock indexes, including the S&P 500 and Nasdaq, dropped more than 10% as investors braced for a potential global trade war.

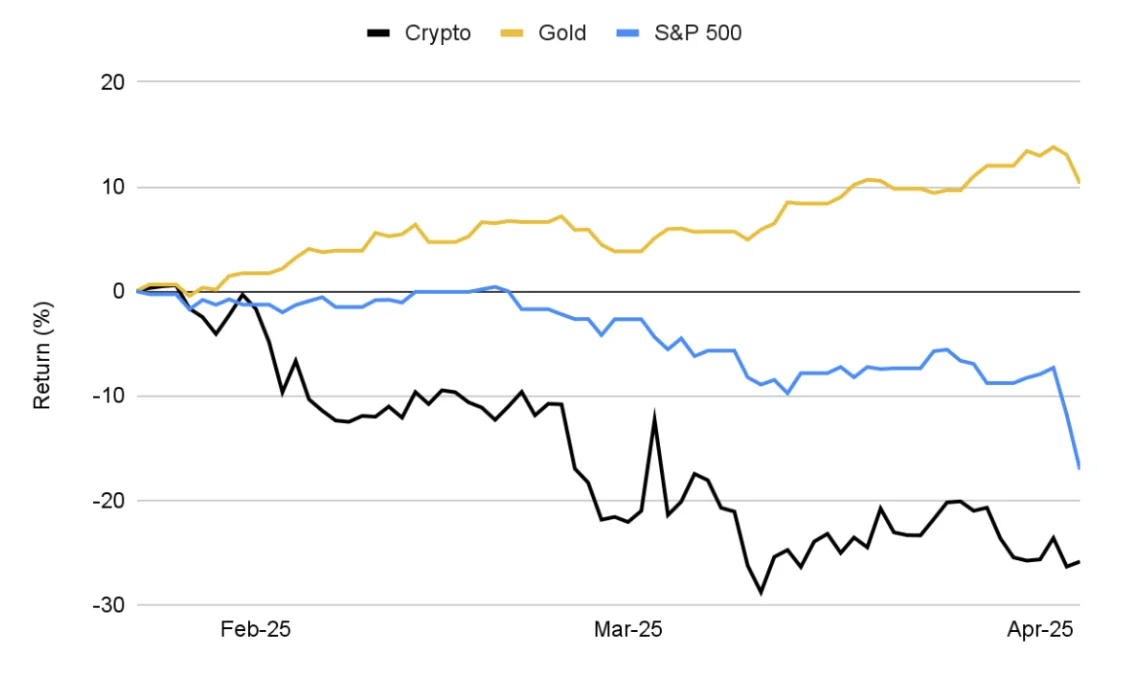

Although Bitcoin also fell around 12% since the start of April – a larger drop than that seen in equities – it has remained more stable than the overall cryptocurrency market, which has lost as much as 25% during the same period.

The Binance report emphasized: “As reciprocal tariff policies take hold and global markets adapt to a potentially fragmented trade future, Bitcoin may undergo significant changes in its perceived role as a safe-haven asset.”

According to Binance data, Bitcoin’s correlation with gold – traditionally seen as the ultimate safe-haven asset during macroeconomic instability – is currently quite low, at just 0.12 over the past 90 days. By contrast, Bitcoin has shown a stronger connection to equities, with a correlation coefficient of 0.32.

Nonetheless, Binance noted: “Despite short-term volatility, BTC still has room to reaffirm its status as a macro-independent asset.”

The report raised a key question: “Can Bitcoin return to a state of low correlation with equities in the long term?”

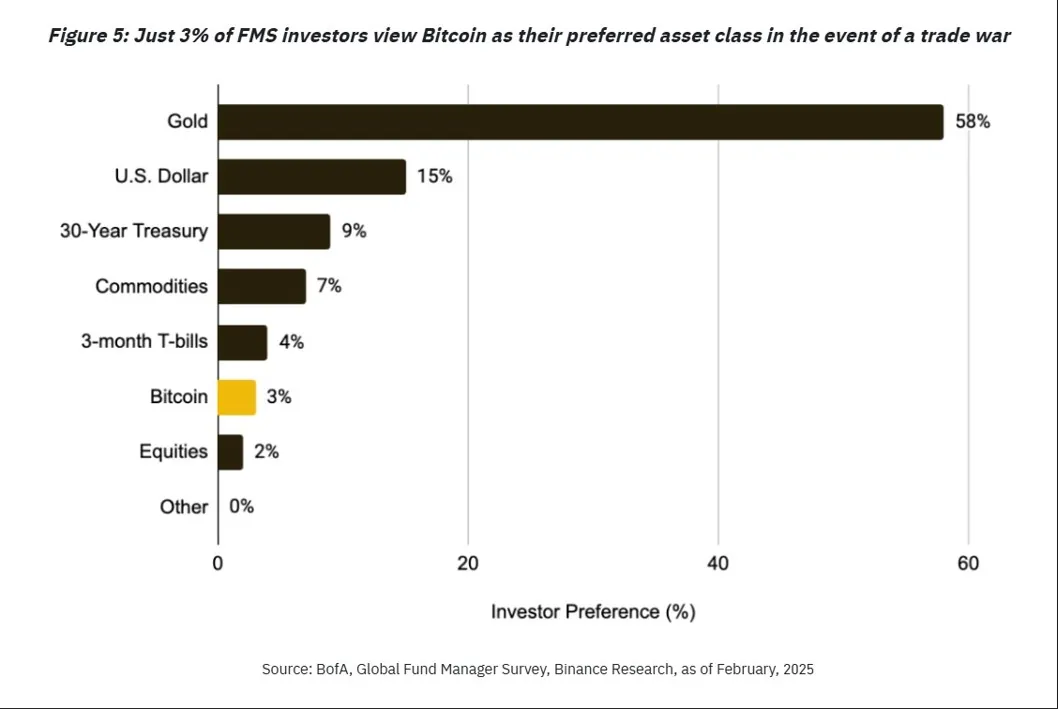

Currently, according to Binance, gold remains the safe-haven asset of choice among institutional investors. In a survey cited in the report, 58% of respondents said they would hold gold during a trade war, while only 3% chose Bitcoin.

Binance concluded: “Investors will be closely watching to see whether Bitcoin can maintain its appeal as a decentralized, permissionless, and censorship-resistant asset in an increasingly protectionist global economy.”