After four consecutive days of decline, with prices hitting a low of $103,200, Bitcoin has rebounded over the past two days and is now trading steadily above the $105,000 mark.

One key level to watch is the local high from December 17, 2024, which hovered around $104,450. Prominent analyst Matthew Hyland emphasized that this week’s closing price is “extremely important.” He also shared a chart highlighting a bearish divergence between price action and the RSI indicator on the weekly timeframe.

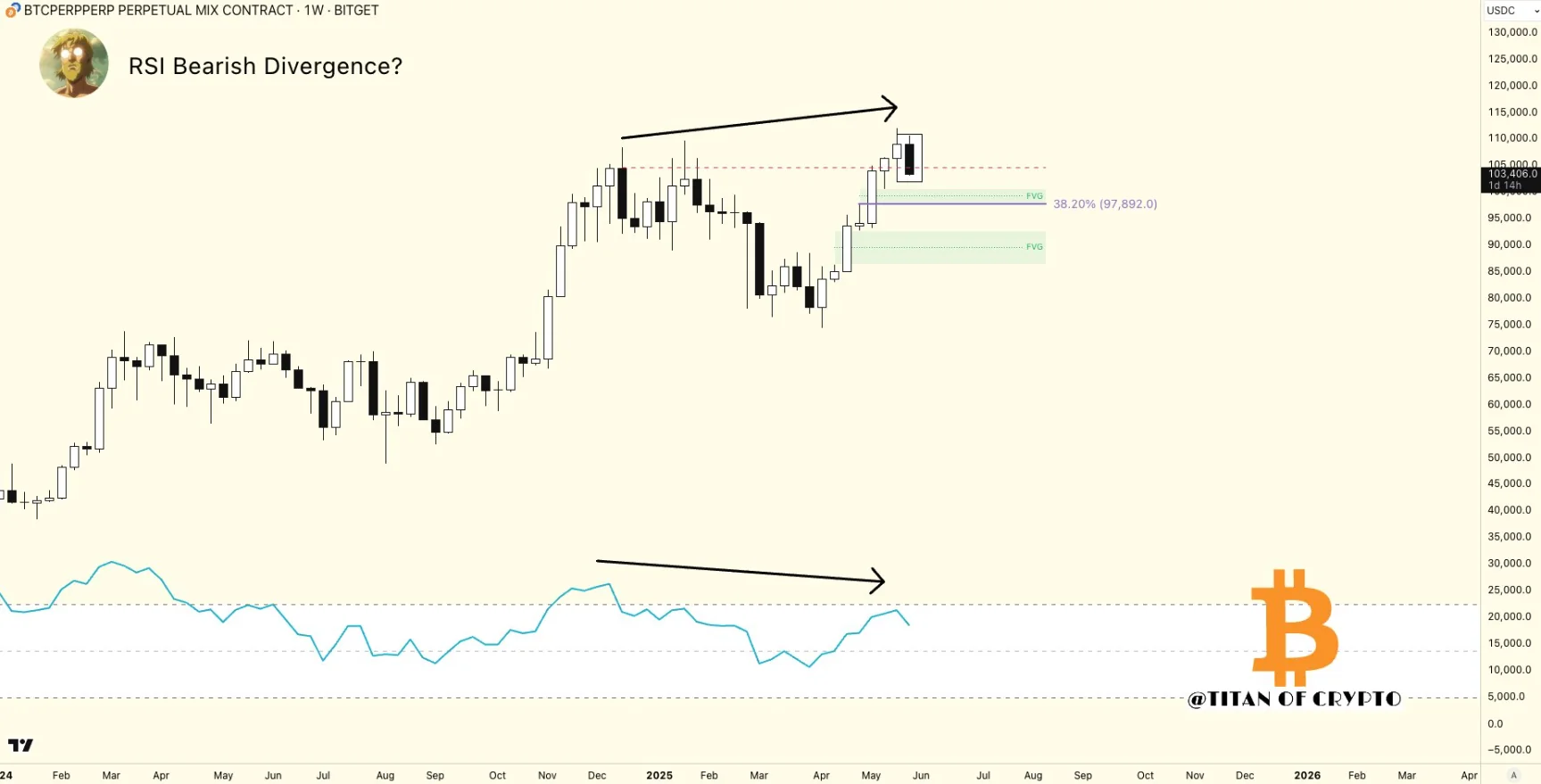

The Relative Strength Index (RSI) is a traditional technical analysis tool used to gauge market momentum at specific price levels. According to trader Titan of Crypto, the emerging bearish divergence on the weekly RSI could have significant implications for the bulls. “A potential RSI divergence is forming on the weekly chart. While not yet confirmed, it’s a signal that needs close attention,” he warned in a May 31 post.

The accompanying chart also shows Fair Value Gaps (FVGs), identified using the Fibonacci tool. These indicate supply-demand imbalances created during strong price rallies. Two notable FVG zones are currently located around $97,000 and $90,000. Titan of Crypto noted, “After a more than 50% surge, a correction is completely normal. A healthy market structure always includes some degree of pullback.”

Market Sentiment Remains Positive

Based on liquidity data from order books, trader CrypNuevo suggested that the $100,000 level could act as a “price magnet” if the correction continues. “This is a strong psychological level where liquidity often accumulates. The likelihood of a retest is quite high,” he wrote in a series of posts on May 31.

Despite an 8% drop over the past week, CrypNuevo remains optimistic about the broader uptrend. “I believe there’s a high chance we’ll touch $100,000 and hover around it for a few days. There might be a brief dip to shake out the market, but that won’t change the overall picture,” he concluded. “We’re seeing a solid support zone forming around $84,000, gradually catching up with the current price. The uptrend remains intact, and liquidity is still strong.”