Bitcoin [BTC] is currently losing short-term momentum, continuing its sideways consolidation pattern throughout June. After a failed attempt to break above the $110,500 resistance, the cryptocurrency has managed to hold its ground near the crucial $104,800 support zone.

On the 12-hour chart, a clear “bullish breaker block” — marked by a white box — has formed at the $104,800 level, acting as a critical support area for buyers. Based on the previous upward move from $100,300 to $110,500, Fibonacci retracement levels highlight $104,200 and $102,500 as important price points to monitor.

Additionally, June’s opening and peak levels — $104,600 and $110,200 respectively — now form a short-term price range. If BTC falls below the $104,800 threshold, a retest of the psychological $100,000 support becomes increasingly likely.

Despite the current price action suggesting market indecision and range-bound behavior, long-term investors remain optimistic. This indicates that Bitcoin may be entering an “accumulation phase,” where price consolidates in a tight range while smart money and long-term holders quietly increase their positions.

Analyst Axel Adler Jr. has highlighted several data points supporting this theory. One key observation is the significant drop in stablecoin inflows (USDT and USDC) into centralized exchanges. From a peak of $131 billion in December 2023, inflows have declined to just around $70 billion in June 2025 — falling below the 365-day moving average.

This decline signals cooling market sentiment and a shift toward patience and caution among investors. The fact that BTC continues to trade above the $100,000 mark despite reduced inflows indicates a weakening of selling pressure.

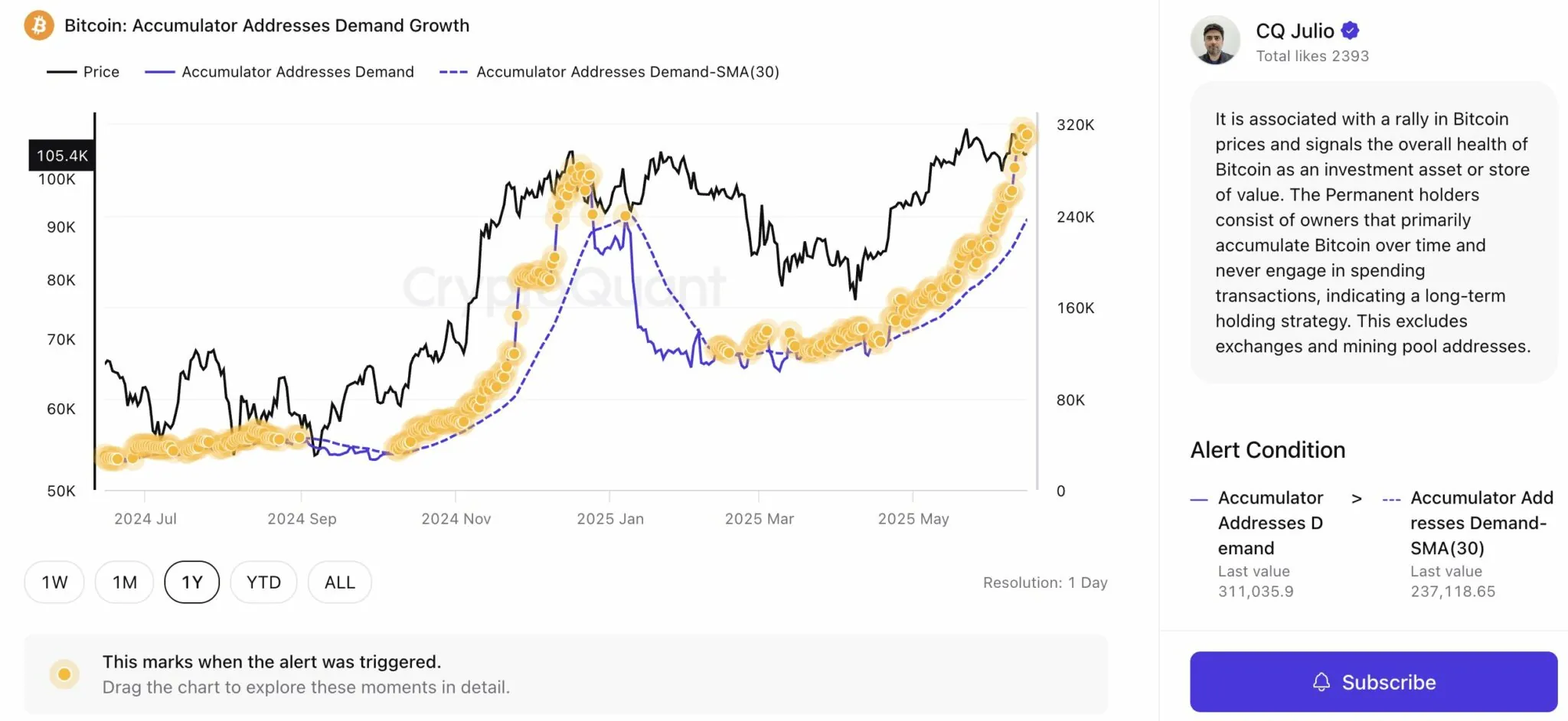

Meanwhile, data from CryptoQuant shows a steady increase in the number of “accumulation addresses” over the past 30 days — wallets that consistently buy without spending. This reinforces the growing dominance of long-term holding sentiment in the market.

Bringing all the data together — reduced speculative inflows, declining selling pressure, price stability above key psychological levels, and increasing accumulation — the stage appears to be set for Bitcoin’s next major breakout in the near future.