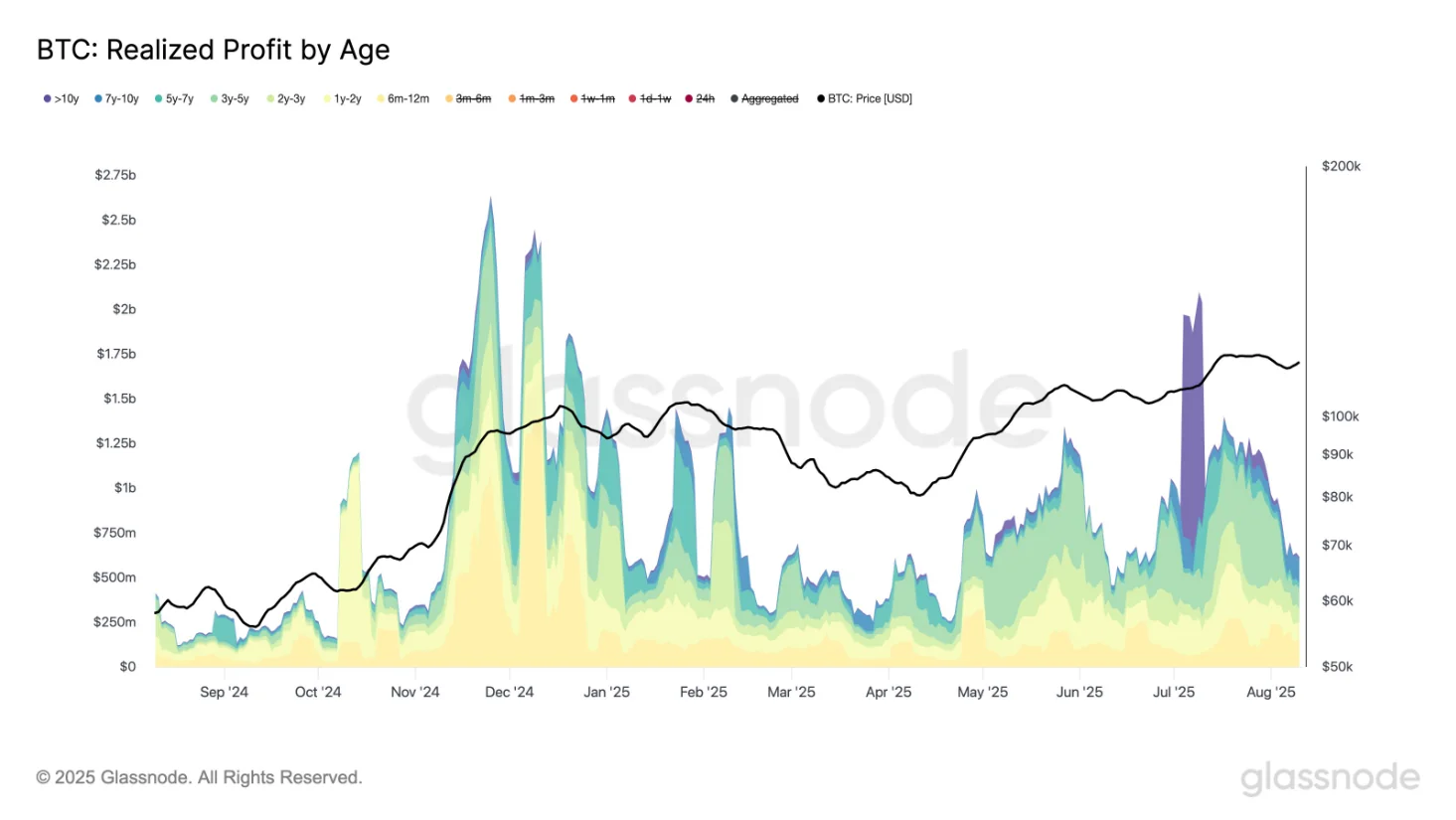

After a record-breaking July that saw a wave of heavy profit-taking, the pace of selling among Bitcoin “veterans” has slowed significantly in August, signaling a shift in market sentiment.

Data from on-chain analytics platform Glassnode shows realized profits by long-term holders — measured on a seven-day moving average — have dropped sharply from the $1 billion per day seen in July, one of the most intense selling periods in BTC’s history.

Long-Term Holders Stay Put After Historic Profit-Taking

Unlike the large-scale profit-taking between November and December 2024 — which was mostly driven by short-term holders who had purchased BTC in the prior six to twelve months — the latest activity is led by long-term investors.

In particular, those who accumulated Bitcoin during the 2020–2022 cycle are now cashing in, while others appear content to hold their positions, even with prices lingering just below the all-time high of $123,091 set only weeks ago.

The market structure is also shifting. According to CryptoQuant, smaller retail orders are now dominating BTC futures trading, while large-volume whale and institutional trades have dropped noticeably since late Q2 2025.

In previous cycles, markets dominated near their peaks by large players often signaled a distribution phase. This time, however, the retail-heavy structure could give prices room to test new highs — unless a fresh wave of selling from large holders emerges.

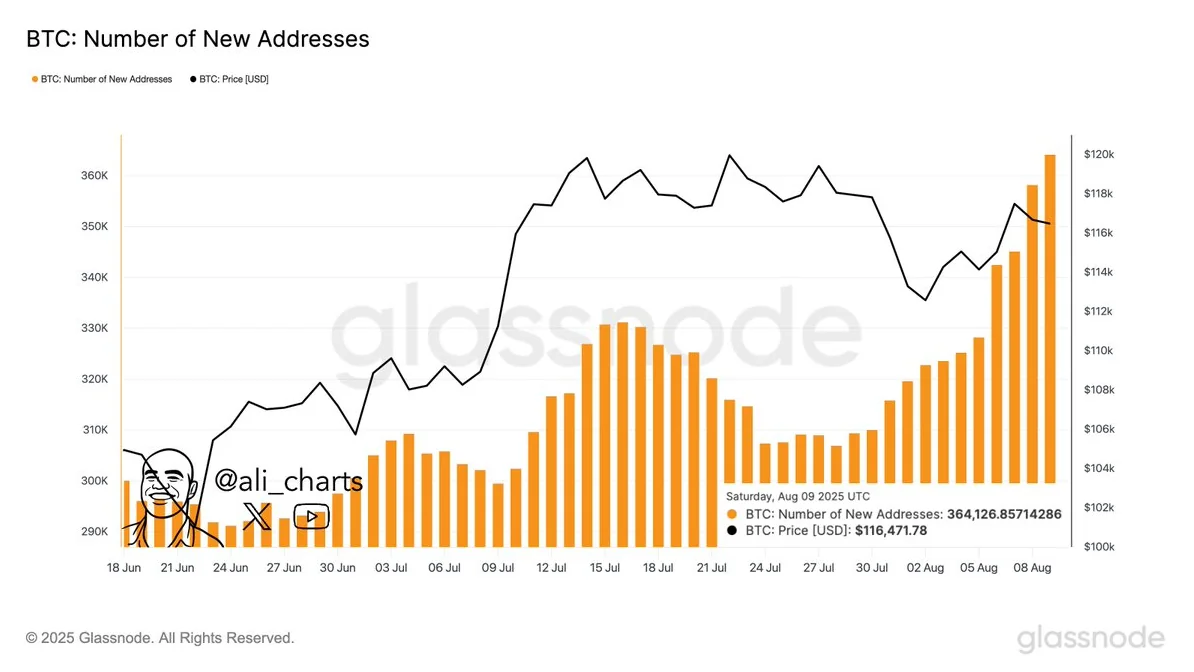

Network Growth Remains Solid

At the same time, Bitcoin’s network growth continues to show strength. Analyst Ali Martinez reported that more than 364,000 new BTC addresses were created daily last week — the highest level in a year. This suggests new retail participation, even as institutional inflows temporarily slow.

While its year-on-year gain of 97.9% is remarkable, the recent pace is clearly more subdued compared to July’s sharp surge: over the past two weeks, BTC has risen just 1.9%, and over the past 30 days, only 2.6%.

Market metrics also support this “cooling” narrative. CryptoQuant’s Bull Score Index fell from 80 to 60 on August 10, signaling a potential slowdown in bullish momentum. Meanwhile, stablecoin inflows have declined — an indicator that fresh capital entering the crypto market remains limited.