This month, Bitcoin’s lackluster performance has fueled bearish sentiment among institutional investors, raising concerns that the cryptocurrency could end September in the red. On-chain data also reveals a decline in miner accumulation, further clouding BTC’s outlook.

ETF Outflows and Miner Selling Threaten Further Downside

The persistent capital outflows from spot Bitcoin ETFs highlight waning institutional interest. According to data from Sosovalue, between September 22 and 26, these funds saw withdrawals totaling $903 million, marking a significant retreat of institutional capital.

Historically, ETF flows have closely correlated with BTC’s price action. Back in July, Bitcoin surged above $120,000 as ETF inflows exceeded $5 billion. In stark contrast, the current outflows suggest institutional participation is fading, leaving the top cryptocurrency at risk of deeper declines if the trend continues.

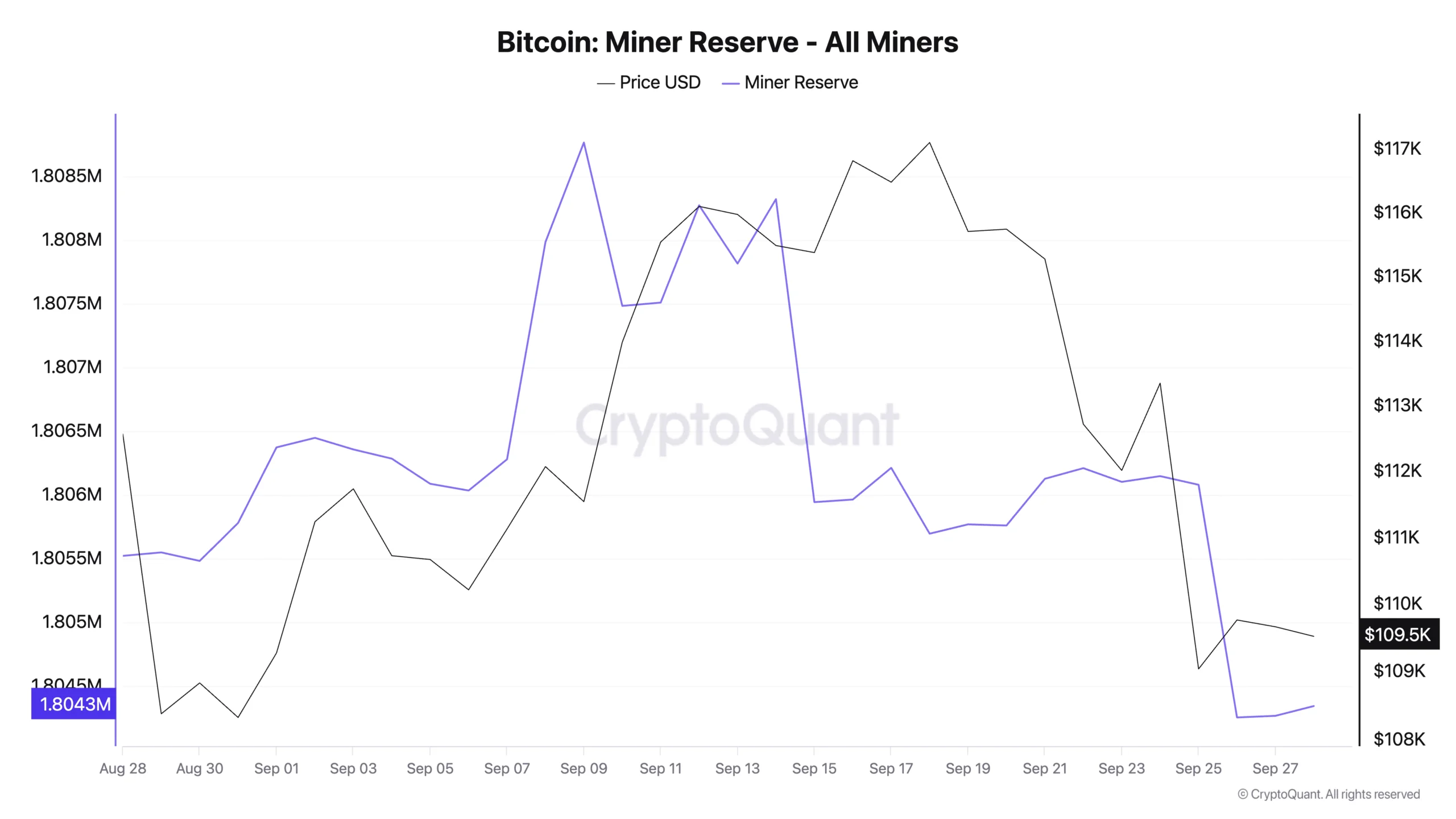

Meanwhile, CryptoQuant data shows that miner reserves are shrinking. Currently, miners hold around 1.8 million BTC, but reserves have dropped by 0.24% since September 9. Instead of accumulating, miners are selling to realize profits or cover operational costs—adding more supply to the market and intensifying selling pressure.

Risk of New Lows

With ETF outflows persisting and miners offloading holdings, Bitcoin’s price could slip toward $107,557. However, if demand surges and market sentiment improves, BTC could rebound, climbing above $110,034 and potentially reaching $111,961.