While the market appears calm, Bitcoin continues its upward momentum. Trading volumes have dropped to the lowest levels since the beginning of the 2023–2026 cycle, and retail investor activity has significantly decreased. Notably, funding rates in perpetual futures have turned negative — a rare occurrence as Bitcoin approaches its all-time highs.

However, on-chain data reveals a different story: a silent accumulation phase is underway. Beneath the surface, supply is quietly diminishing. Bitcoin futures open interest remains near record highs, suggesting the market is tightly coiled and ready for substantial price swings.

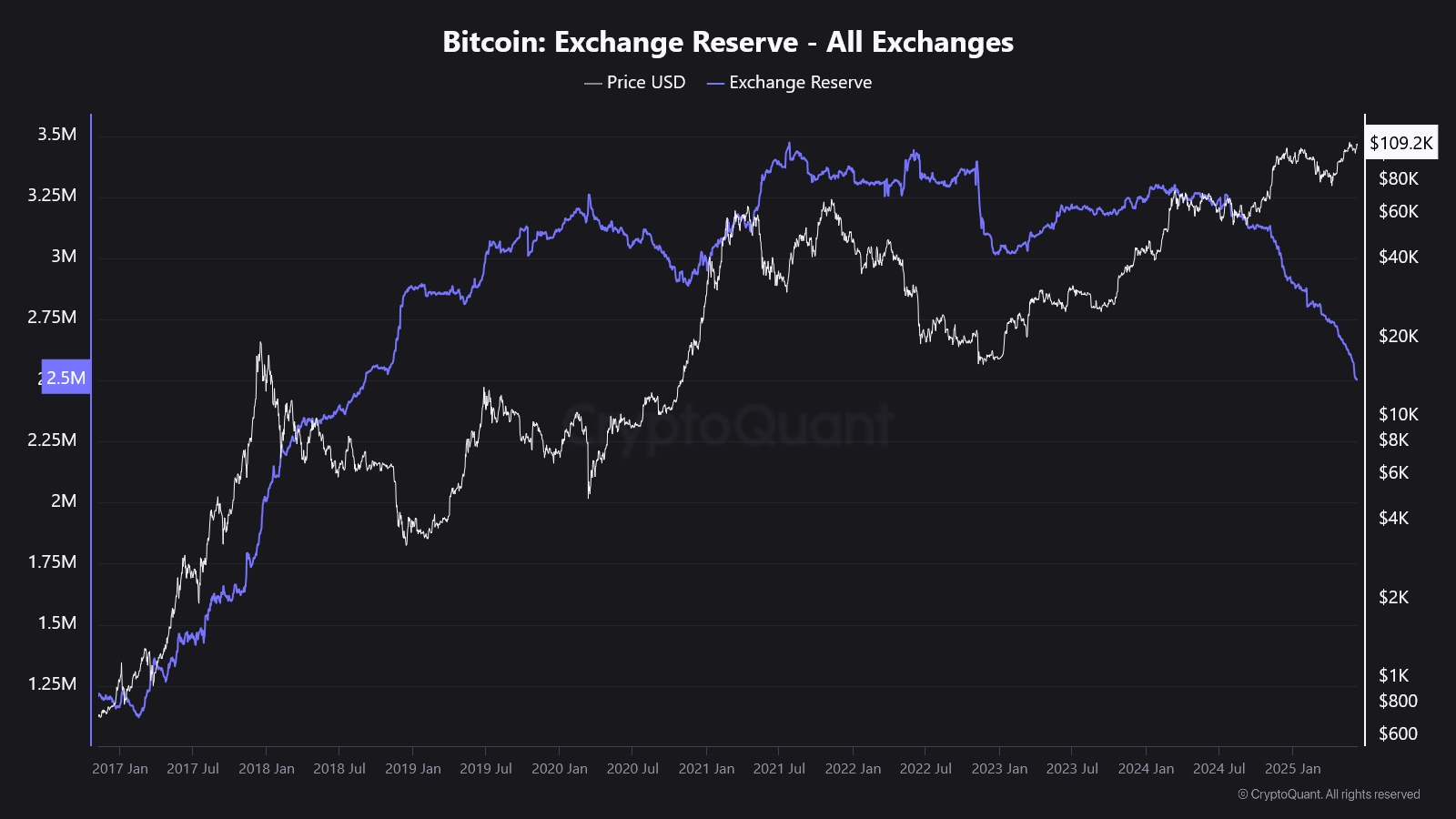

Bitcoin Supply on Exchanges Continues to Decline

Despite rising demand for Bitcoin, particularly in the U.S., the amount of BTC held on centralized exchanges keeps falling. Since early 2025, balances have dropped another 14%, reaching just 2.5 million BTC — the lowest level since August 2022.

This trend indicates growing investor confidence and long-term holding behavior. Investors are moving BTC into cold storage or custodial wallets, reducing the liquid supply available for trading. Large entities often withdraw BTC after purchase, reinforcing the notion that accumulation is in full swing. As the available coins for short-term selling shrink, downward pressure on prices weakens.

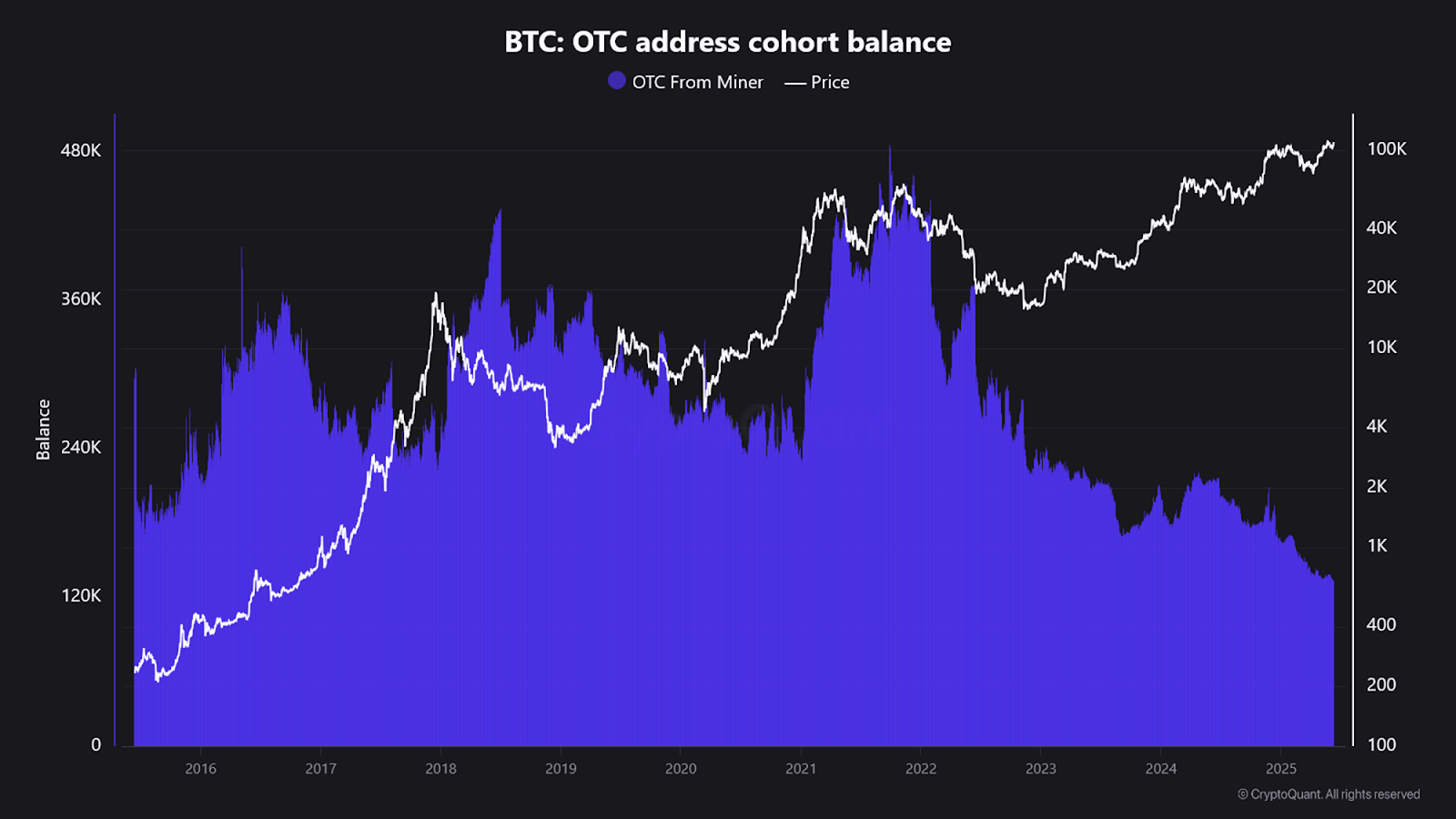

OTC Bitcoin Reserves Hit Record Lows

Beyond exchanges, over-the-counter (OTC) desks — which handle large off-exchange trades — are also seeing a sharp decline in available supply. These desks typically maintain BTC reserves to facilitate quick execution of large transactions.

According to CryptoQuant, BTC balances at OTC addresses linked to miners have dropped 19% since January, now holding just 134,252 BTC — a historic low. This data aggregates inflows from specific “1-hop” addresses connected to mining pools, excluding miners themselves and centralized exchange wallets.

As both exchange and OTC liquidity tighten, circulating supply shrinks dramatically. With demand still growing, this imbalance can drive more extreme price movements.