Bitcoin’s price suddenly plunged below the $86,000 mark after a relatively quiet weekend, during which neither buyers nor sellers managed to take control of the market. The sell-off accelerated quickly, triggering a wave of liquidations across the derivatives market, with more than $130 million in leveraged positions wiped out in just 60 minutes.

Earlier, Bitcoin had been rejected near the $89,000 level before weakening rapidly as futures markets opened for a new session. Selling pressure intensified, pushing BTC to its lowest level in about five days and dragging the price well below $86,000, raising concerns that a short-term correction is taking shape.

The downturn was not limited to Bitcoin. The broader altcoin market also turned sharply red. Ethereum lost more than 1.5% in just one hour, falling below the $2,900 zone and remaining under heavy selling pressure. Solana dropped over 2.5% in the same period, while other tokens such as SUI, ARB, PEPE, ENA, and ADA also slid by more than 2%, reflecting a defensive shift in overall market sentiment.

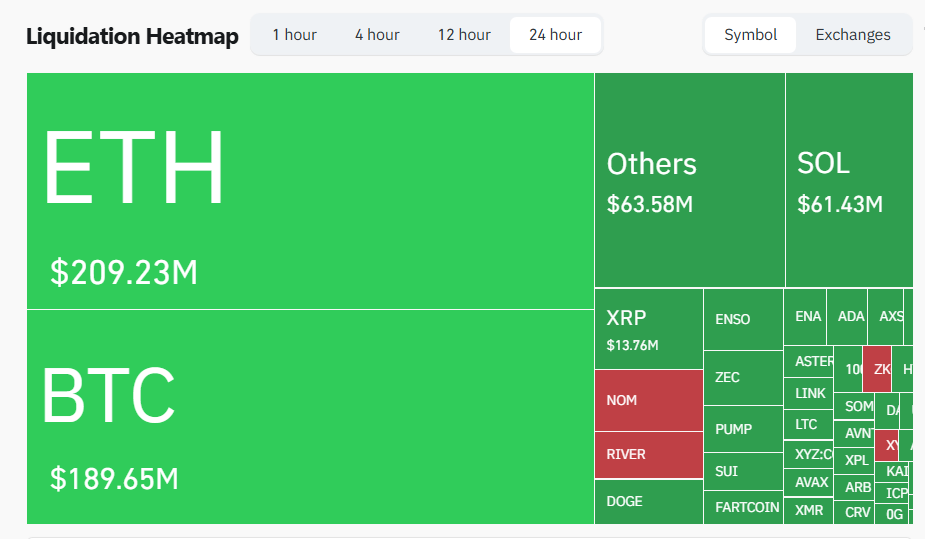

According to CoinGlass data, the total value of liquidated positions over the past 24 hours reached roughly $250 million, with more than half of that amount occurring in the most recent hour alone, equivalent to about $131 million. More than 130,000 traders were liquidated during the day, and the largest single liquidation was recorded on Hyperliquid, worth approximately $6.3 million.

Analysts from Kobeissi Letter suggest that the current correction is driven not only by technical factors but also by broader macroeconomic uncertainty. Markets are increasingly concerned about the possibility of a US government shutdown, along with escalating trade tensions after President Donald Trump threatened to impose a 100% tariff on Canada if the country signs a major agreement with China. These policy risks have made capital flows more cautious and intensified profit-taking pressure across the crypto market.

This episode mirrors last weekend’s price action, when Bitcoin initially held steady but weakened noticeably once derivatives markets opened. It highlights how leveraged positions continue to play a major role, making Bitcoin and altcoins vulnerable to sharp, short-term volatility.