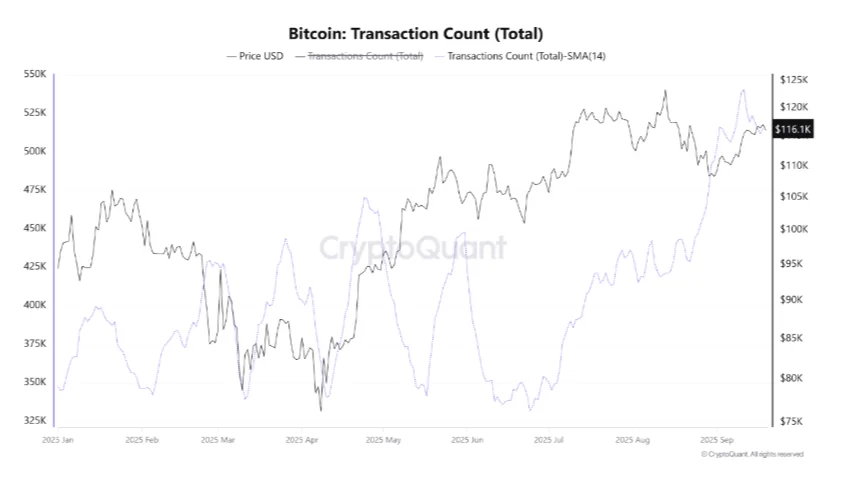

Bitcoin’s on-chain activity has reached an all-time high, with the 14-day average of transactions hitting 540,000 – the highest level in 2025. Analysts believe this surge signals growing demand and could fuel the next bullish cycle for the world’s leading cryptocurrency.

Rising On-Chain Transactions Point to Explosive Demand

According to QryptoQuant’s latest report, Bitcoin network activity has seen a sharp increase. The 14-day average of confirmed transactions has reached 540,000 – the highest figure so far this year. Experts suggest this growth reflects stronger real demand and is partly driven by new protocols such as Bitcoin Ordinals and Runes.

Notably, CryptoOnchain highlighted a “bullish convergence” between transaction counts and price movements since July. Unlike previous periods when price and activity often diverged, the current rally appears to be supported by real network usage. However, maintaining this high level of activity will be crucial for Bitcoin to sustain its momentum.

Market Outlook: Opportunities Mixed with Risks

At the time of writing, Bitcoin is trading around $112,500, down about 4% on the day, after breaking down from its recent consolidation range under mild selling pressure. Over the past week, BTC has experienced sharp swings: dipping below $113,000, then rallying to $117,800 following the Federal Reserve’s 25-bps rate cut, before sliding back to its previous levels and today’s decline.

Since September 9, U.S. spot Bitcoin ETFs have attracted more than $2.8 billion in net inflows, reinforcing institutional demand as a key stabilizing force. Exchange withdrawals alongside ETF allocations continue to bolster long-term investor confidence.

From a technical perspective, several indicators point toward a potential breakout, yet network activity has not fully kept pace with price momentum, while miner incentives remain under scrutiny. Meanwhile, sentiment gauges — including a neutral Fear & Greed Index and mixed MACD signals — suggest investors should exercise caution.

Amid this backdrop, macroeconomic shifts and ETF flows will play a decisive role in shaping Bitcoin’s next trajectory.