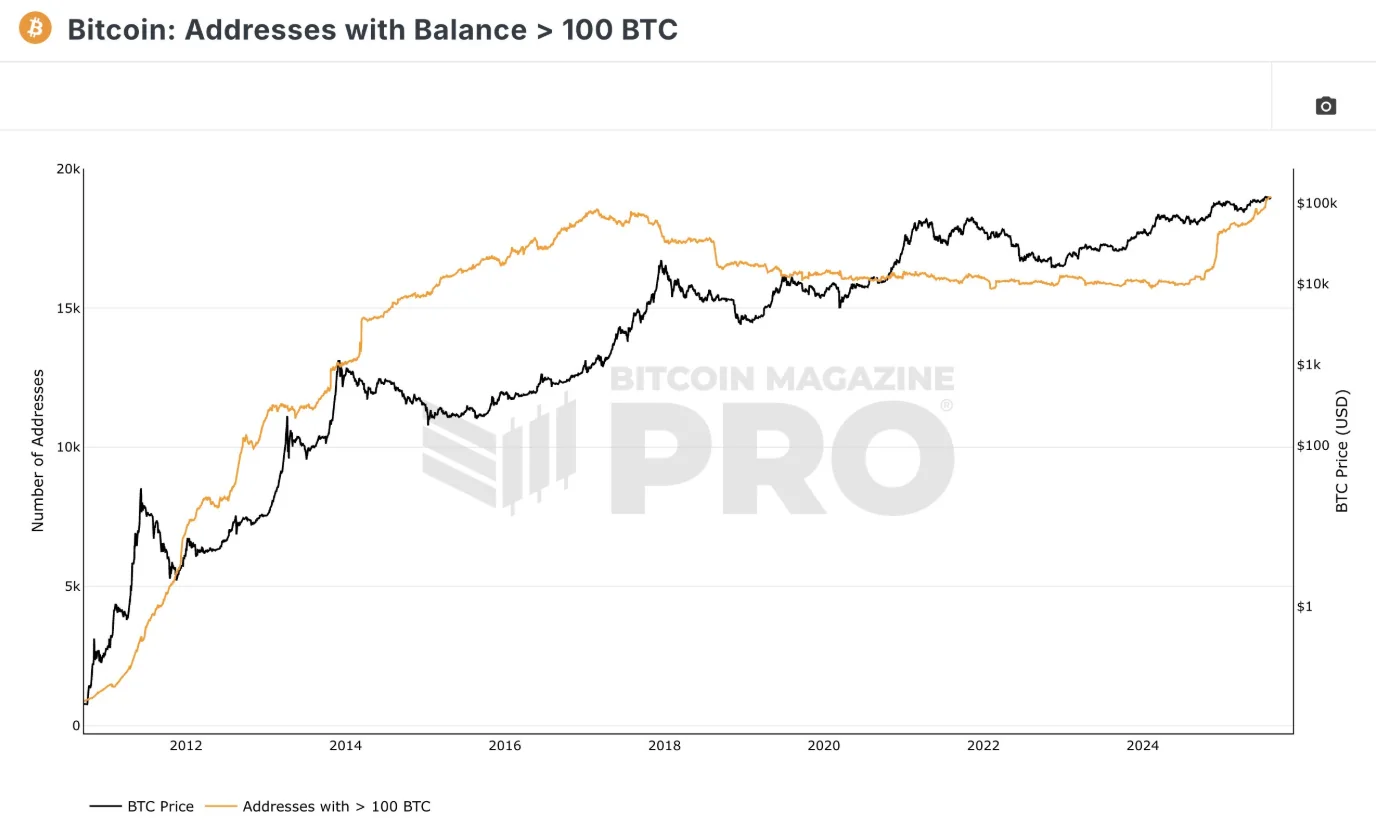

Bitcoin is holding steady around $120,000, less than 3% away from its all-time high of $123,180, as whales continue their aggressive accumulation. According to the latest data from Bitcoin Magazine Pro, the number of addresses holding over 100 BTC has reached a record high of 18,996.

The chart shows a consistent increase in the number of wallets with at least 100 BTC, surpassing the previous peak of 18,544 recorded on February 26, 2017. Combined with other address balance charts, this data helps assess whether Bitcoin adoption and usage are rising or falling across different investor groups.

Part of this accumulation trend comes from corporate treasuries ramping up their Bitcoin reserves. Michael Saylor’s firm has more than doubled its BTC holdings since Donald Trump’s election victory, increasing its total Bitcoin treasury by 60%. This aligns with the Trump administration’s pro-crypto stance, which rolled back several Biden-era enforcement actions, creating a more favorable regulatory environment and attracting significant institutional capital.

Today, more than 160 publicly listed companies hold Bitcoin as a primary reserve asset—up from just 43 in 2023. Notable examples include David Bailey’s Nakamoto, which plans to purchase over $760 million worth of BTC after completing its merger with KindlyMD, and Jack Maller’s Twenty One Capital, which already holds 43,514 BTC, making it the third-largest corporate holder in the world.

Technically, a Bitcoin address is a string of 26–35 characters functioning as a public key for sending and receiving BTC. A single wallet can contain multiple addresses, with no theoretical limit to how much Bitcoin an address can store. While the number of small-balance addresses (under 0.1 BTC) is also increasing, the sharp rise in addresses holding over 100 BTC highlights a growing concentration of wealth among high-value holders.

With a fixed supply of only 21 million BTC—about 19 million already mined and an estimated 3 million permanently lost—the race to secure large Bitcoin holdings is intensifying. If institutional accumulation continues at the current pace, Bitcoin could break its all-time high in the coming days.