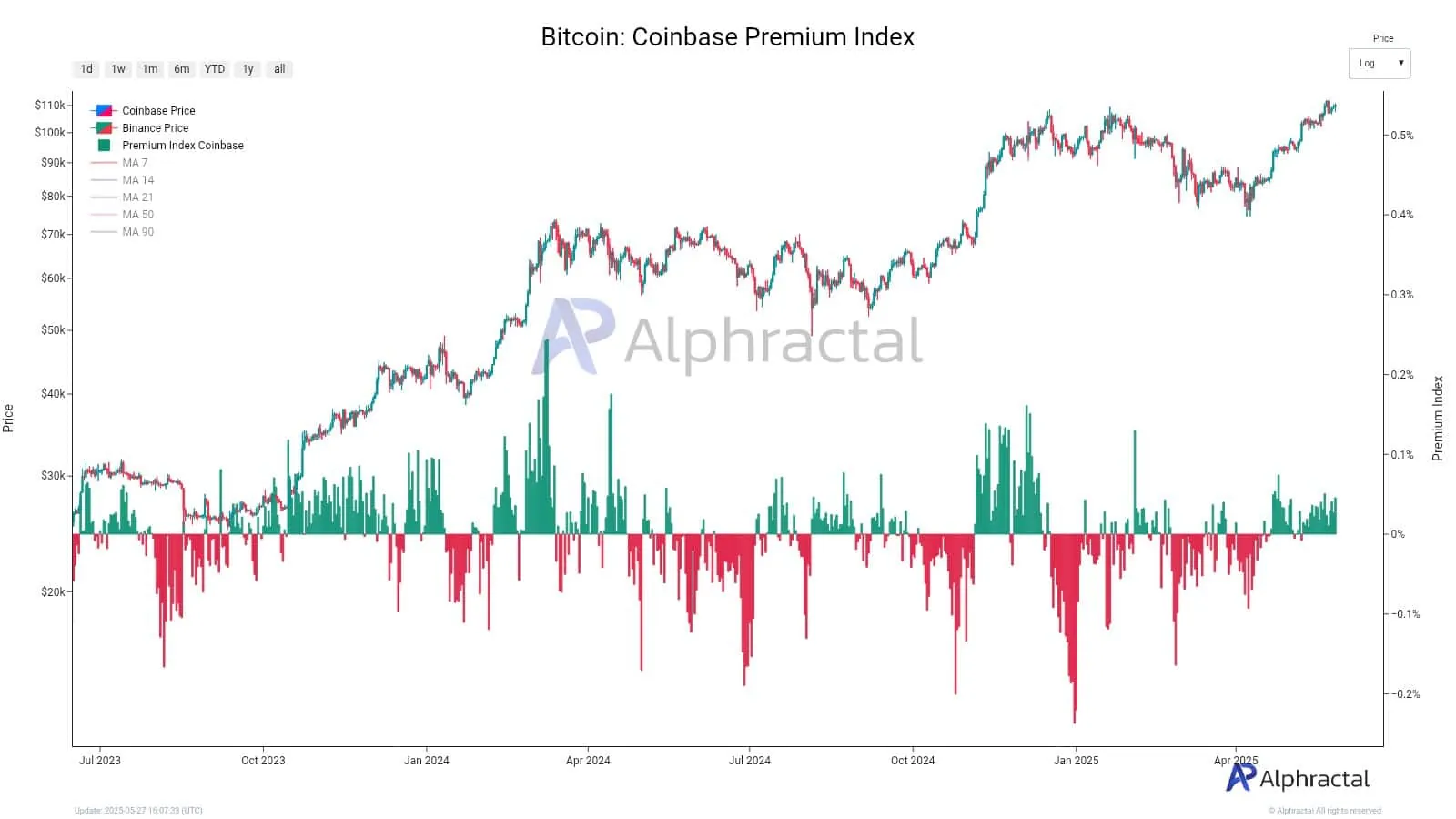

For the first time in 2025, the Coinbase Premium Index has remained in positive territory for three consecutive weeks. According to analyst Alphractal, this is a clear signal that U.S. investors are returning to the market with strong and sustained buying power.

U.S. Investor Demand Fuels Bitcoin’s Rally

When Bitcoin’s price on Coinbase trades higher than on other exchanges, it reflects active buying from American investors. This time, the buying momentum isn’t limited to institutional players or whales—it’s spreading across the entire market, including retail investors.

Whale activity has noticeably surged. According to data from Glassnode, after a dip in late April, the number of wallets holding at least 1,000 BTC has rebounded. The count has now reached 1,455 wallets—coinciding with Bitcoin’s recent price peak—indicating continued accumulation by whales despite high prices.

Retail Investors Are Also Stepping In

It’s not just the big players. Retail investors are also entering the market with renewed vigor. The buy/sell ratio on CryptoQuant has turned positive, showing that buy orders are outpacing sell orders. This suggests strong demand across the board, regardless of investor size.

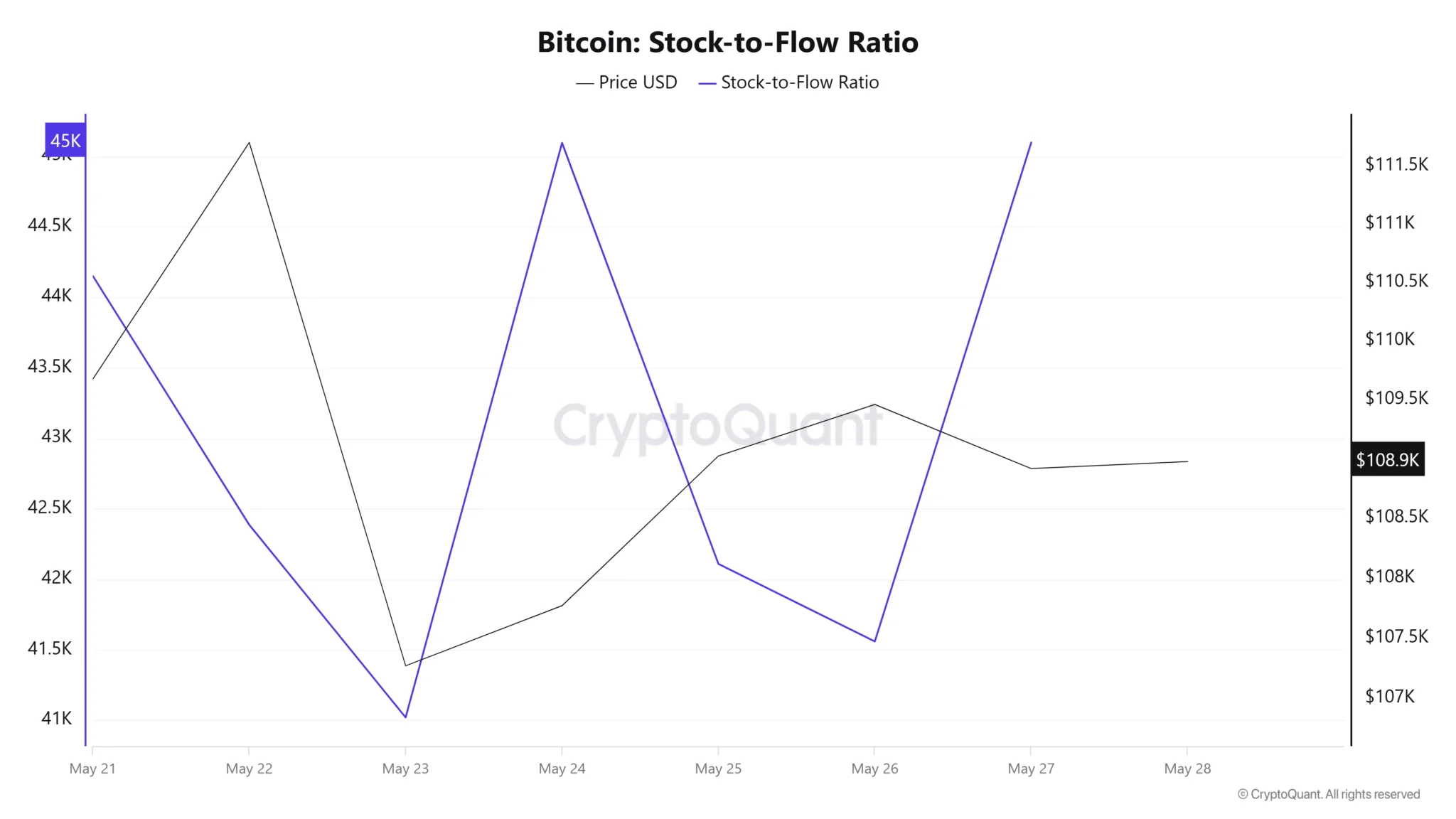

The widespread accumulation from both large and small wallets is making Bitcoin increasingly scarce. The Stock-to-Flow ratio—a metric that gauges Bitcoin’s scarcity—has jumped from 41,000 to 45,000 BTC in just one day, signaling that available supply for sale is rapidly shrinking.

In theory, when supply decreases while demand remains steady or increases, asset prices tend to rise sharply.

What Lies Ahead for Bitcoin?

There’s little doubt that the influx of buying activity on Coinbase—driven by both whales and retail investors—reflects growing market confidence in a continued accumulation trend. Although concerns were raised after $150 million worth of BTC was transferred to Coinbase, most analysts believe this is not a sell-off but rather a rebalancing move by major holders.

If the accumulation trend continues, Bitcoin could make a fourth return to the $110,000 mark. And if it manages to hold above that level this time, it may establish $110,000 as a solid support zone—paving the way for a stronger, more sustained rally.

However, if the recent large BTC transfers are indeed signs of impending sell-offs, the market may face a short-term correction, potentially pushing prices down to the $106,204 level.