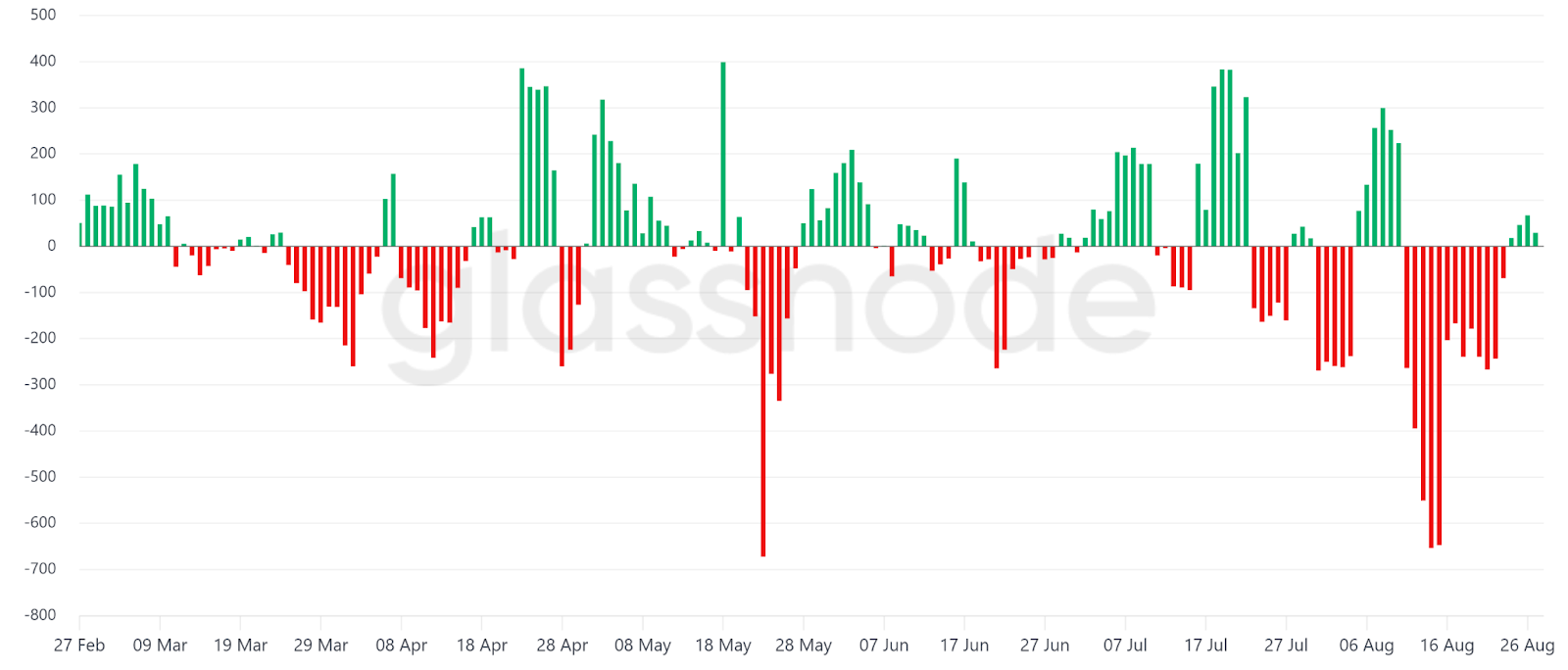

According to Glassnode, between August 11 and August 23, miner wallets offloaded 4,207 BTC worth roughly $485 million. This marked a consistent period of net outflows, contrasting with Q2 when miners added 6,675 BTC to their reserves. Their current balance stands at about 63,736 BTC, valued at more than $7.1 billion.

Although these sales are far smaller than allocations made by giants like MicroStrategy, the moves have fueled market concerns. The main issue lies in shrinking miner margins. HashRateIndex data shows that while Bitcoin’s price has risen 18% over the past nine months, miner profitability has actually dropped 10%. Rising mining difficulty and weaker on-chain transaction demand have been squeezing margins.

The hashprice index now sits at 54 PH/second, down from 59 PH/second a month ago, though still far stronger compared to early this year. With electricity costs around $0.09 per kWh, even older rigs such as Bitmain’s S19 XP, launched in late 2022, remain profitable—indicating the situation is not yet critical.

Another source of pressure is the growing capital shift toward artificial intelligence (AI) infrastructure. Recently, TeraWulf struck a $3.2 billion deal with Google to expand its AI data center in New York. Other miners, including Australia’s Iren and Canada’s Hive, are also investing heavily in GPUs and building AI-focused data centers. This trend has raised concerns that Bitcoin may lose investor attention to the booming AI sector.

Still, Bitcoin’s fundamentals remain strong. The network hashrate is closing in on an all-time high of 960 million TH/second, up 7% in the past three months. This underscores the resilience of the system, despite miner sell-offs.

There is no evidence yet that miners are under immediate financial stress or forced to liquidate holdings. Even if selling persists, institutional inflows appear more than capable of absorbing the pressure. As such, the $485 million in miner sales looks more like routine profit-taking rather than a sign of deeper trouble.