Over the past 24 hours, the Bitcoin market has recorded a notable surge. BTC’s price climbed to $93,684, marking a 6.54% increase, signaling a partial recovery in trading demand.

What stands out is that this upward momentum occurred amid ongoing challenges in the market—including weak demand, low market momentum, and limited liquidity. According to analysis, shifts in investor behavior and liquidity sentiment are likely key factors influencing the current trend.

Market Demand Still on a Downward Trajectory

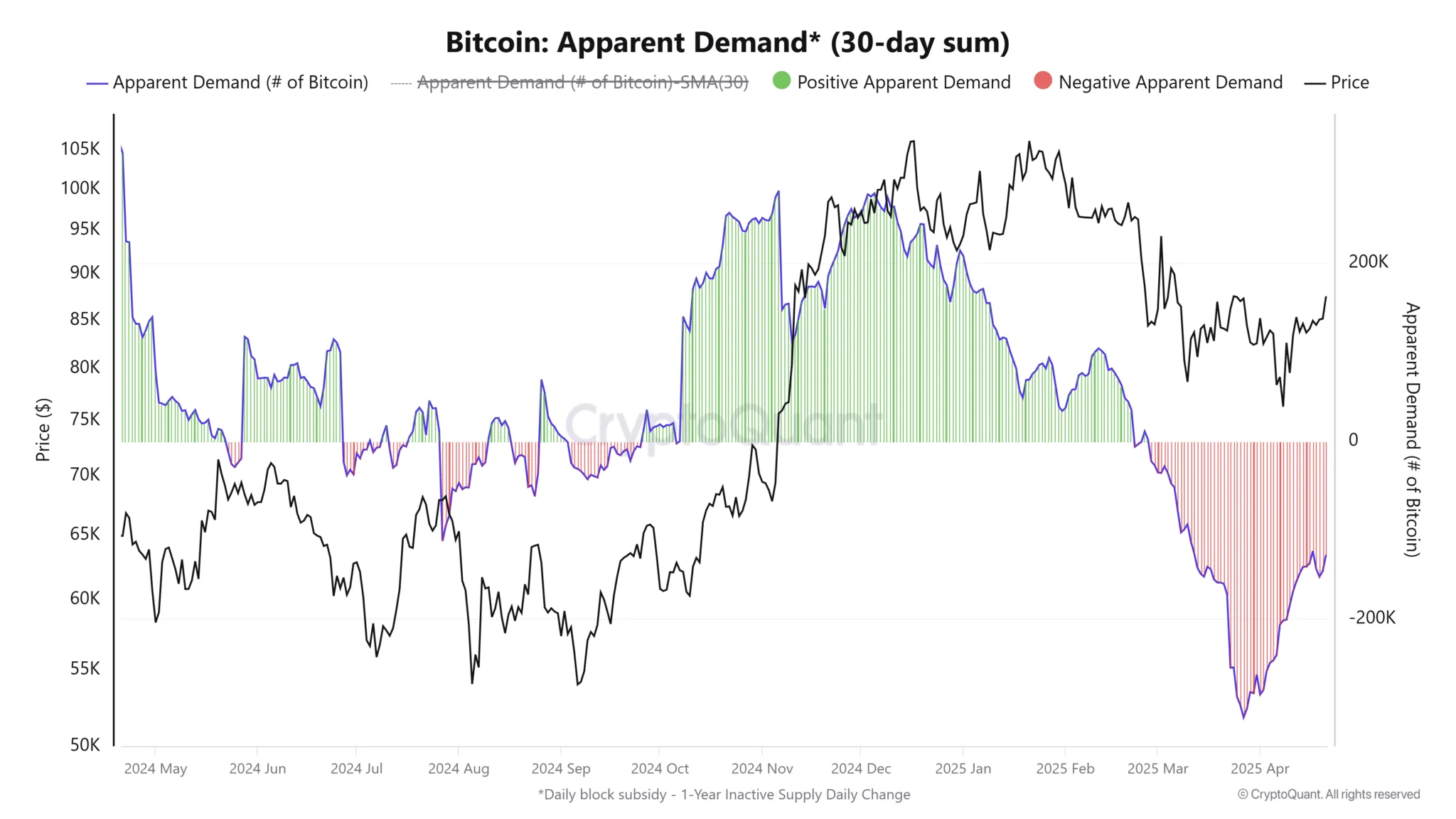

Data from CryptoQuant reveals that demand for BTC in the spot market has dropped by 146,000 BTC, equivalent to approximately $13 billion. However, this figure is still significantly lower than the 311,000 BTC decline recorded on March 27—less than half, in fact.

Since October 2024, net BTC buying activity has weakened substantially, with a cumulative drop of 624,000 BTC—marking the lowest level in the past six months.

Demand Momentum Continues to Fade

Fewer new investors are entering the market, reflecting a decline in real demand and a slowdown in the influx of fresh capital. Additionally, some long-term holders are also reducing their BTC exposure.

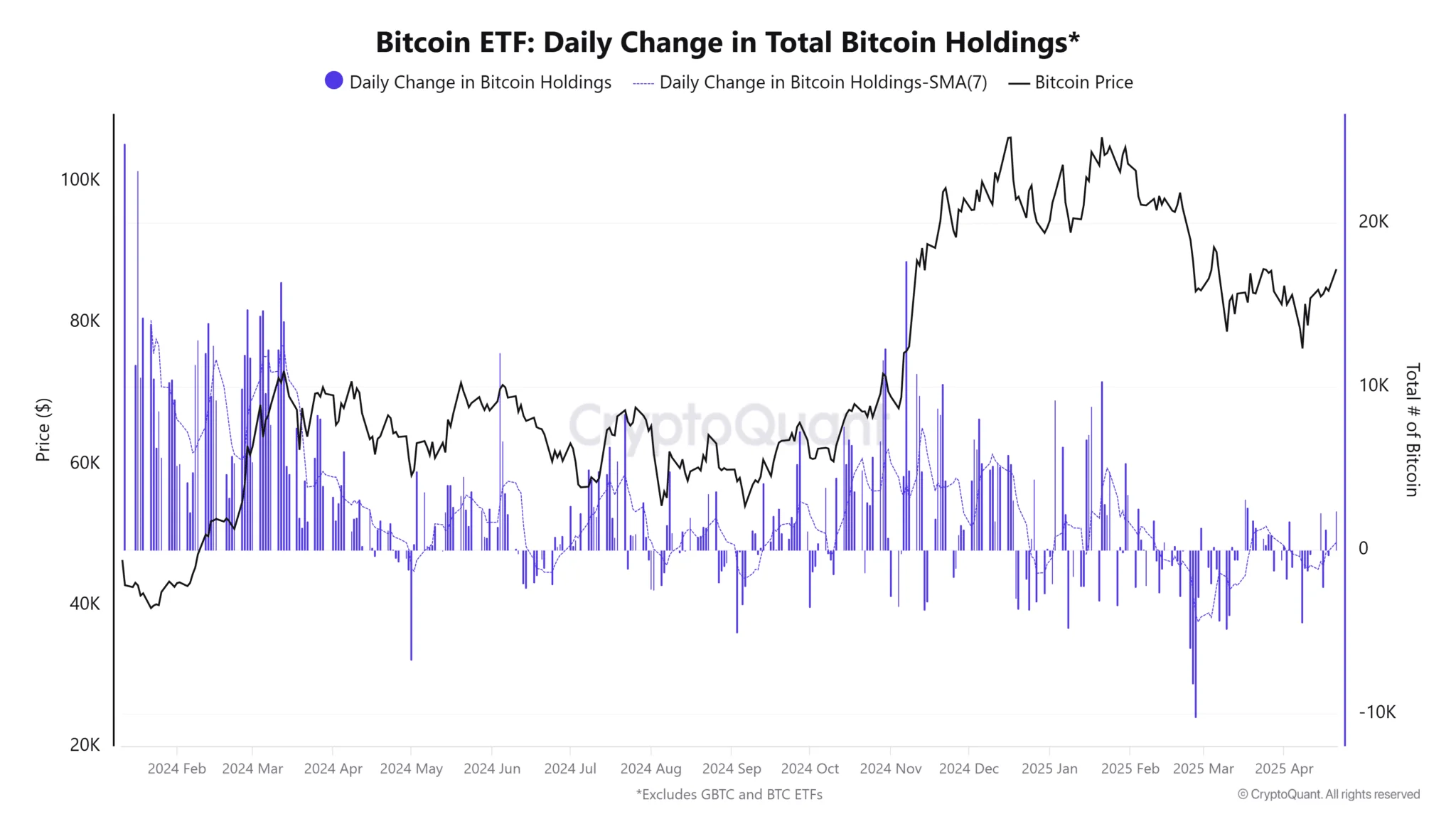

This trend is clearly reflected in the performance of spot Bitcoin ETFs in the U.S. Since March, net flows into these ETFs have hovered between -5,000 BTC and +3,000 BTC per day—a stark contrast to the bullish wave last November–December, when daily inflows reached up to 8,000 BTC.

By the end of 2024, these ETFs had recorded a net purchase of 208,000 BTC. However, entering 2025, this trend reversed, with net outflows totaling 10,000 BTC.

Liquidity—A Crucial Growth Driver—Remains Under Pressure

The supply of USDT, a key indicator of market demand and liquidity, has increased by $2.9 billion over the past 60 days. While this is a positive signal, it’s still insufficient to sustain a strong uptrend for BTC.

Typically, a robust Bitcoin rally requires a stablecoin market cap increase of at least $5 billion—surpassing the 30-day average. At present, this threshold has yet to be met.