Shifts in the behavior of both short-term and long-term investors suggest that the Bitcoin market is entering a new stage in its familiar halving cycle.

Bitcoin has long been known for its four-year cycle, in which halving events—when block rewards are cut in half—act as key catalysts for significant price increases. Within this broader framework, the market typically moves through three distinct phases: accumulation, parabolic growth, and correction/decline.

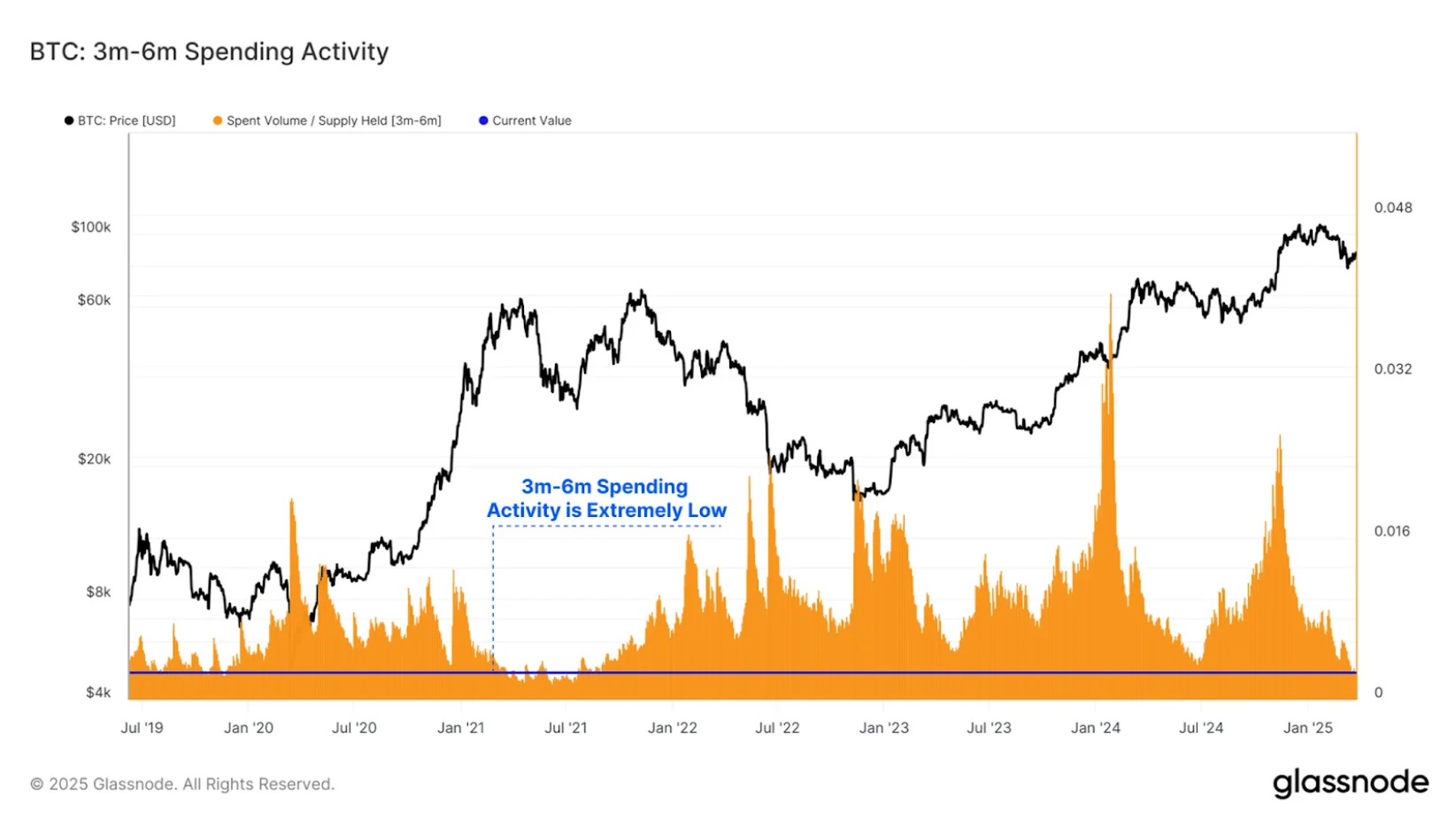

In addition to this long-term cycle, shorter-term cycles also exist, driven primarily by changes in investor sentiment and the behavior of various holder groups. These smaller cycles often provide valuable signals about Bitcoin’s potential next moves.

Long-term holders—those who have held Bitcoin for 3 to 5 years—are generally seen as seasoned investors, known for their resilience during major market downturns. They tend to hold through bear markets and only sell near local price peaks.

According to data from Glassnode, during the current cycle, long-term holders have offloaded more than 2 million BTC in two major waves. Notably, each of these sell-offs was followed by a strong wave of accumulation, helping the market absorb selling pressure and maintain price stability. Recently, they have entered a new accumulation phase—adding nearly 363,000 BTC since mid-February alone.

Alongside them is another key group: the “whales,” or wallet addresses holding more than 1,000 BTC. Among them, the “mega whales”—those holding over 10,000 BTC—stand out. According to BitInfoCharts, there are currently 93 such addresses, and recent activity suggests they are also quietly accumulating more coins.

The growing accumulation trend among both long-term holders and whales signals a potentially bullish setup for the market. While short-term movements are always uncertain, the actions of seasoned investors often serve as reliable indicators of long-term trends. This renewed accumulation phase could be laying the foundation for Bitcoin’s next major growth cycle—just as it has in past halving cycles.