Bitcoin continues to uphold its impressive upward momentum, defying the latest data from the U.S. labor market. Risk assets appear unfazed by jobless claims figures, and many experts believe another breakout for Bitcoin could be imminent.

Recent data shows that Bitcoin’s price volatility is gradually narrowing and becoming increasingly aligned with stock market trends. Meanwhile, macroeconomic indicators are painting a mixed picture of labor market health in relation to inflationary trends. Specifically, initial jobless claims stood at 227,000—lower than expected—while continuing claims exceeded projections by around 13,000.

Despite this, risk asset markets have remained stable, with no negative reactions to the data. Analysts suggest this indicates a generally optimistic investor sentiment. “Initial jobless claims came in below expectations, while continuing claims rose above forecast—clearly a mixed signal,” said Blacknox, co-founder of Material Indicators, on platform X. “Yet Bitcoin is in a price discovery phase, and the market is choosing to celebrate the good news while overlooking the bad.”

Keith Alan, another co-founder of Material Indicators, described the current development as “another push” in BTC’s ongoing rally. Meanwhile, popular trading source The Kobeissi Letter advised investors to closely monitor Bitcoin and gold, while predicting potential U.S. government intervention in the bond market following a strong stock market surge.

Bitcoin Poised for Breakout Amid Modest Profit-Taking

Compared to previous growth cycles, current Bitcoin investor behavior is considered unusually calm. Even as the price reached a new all-time high of $111,000, both volatility and profit-taking activity have remained muted.

“We’ve never seen a time in Bitcoin’s history where it fluctuates within just 1% of its all-time high,” wrote well-known trader Daan Crypto Trades on X. “A sharp move is likely once BTC breaks out of its current narrow range, which is seeing substantial position-building on both sides.”

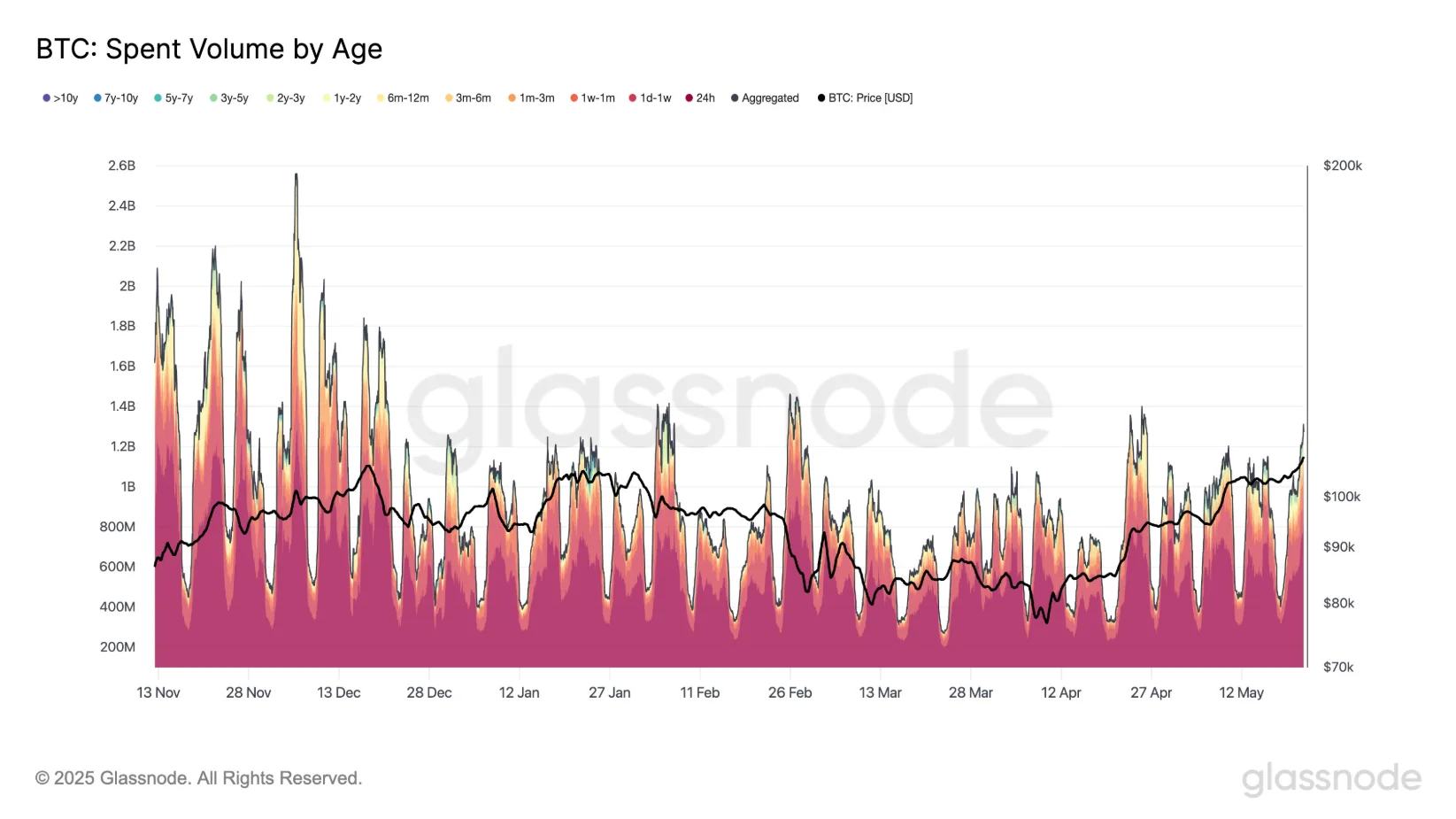

Data from CoinGlass shows increasing buy and sell orders around the current price range, creating a thicker liquidity layer. At the same time, on-chain analytics platform Glassnode reports that long-term holders are maintaining strong conviction, even as profits remain modest.

When Bitcoin hit its new high yesterday, total profit-taking amounted to only about $1 billion—less than half of the $2.1 billion recorded when BTC first crossed the $100,000 mark in December last year. “Prices are higher, but realized profits are significantly lower,” Glassnode’s report concluded.