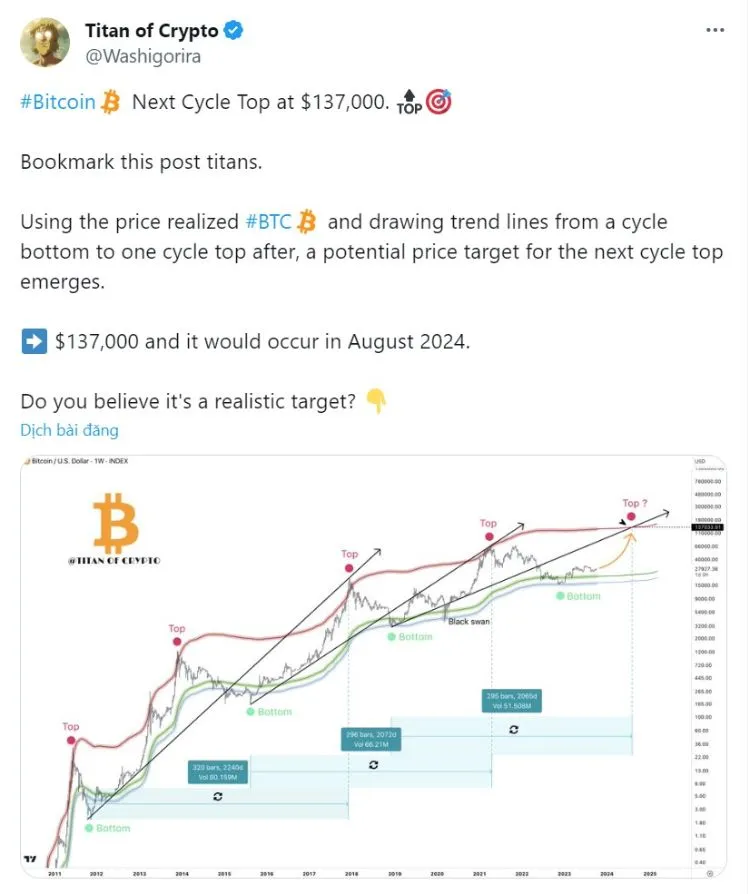

The forecast for the next Bitcoin cycle peak is $137,000

This trader conducted an in-depth analysis of BTC’s historical price data and employed trendline drawing methods from the previous cycle’s low to the projected high to estimate the price target for the upcoming cycle peak.

According to Titan of Crypto’s assessment, BTC has the potential to reach a price level of approximately $137,000, with expectations of this occurring in August 2024. Currently, BTC is trading at $27,952.35, with a slight 0.15% increase in the past 24 hours, according to CoinMarketCap. BTC has also experienced a more than 3% increase over the past seven days and a 6.57% rise in the last 30 days, indicating the cryptocurrency market’s strength during this period.

However, it’s worth noting that BTC’s 24-hour trading volume has decreased by over 48%, now standing at $6,951,099,043. To reach the $137,000 price target, BTC would need to increase by approximately 59% from its all-time high of $68,789.36, which was achieved in November 2021. Market leaders are currently attempting to break through the resistance level at $27,915. If BTC manages to close the daily candle above this price level in the next 48 hours, it could potentially rise to the significant next threshold at $29,210 over the next two weeks.

On the other hand, failure to close the daily candle above $27,915 in the coming days could weaken the bullish argument. In this scenario, the cryptocurrency’s price might immediately test the support level at $26,915 over the following week. In summary, BTC is operating within a positive medium-term price channel, suggesting potential for price appreciation in the days ahead. This upward price channel has formed over the past few weeks, following higher lows and higher highs in BTC’s price during this period.

Here are three compelling reasons why Bitcoin may be gearing up for a significant price surge:

Historical Price Trends: Bitcoin has shown a historical tendency to surpass downward monthly trends early in 2023. After marking new highs, it experienced a minor retracement. Consequently, it’s possible for Bitcoin’s price to revisit levels near or below $20,000 before initiating a strong upward rally towards nearly $100,000.

>>> The Future President of The USA Expresses Concerns About Government Attacks on Bitcoin

Entering the Pre-Halving Phase: The halving event is considered one of the key drivers of substantial price increases. As seen in the chart, Bitcoin has previously witnessed significant price surges after consolidating post-halving. However, it currently appears to be entering the pre-halving phase, potentially testing lower support levels as it has done in the past.

Bitcoin’s Strong Recovery: Bitcoin has followed a consistent pattern throughout its history. After each price surge, a notable market correction typically occurs, indicated by a red candlestick. Subsequently, the bullish camp regains dominance, followed by a recovery phase and a substantial price increase.

Following the price surge in 2021, Bitcoin experienced a significant price correction in 2022. Now, as the price approaches the point of triggering a recovery, a robust recovery phase may follow, paving the way for the next price surge in the years ahead.

Conclusion

Investors should consider accumulating Bitcoin starting now to prepare for the anticipated price surge in 2024-2025. This is a crucial period, so don’t miss out on this excellent opportunity, or you may regret it later.