Bitcoin is experiencing significant fluctuations, with a notable shift in the short-term holders (STH) group, who now control 40% of the total supply in the network. Although the market has recently seen losses, the investors who typically react strongly to price volatility are showing greater caution, helping to ease selling pressure.

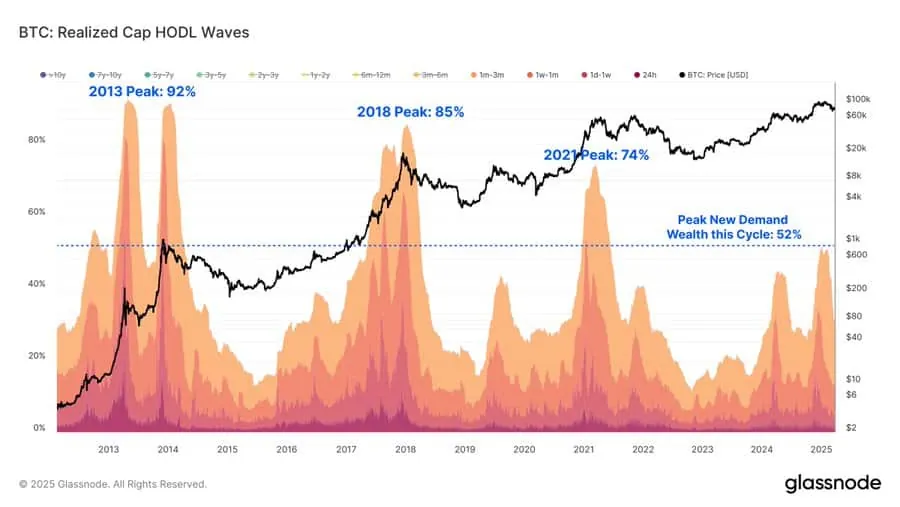

The ownership ratio of STH is currently much lower compared to previous peaks, when new investors held between 70% and 90% of the supply. However, this reflects a more stable bullish market with significantly reduced volatility. Changes in holding structure suggest that Bitcoin may be entering a more stable phase, with better-managed downside risks, setting the stage for sustainable growth.

Data on the net profit and loss (PNL) of STH when depositing Bitcoin to exchanges shows a clear correlation with BTC price movements. Notably, green bars (indicating profits) surged at the end of December and mid-February, reflecting increased selling activity. However, as Bitcoin’s price corrected from its peak, red bars (indicating realized losses) appeared more frequently, especially from late February to early March. This suggests that some short-term investors have accepted selling at a loss, indicating capitulation among a portion of the market. Nonetheless, selling pressure has gradually weakened, with fewer large sell-offs occurring.

This trend highlights market recovery, as short-term investors seem less reactive to extreme price swings, helping stabilize prices and reduce sharp fluctuations in the near future. A noteworthy observation is that the behavioral shift within the STH group aligns with previous Bitcoin market cycles, where the role of new investors has diminished over time.

During previous bull cycles, STH typically held 70–90% of Bitcoin’s supply when the market reached its peak, such as in 2013 (92%), 2018 (85%), and 2021 (74%). However, in the current cycle, this figure stands at only 52%, indicating a more balanced supply distribution. This reflects strong confidence among long-term holders (LTH), reducing speculative capital dominance. With fewer new investors participating in extreme price surges, the Bitcoin market appears to be operating in a more stable and sustainable manner.

Selling pressure from the STH group is gradually decreasing, suggesting that Bitcoin may be entering a phase of lower volatility with a more stable upward trend. As long-term holders continue to retain most of the supply, the Bitcoin market is becoming less dependent on intense speculative activity, strengthening its foundation for long-term growth.

Currently, BTC is fluctuating around $84,000, with an RSI of 46.93—indicating neutral market momentum. If buying pressure increases, Bitcoin may continue its uptrend. Conversely, if demand remains insufficient, BTC could move sideways or undergo a slight correction. Overall, changes in market structure indicate that Bitcoin is transitioning into a more mature phase, where extreme price fluctuations occur less frequently than before.