November saw digital asset funds continue to aggressively accumulate Bitcoin despite a deep market correction. According to data from Sentora, Digital Asset Treasuries added 18,700 BTC this month, even as Bitcoin’s price dropped 15.62%, falling from around $103,000 to lows near $86,000. This marked one of the steepest multi-day pullbacks in recent months, driven largely by rising macro uncertainty and high volatility across risk assets.

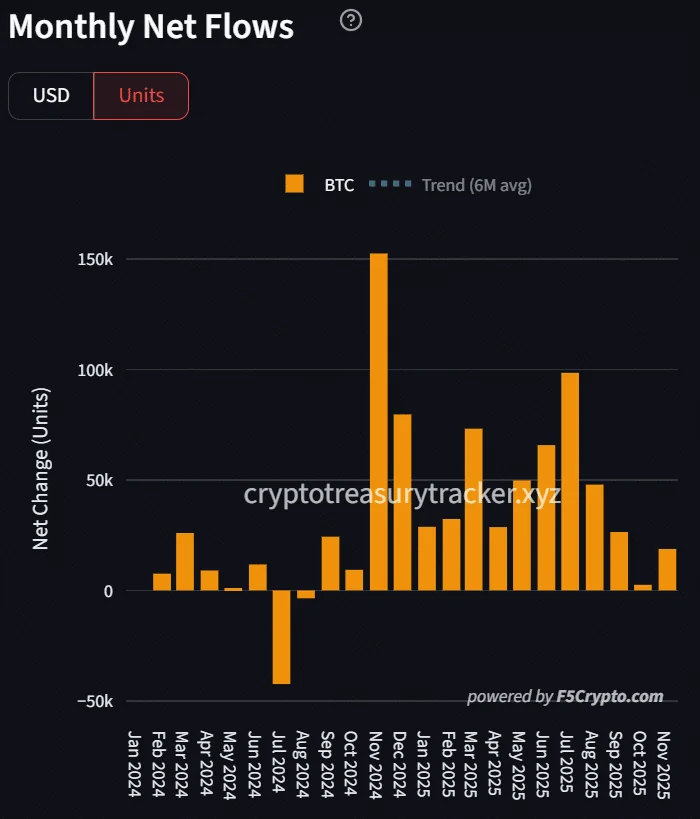

The total Bitcoin held in corporate treasuries now stands at nearly 1.86 million BTC, equivalent to about 9% of the circulating supply, locked on the balance sheets of companies, institutions, and governments. The largest long-term holders continued to accumulate aggressively even during sharp market declines, demonstrating sustained confidence in Bitcoin’s long-term outlook. This trend is further reflected in treasury flows over the past six months, showing consistent accumulation during both rallies and corrections, as long-horizon wallets absorb supply during periods of downward pressure.

Institutional Confidence and Market Supply Impact

Market signals also reinforce the view that institutions see the recent price drop as a buying opportunity. Strategy is a prime example, revealing that it has raised $21 billion in 2025 across seven different securities, including $11.9 billion in common equity, $6.9 billion in preferred equity, and $2 billion in convertible debt. During the decline, Michael Saylor emphasized that Strategy would continue accumulating BTC, cementing its position as the world’s largest corporate Bitcoin holder.

With nearly 1.86 million BTC effectively removed from circulation, market supply has tightened further, at a time when new issuance remains historically low. While short-term price pressure persists and BTC trades around the mid-$80,000 range, institutional behavior indicates enduring confidence in Bitcoin’s long-term value. Treasury flows suggest that long-term buyers view the recent correction as an opportunity rather than a risk, reinforcing the notion that the market is in a strategic accumulation phase.

Overall, November highlights a clear trend of strong institutional accumulation, increasing the amount of Bitcoin locked away, tightening market supply, and reinforcing confidence in the long-term prospects of the world’s leading cryptocurrency.