Bitcoin is firmly maintaining its position above the $100,000 mark as global markets enter a distinctly “risk-on” phase, supported by a wave of positive developments such as the U.S.–China trade agreement, cooling inflation, and a notable improvement in investor sentiment.

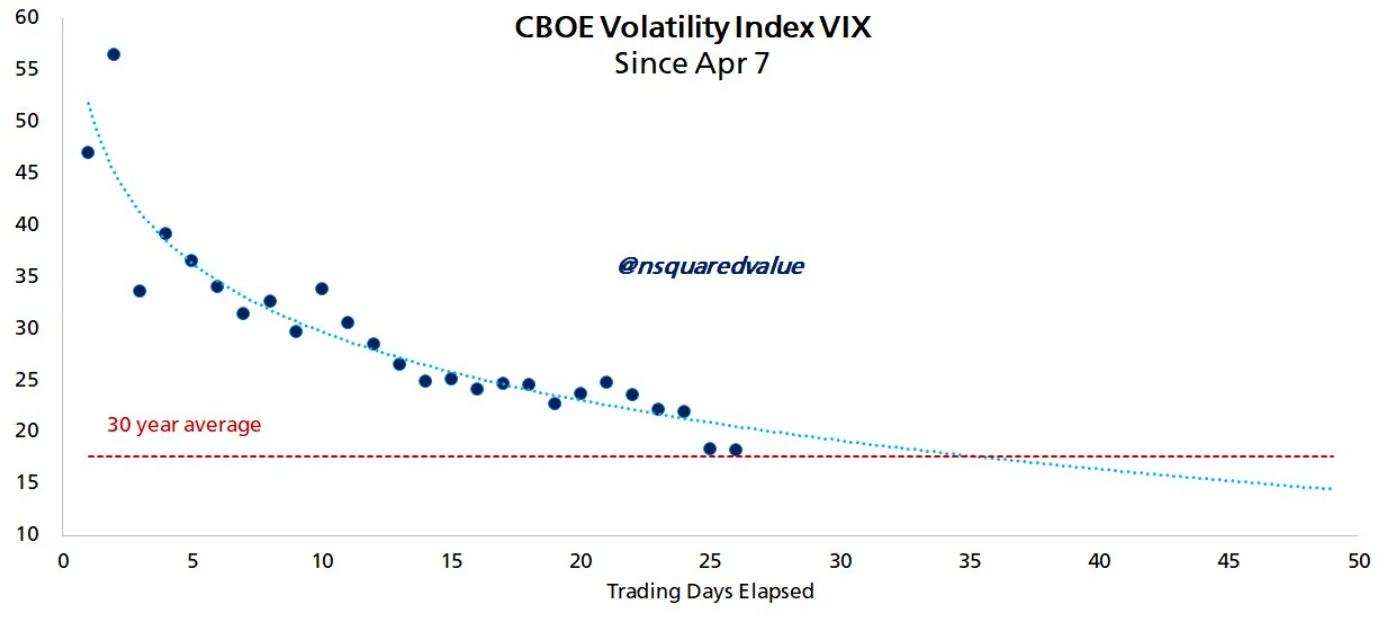

The cryptocurrency’s rally gained further momentum after the CBOE Volatility Index (VIX) dropped sharply to 20 — a level consistent with its 30-year average — down from a peak of 60 earlier in 2025. This decline followed a trade deal reached between the U.S. and China on May 12, where both sides agreed to suspend new tariffs for 90 days and implement a 115% reduction in current tariffs.

According to Timothy Peterson, an economist specializing in Bitcoin network models, the agreement has reignited a “risk-on” attitude in markets, prompting capital to flow into high-volatility assets such as equities and Bitcoin. He commented:

“The VIX plunged yesterday after news of a potential trade deal with China. It has now returned to normal levels — creating an ideal environment for risk assets.”

At the same time, U.S. inflation is also showing signs of cooling. The latest data reveals that the Consumer Price Index (CPI) for April 2025 fell to 2.3% year-over-year — the lowest since February 2021 and even lower than the expected 2.4%. This has raised hopes that the Federal Reserve may consider cutting interest rates later this year if the positive economic trend continues.

Against a backdrop of subdued market volatility, declining inflation, and easing trade tensions, many experts see this as a highly favorable environment for Bitcoin to continue its upward momentum.

Earlier this month, Peterson predicted that Bitcoin could reach $135,000 within the next 100 days, based on a model with a 95% accuracy rate. He noted that the drop in the VIX from 55 to 25 is a clear signal of a new bullish cycle, driven by rising investor confidence in risk assets.