On May 21, Bitcoin reached a new all-time high on the Binance exchange, touching the $110,000 mark. This also marked the seventh consecutive green weekly candle since the cryptocurrency rebounded from the $74,500 bottom. If Bitcoin can close this week above $106,500 by May 25, it would be the longest streak of weekly green candles since October 2023.

In addition to the price surge, Bitcoin’s market capitalization and realized capitalization also hit record highs, reaching $2.17 trillion and $911.5 billion respectively, according to blockchain analytics platform Glassnode.

Amid this bullish momentum, many investors are now expecting Bitcoin to soon break past the $110,000 level. Trader Titan of Crypto believes a target of $135,000 in 2025 is entirely achievable. Based on an analysis of resistance and support zones over the past two years, combined with the use of Fibonacci extension tools, he identified a potential target range between $135,000 and $140,000.

Veteran trader Peter Brandt, while acknowledging Bitcoin’s new high, pointed out that such milestones may carry limited technical significance during a bull run. He stated:

“A bull market is defined by making new highs—that’s its nature. The real question is: can we see $125,000 to $150,000 by the end of August?”

Taking a more ambitious stance, technical analyst Gert van Lagen predicted that Bitcoin could reach $300,000 to $320,000. In a recent post on platform X, he noted that Bitcoin had just broken out of a 4-year-long bullish “Megaphone” pattern—a structure defined by diverging trendlines—signaling a potentially powerful uptrend ahead. According to Elliott Wave Theory, he believes Bitcoin is now in the fifth and final wave of its current cycle, with a potential price increase of 170% to 190%.

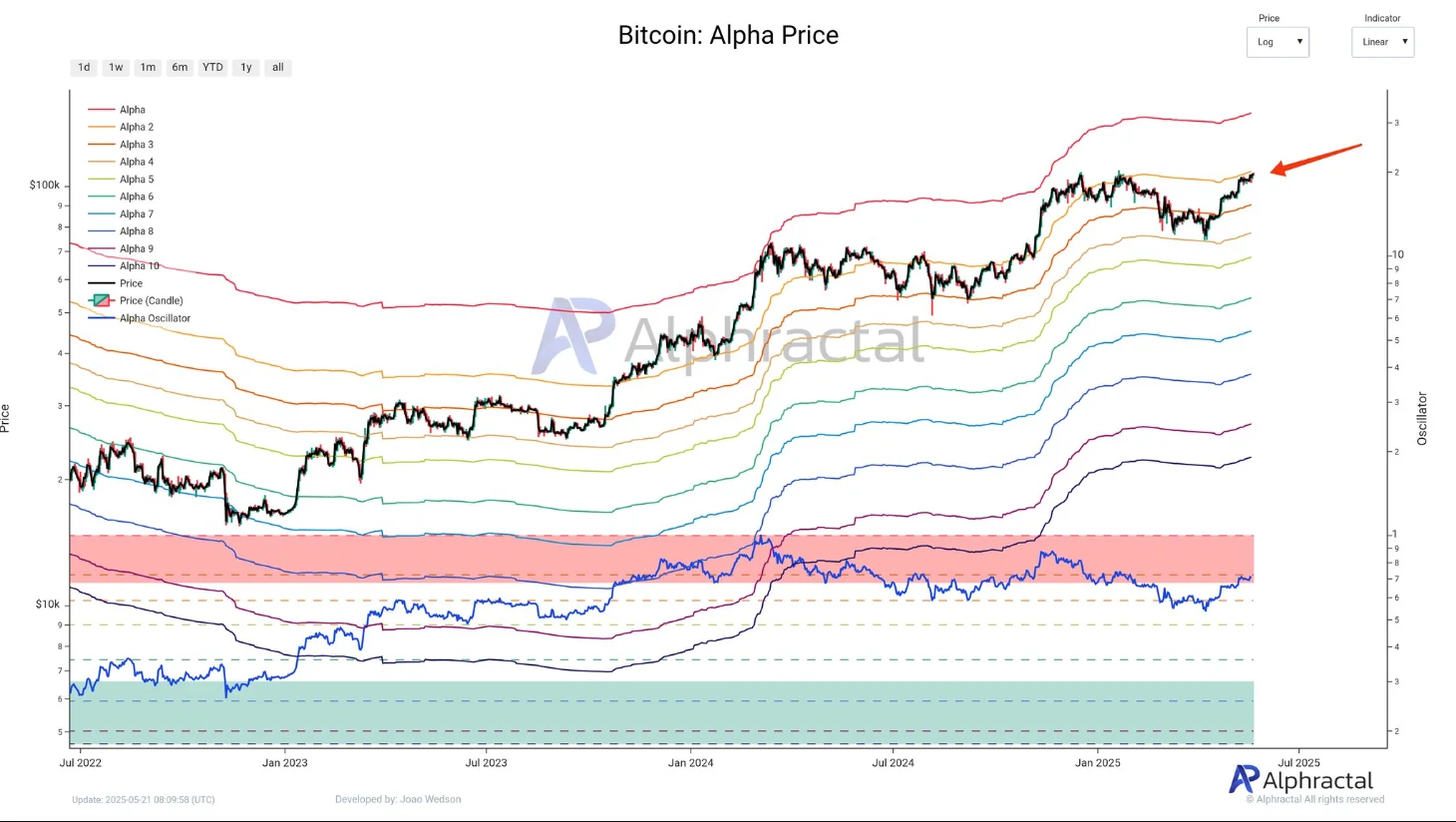

Despite the growing excitement in the market, João Wedson, CEO of Alphractal, urged investors to remain cautious and patient. He pointed out that Bitcoin’s heatmap indicates the asset is currently trading in a high-leverage zone, increasing the risk of liquidation by market makers targeting overconfident positions.

He emphasized:

“The obsession with new highs can become a trap for both bulls and bears. The most important thing is to always manage your risk with discipline and strategy.”