The cryptocurrency market remains under heavy selling pressure as Bitcoin slid to its lowest level of 2026, while US-listed spot Bitcoin exchange-traded funds (ETFs) recorded nearly $3 billion in net outflows in less than two weeks. The move highlights a growing risk-off sentiment across both crypto and technology-driven asset markets.

On Wednesday, Bitcoin fell below $73,000 after failing to sustain a rebound toward the $79,500 area a day earlier. The decline mirrored weakness in the Nasdaq index, which was dragged lower by a cautious sales outlook from chipmaker AMD and disappointing US employment data.

The main source of pressure comes from spot Bitcoin ETFs. Over the past 12 trading sessions, investors have pulled more than $2.9 billion from US-listed funds. Since Jan. 16, average daily net outflows have reached about $243 million — almost coinciding with Bitcoin’s rejection at the $98,000 level.

Following that rejection, BTC corrected roughly 26% within three weeks, triggering more than $3.25 billion in liquidations of leveraged long futures positions. For traders using leverage above 4x, most accounts were effectively wiped out unless additional margin was added in time.

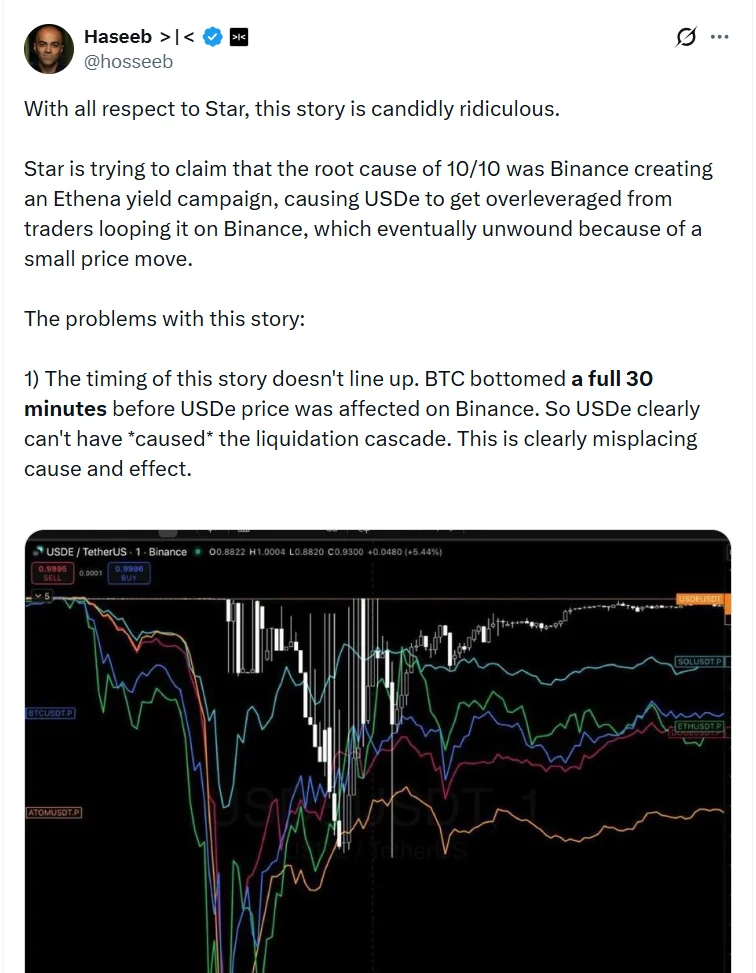

Some market participants argue the current downturn still reflects the aftershocks of the $19 billion liquidation event at Binance in October 2025. At the time, database query glitches reportedly delayed transfers and produced incorrect price feeds. Binance later acknowledged technical problems during the sell-off and paid more than $283 million in compensation to affected users.

According to Haseeb Qureshi, managing partner at Dragonfly, liquidation orders at Binance “couldn’t get filled, but the engines kept firing,” wiping out market makers who were unable to absorb the shock. While the crash did not permanently “break the market,” he noted that liquidity providers need time to recover.

Unlike traditional financial markets, which use circuit breakers to stabilize volatility, crypto liquidation systems are designed primarily to minimize insolvency risk rather than calm markets. As a result, shocks in crypto tend to be amplified instead of absorbed.

Derivatives data also shows professional traders remain skeptical that Bitcoin has found a bottom near $72,100. The BTC options delta skew jumped to 13%, well above the neutral 6% level, signaling rising demand for downside protection.

Sentiment is further pressured by fears of intensified competition in the AI sector as Google and AMD roll out proprietary artificial intelligence chips, along with unfounded rumors surrounding large Bitcoin sales and Binance’s solvency. Still, on-chain data indicates that BTC deposits on Binance remain relatively stable.

With macroeconomic uncertainty persisting and ETF capital continuing to exit the market, it remains difficult to identify where Bitcoin’s current downturn will ultimately find support.