Post-Halving Profits Are Shrinking

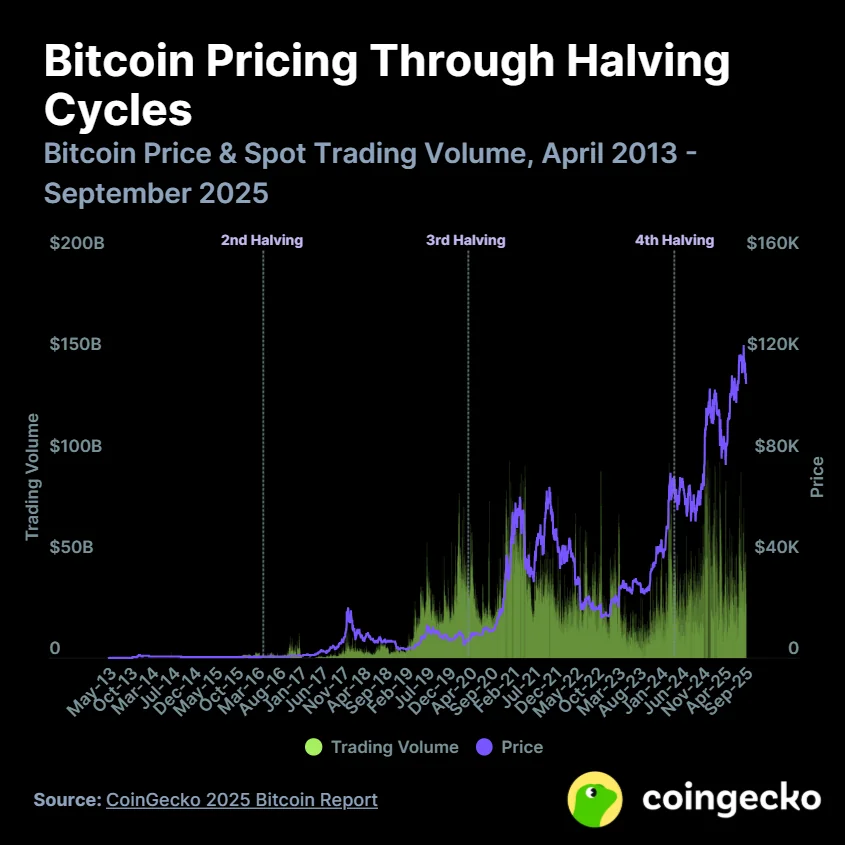

Halving events — which cut miners’ block rewards in half — have long been viewed as catalysts driving Bitcoin’s scarcity and price surges. Since 2012, rewards have fallen by 87.5%, from 25 BTC to 3.125 BTC. Over that same period, Bitcoin’s price has skyrocketed over 9,100-fold, reaching $109,000 on September 1, 2025, and surpassing $120,000 just a month later.

However, CoinGecko data reveals that post-halving returns are shrinking rapidly. The 2017 halving cycle recorded peak gains of 29x, which dropped to 6.7x in 2021. The 2025 run has been far more modest, with gains of only 93.1% so far.

Notably, Bitcoin’s record high of $73,400 in March 2024 occurred months before the fourth halving, defying previous post-halving price trends.

Despite the reduced returns, market activity has surged dramatically — daily trading volume has soared from around $20 million in 2013 to nearly $30 billion in 2025.

Corporations Continue to Accumulate Bitcoin

Publicly traded companies are increasingly adopting Bitcoin as a strategic treasury asset. As of October 3, nearly 200 companies collectively held 1,040,061 BTC, representing almost 5% of the total Bitcoin supply.

Strategy leads the pack with 640,031 BTC, accounting for 63% of all corporate-held Bitcoin, and added another 4,048 BTC on September 2.

New entrants are also making bold moves. Twenty One — backed by Tether, Bitfinex, Cantor Fitzgerald, and SoftBank — has accumulated 43,514 BTC since May, becoming the third-largest corporate holder.

In the U.S., KindlyMD, a healthcare company, merged with Nakamoto BTC Holdings, adding 5,765 BTC to its reserves and announcing plans to raise $5 billion for further treasury expansion.

Across Asia and Europe, firms like MetaPlanet (Japan) and Treasury BV (Europe) are also building significant Bitcoin holdings, with Treasury BV raising $147 million to purchase over 1,000 BTC.

The Bitcoin Network Grows Stronger

Alongside institutional accumulation, Bitcoin’s computational power (hash rate) has reached record highs. Over the past year, the network’s hash rate surged 88%, climbing from 670 million TH/s to 1.266 ZH/s, reflecting the growing participation of both individual and institutional miners.

Under the Trump administration, the U.S. Bitcoin mining industry has expanded rapidly. Chinese mining hardware giants such as Bitmain, Canaan, and MicroBT have relocated operations to the U.S., driven by tariffs and regulatory pressure.

Meanwhile, domestic miners like HIVE, Hut 8, Marathon, and CleanSpark are increasingly prioritizing renewable energy for their facilities. Adding to the momentum, Eric Trump recently co-founded American Bitcoin Corp, which has officially listed on Nasdaq, marking another milestone for the U.S. Bitcoin mining sector.