In recent days, investors may have felt anxious as the price of Bitcoin (BTC) has undergone several adjustments. However, they should not lose hope as this may just be another testing phase, which could end with a new upward trend.

Over the past week, there hasn’t been significant volatility in BTC price action, with the value of this cryptocurrency moving gently. A similar situation has also been observed over the last 24 hours. According to data from CoinMarketCap, at the current moment, BTC is trading at $66,696 with a market capitalization of over $1.28 trillion.

What history suggests

However, there might be fluctuations in the price of BTC in the coming days. Mustache, a renowned cryptocurrency analyst, recently tweeted emphasizing how BTC is undergoing a “reassessment” phase.

Considering historical patterns, there’s a possibility that BTC might soon begin a new uptrend, as similar patterns were observed in 2017 and 2020. Therefore, it’s essential to examine Bitcoin’s data to see if this cryptocurrency is indeed starting a new price surge.

However, there are signs indicating a decline

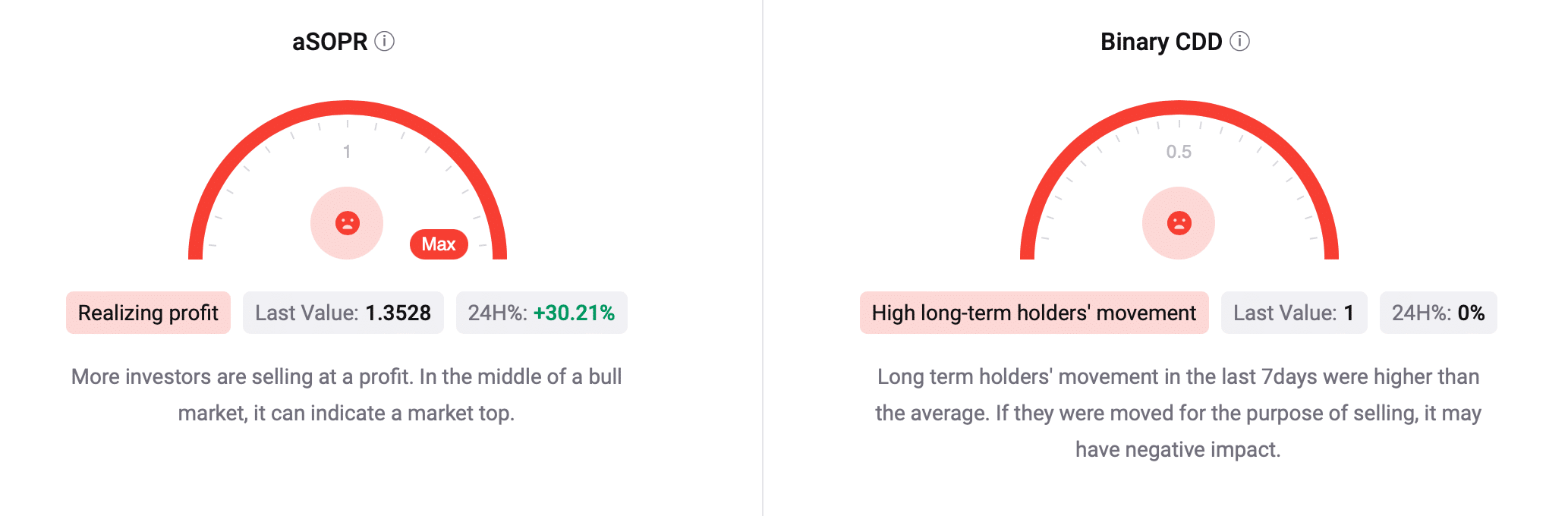

Source: CryptoQuant

Despite the history of price increases, data on the Bitcoin blockchain still suggests a downward trend. For example, the aSOPR indicator is red, according to our analysis of data from CryptoQuant. This implies that many investors are selling to profit. In a bullish market, this could indicate a market peak.

Related: Bitcoin Witnesses a Series of Extremely Large Whale Transactions

Its binary CDD is also following a similar trend, indicating that the actions of long-term holders over the past seven days are higher than average. If these actions are for selling purposes, they could have a negative impact.

Source: CryptoQuant

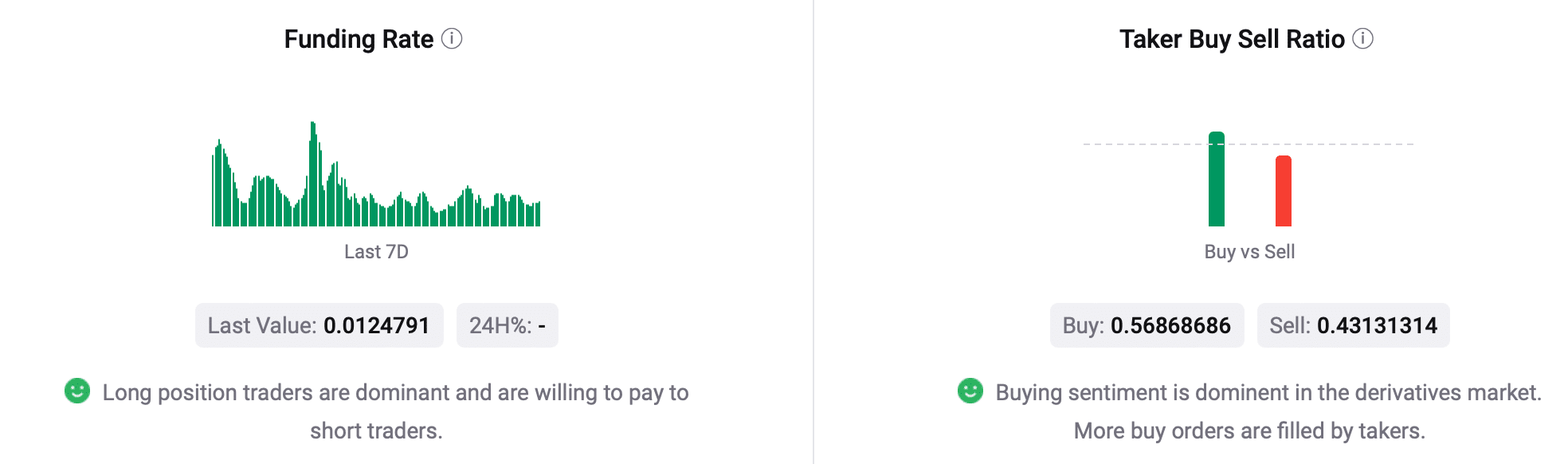

However, other data tells a different story. Bitcoin’s exchange reserves are decreasing, indicating that selling pressure on this currency is decreasing.

Moreover, both the funding rate and the buy-sell ratio of BTC buyers are green, indicating that the buying sentiment dominates in the derivatives market.

Checking BTC’s daily chart is essential to determine the direction of this currency.

Source: TradingView

Analysis from TradingView charts suggests that investors may witness a few more days of slow movement as the Relative Strength Index (RSI) oscillates near the neutral zone. The Money Flow Index (MFI) is also following a similar trend, indicating a high likelihood of less price volatility.