Bitcoin is heading into a dramatic November as two critical events — the CPI report and the FOMC meeting — approach. After weeks of consolidation, the market is showing signs of recovery with shorts being squeezed and real spot demand returning. But is this truly Bitcoin’s bottom?

Macro Pressure Mounts – CPI and FOMC Could Decide the Direction

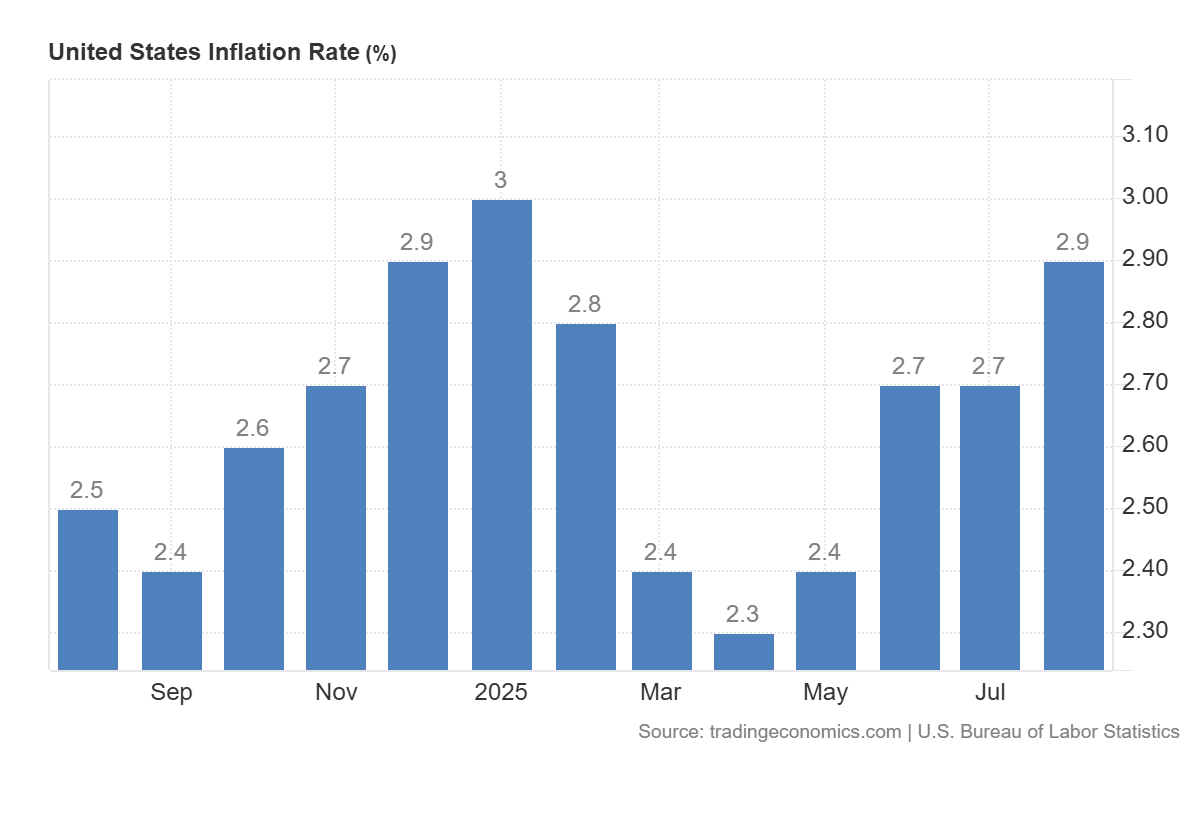

While the crypto market cap has climbed over 4% and sentiment is gradually improving, Bitcoin remains under heavy macroeconomic pressure. On October 24, the U.S. Bureau of Labor Statistics (BLS) will release the Consumer Price Index (CPI) report, just five days before the next FOMC meeting — a particularly sensitive period for risk assets.

Forecasts suggest a 3.1% year-over-year CPI rise, up from last month, amid lingering U.S.–China trade tensions and uncertainty around the labor market. This is the same kind of macro backdrop that helped push Bitcoin to $125,000 in early October, when traders bet on potential Fed rate cuts.

Now, however, that catalyst has faded while inflation remains stubbornly high. Even if the Fed decides to cut rates again, risk assets like Bitcoin may not benefit as expected — a scenario reminiscent of the post-rate-cut slump seen in September.

Whales Move Early – Volatility Is on the Horizon

The Fed’s rate cut in September barely moved the needle for Bitcoin. BTC fell 8% the week after as inflation printed a 0.2% monthly increase.

Although Bitcoin reached a new all-time high of $125,000, the rally quickly lost steam as fear kept many bulls on the sidelines.

Currently, market data shows whales are positioning ahead of a potential bullish leg, with perpetual markets leaning long and leverage piling up — a clear signal of preparation for heightened volatility.

Still, Bitcoin’s path through November will be anything but smooth. With less than a week to the FOMC, markets are almost certain the Fed will deliver another 25bps rate cut, despite persistent inflation. But that doesn’t guarantee a clean bullish cycle. The dense liquidity clusters and heavily leveraged long positions could make Bitcoin’s push toward a new ATH messy — turning November into a true “make-or-break” moment.

In summary: Bitcoin is entering a decisive phase where every macro shift could flip the trend. Expectations are high, whales are already moving, but the outcome will depend on how the Fed responds to sticky inflation.

This November, Bitcoin isn’t just fighting for price — it’s fighting for market confidence.