For years, Bitcoin [BTC] halving has been seen as a catalyst for explosive price surges — a predictable supply shock that often sends prices soaring.

But this time, things seem different.

While previous halving cycles delivered exponential growth, the current post-halving phase is marked more by caution than excitement.

The numbers speak for themselves: profits are shrinking, price volatility is fading, and subtle but significant changes may be unfolding beneath the surface of the market.

Bitcoin is no longer simply reacting to supply shocks. Instead, it’s becoming increasingly sensitive to macroeconomic factors — especially inflation expectations and central bank policy.

We may be witnessing Bitcoin’s evolution into a new era: one where halving still matters, but no longer commands the full attention of the market. Today, investors are tuning in more to Jerome Powell’s statements than to block reward cuts.

A Clear Signal: Post-Halving Momentum is Weakening

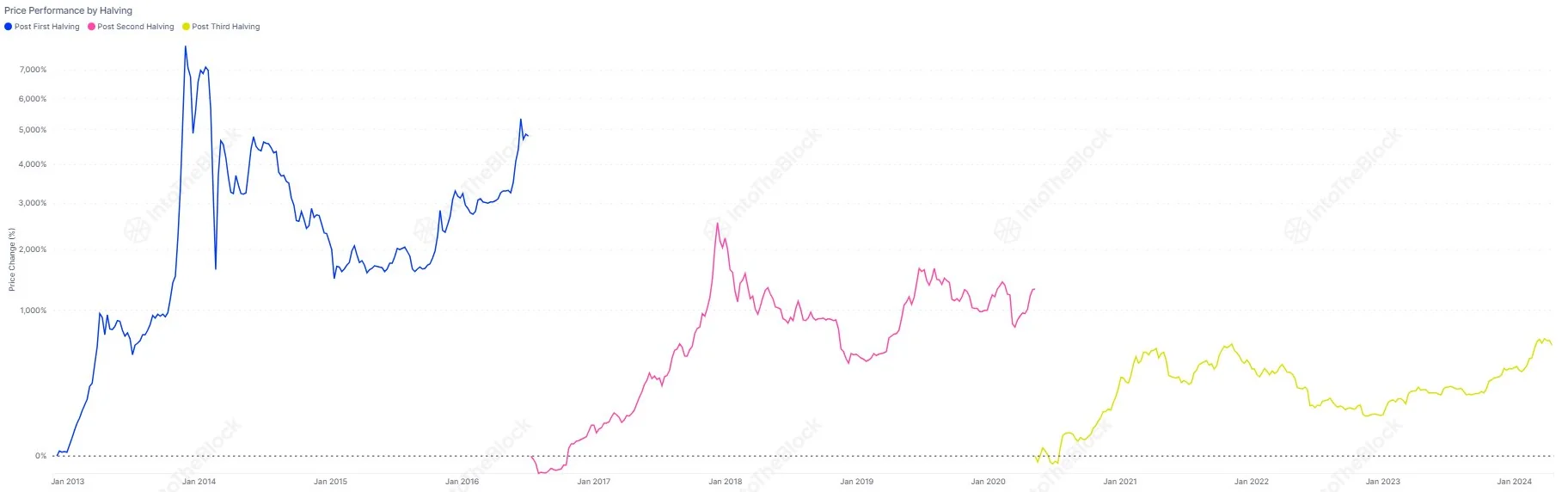

In the past, each halving cycle promised extraordinary returns.

- The first cycle brought an astonishing 6,400% gain.

- By the second cycle, that number had halved.

- The third still impressed with about 1,200%, though the declining trend was clear.

- Now, even with Bitcoin reaching new all-time highs, the latest cycle has only just exceeded 100%.

This isn’t just a slowdown — it’s a sign that the market no longer blindly reacts to supply shocks.

As institutional investors step in and the global economic backdrop grows more influential, Bitcoin is shifting — from a highly volatile speculative asset to one that responds to macroeconomic conditions.

Halving remains fundamental — it sets the groundwork and restricts supply — but it is no longer the sole driver. Today, Bitcoin’s price is increasingly swayed by global liquidity, interest rate expectations, and macro signals from economies like the U.S. and the EU.

If you feel like Bitcoin is gradually integrating into the traditional financial system — you’re absolutely right.

Diminishing returns don’t necessarily indicate Bitcoin is losing strength. Rather, they may be the sign of a new chapter — one in which Bitcoin moves from being a phenomenon to becoming a core asset in the global financial framework.