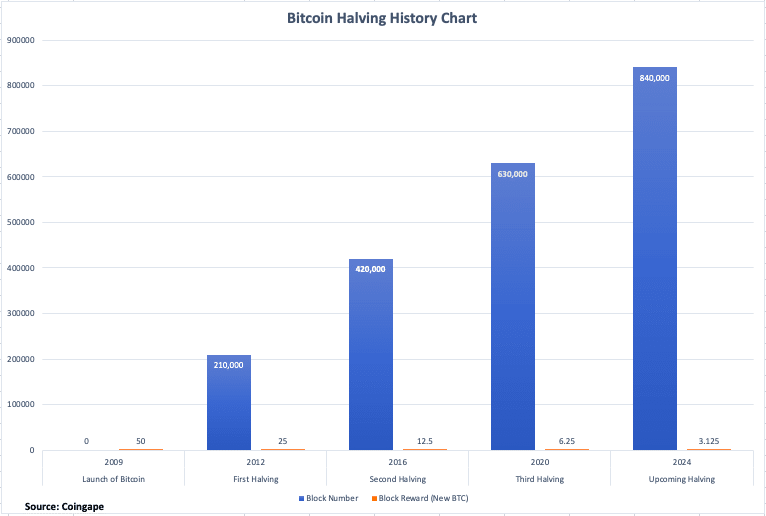

Bitcoin Halving Chart history will show us market fluctuations around special days in the cryptocurrency market. Every four years, the amount of new bitcoins produced is halved on a halving day. This means that during a Bitcoin halving event, the rewards for network defenders are reduced by 50%, directly impacting the rate of new bitcoins entering circulation. The day when the reward is halved is called the halving day. This is a significant event in the cryptocurrency market and has occurred three times since Bitcoin’s inception.

What is the Bitcoin Halving Chart History?

The Bitcoin halving chart history visually illustrates the timeline of halving events and their impact. Typically, it displays the halving dates, changes in mining rewards, and often includes the price movement of Bitcoin throughout history. These charts help understand the Bitcoin supply cycle and its market implications. Now, let’s review how the halving days have unfolded over time.

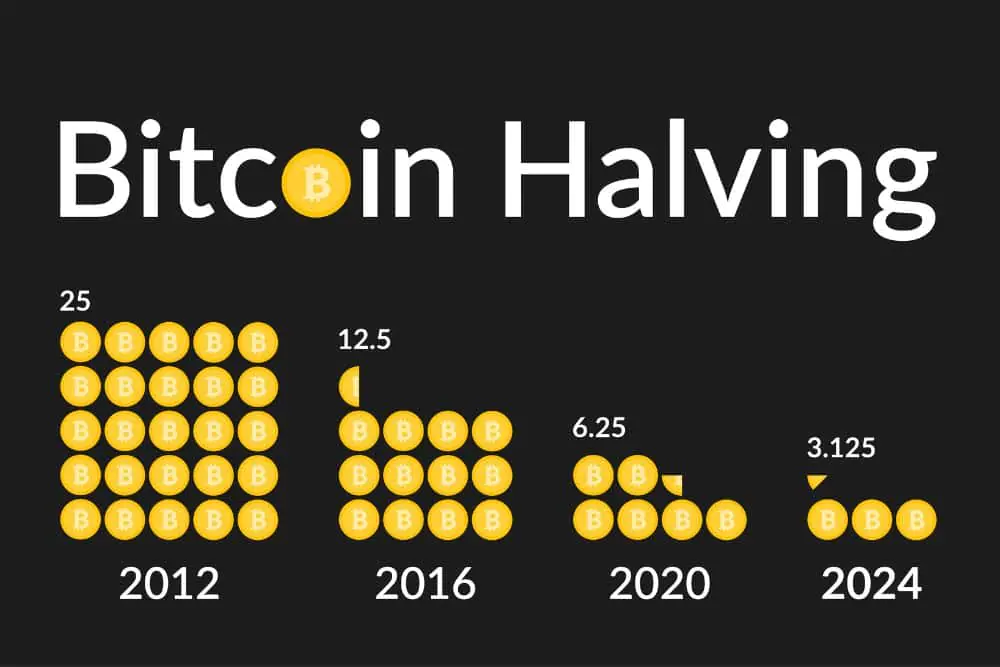

First Halving – 28/11/2012

Bitcoin’s first halving occurred after the network confirmed 210,000 blocks. Miners’ rewards were reduced from 50 bitcoins to 25 bitcoins per block. At the time of halving, the market price of Bitcoin was $12.20. Following the halving, a bull run ensued, driving the price of Bitcoin to $1,000 by the end of 2013.

Second Halving – 09/07/2016

After four years, the second halving event took place in 2016 upon reaching 420,000 blocks. This led to a reduction in mining rewards from 25 to 12.5 bitcoins per block. Before the halving, there was much volatility in Bitcoin’s price. However, BTC was trading at $650.3 at the time and reached a peak of around $19,188 in December 2017.

Third Halving – 11/05/2020

The third halving event occurred after processing 630,000 blocks. Miners’ rewards decreased from 12.5 to 6.25 bitcoins per block. This event was keenly felt as the leading cryptocurrency increasingly penetrated the financial sector. BTC started at $8,821.42 before quickly rising to $10,943 within 150 days. It reached a record high of $69,000 in November 2021.

Upcoming Fourth Halving – 2024

According to CoinMarketCap’s prediction, the next halving will occur after processing 840,000 blocks, on April 17, 2024. Miners are expected to see their rewards reduced from 6.25 to 3.125 bitcoins per block. There is much speculation from enthusiasts and investors about how this halving event will impact the market, leading to significant expectations.

Related: Bitcoin History Indicates a Potential Upward Surge Ahead

Conclusion

According to the bitcoin having chart,, each Bitcoin halving has led to an increase in BTC’s value, although there have been differences in magnitude and timing. Halving reduces the rate of new bitcoin creation, leading to a decreased supply that can trigger price appreciation in the market. However, the ultimate outcome may be influenced by various factors such as market psychology, investor behavior, and global financial conditions.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

What a great and comprehensive bull run to be expected soon

Good to be here as a crypto enthusiast

We are waiting for bull run to expected soon

Excellent

So good

Thank you so much for the analysis. I have been looking forward to seeing something like this. AZC is really doing well.

Pattern is that when bullrun comes, coins tend to go up gradually. It usually happens every 4 years after Bitcoin halving.

What a well and composed one

Nobody does it better than AZC News dropping relevant updates on cryptocurrency market. Thanks AZC

Thank you so much

Great thanks for the orientation @AZC,it nice been on here.

Great info

Great analysis 👍👍

I like being one of your commententors, for sure AZC.NEWS speaks the news that I like most.

The information is amazing. Well detailed. I have been yearning to understand the meaning of Bitcoin halving for a while. I now get it clearly. Thank you

@AZCOINER

Thanks for job Weldon